Ethereum’s validator exit queue swelled on Tuesday to its longest wait time in additional than a yr, that would sign a rush amongst stakers to drag funds after a serious value rally in ether (ETH).

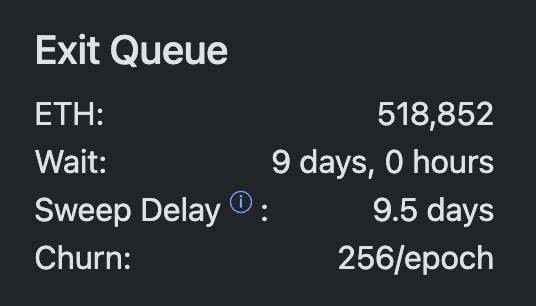

There was practically 519,000 ETH as of Tuesday U.S. afternoon, price $1.92 billion at present costs, in line to exit the community, knowledge by validatorqueue.com reveals.

That the biggest quantity within the exit queue since January 2024, extending withdrawal delays to over 9 days, per the info supply.

The congestion is as a result of dynamics of Ethereum’s proof-of-stake mannequin, which limits how rapidly validators can be part of or go away the community. Validators are entities that stake tokens to assist safe the blockchain in return for a reward.

Revenue-taking after ETH rally

The continued exodus is probably going attributable to profit-taking by those that staked ETH at a lot decrease costs and now cashing out after ETH rallied 160% from the early April trough.

“When costs go up, individuals unstake and promote to lock in income,” mentioned Andy Cronk, co-founder of staking service supplier Figment. “We have seen this sample for retail and institutional ranges via many cycles.” He additionally added unstaking spikes may additionally occur when massive establishments transfer custodians or change their pockets tech.

Notably, there was a surge of validators coming into the community throughout March and early April, a interval when ETH traded between $1,500 and $2,000.

ETH staking demand additionally soars

Regardless of the wave of tokens being unstaked, a big promote stress could not materialize as there is a constant demand to stake tokens and activate new validators.

There’s over 357,000 ETH, price $1.3 billion, ready to enter the community, stretching the entry queue past six days, its longest since April 2024.

Behind this reverse dynamics may very well be “a mixture of older stakers capturing revenue in addition to stakers shifting to a treasury technique,” mentioned David Shuttleworth, companion at Anagram.

Certainly, a few of this recent demand could have come from the brand new wave of ETH company treasuries equivalent to Sharplink Gaming, which has acquired over $1.3 billion in ETH since its pivot in late Might and staked tokens as a part of its technique.

Additionally, the Securities and Change Fee (SEC) clarified on Might 29 that staking doesn’t violate U.S. securities legal guidelines, which bolstered institutional urge for food.

Underscoring the pattern, the variety of lively validators grew 54,000 since late Might to succeed in a report excessive of practically 1.1 million, per validatorqueue.com.

“For the reason that SEC offered steerage on staking in Might, Figment has seen a greater than 100% improve in Ethereum staking delegations from establishments and a greater than 360%+ improve in Ethereum queue occasions, which is inline with the worth will increase we have seen in ETH,” Cronk advised CoinDesk.

Learn extra: Institutions Are Driving Ethereum’s ‘Comeback’