By Omkar Godbole (All instances ET until indicated in any other case)

Bitcoin’s (BTC) consolidation continues to take the wind out of the bull run within the broader market that had raised hopes for the so-called alt season marked by extended outperformance of different cryptocurrencies.

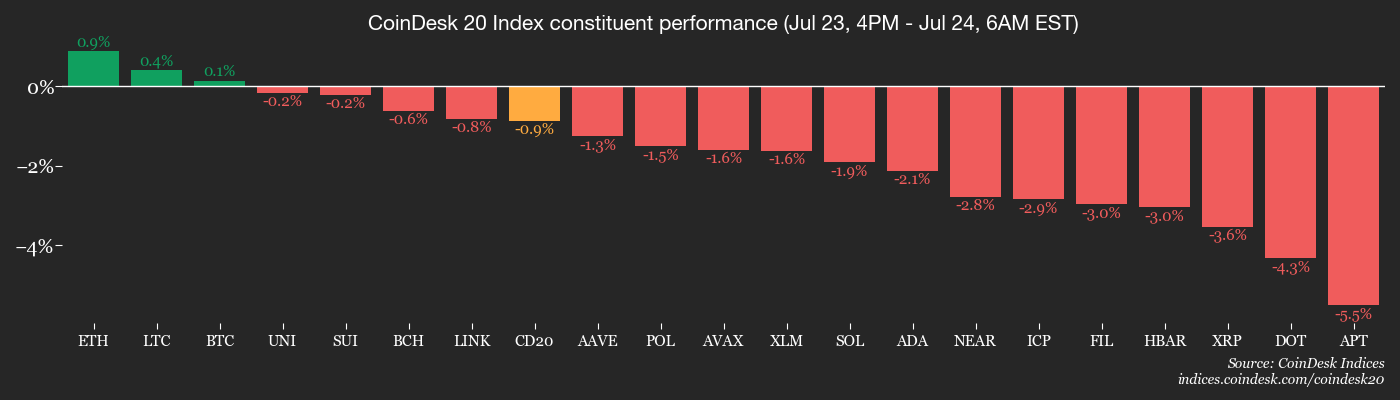

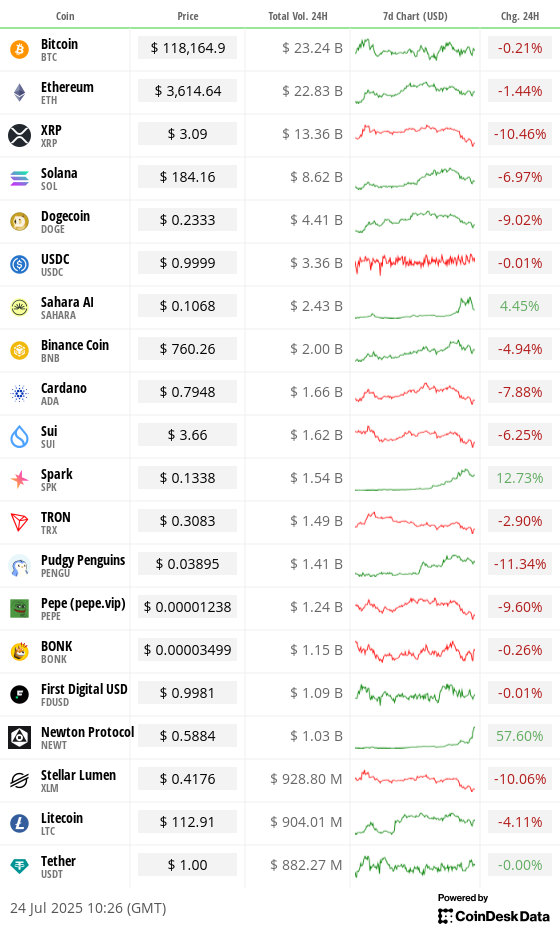

Over the previous 24 hours, main altcoins have skilled a big decline, led by a double-digit drop within the payments-focused XRP and an 8% slide in SOL. The CoinDesk 80 Index, which tracks the efficiency of altcoins, has dropped over 7% whereas the CoinDesk 20 Index, which is dominated by bitcoin and ether, has declined by 4%.

“The crypto market took a nosedive, shedding nearly 4% of its market cap over the past 24 hours. With out bitcoin’s progress, altcoins, which had been driving the market upwards in earlier days, discovered themselves on sale. Forty-eight of the highest 100 altcoins are shedding double-digit charges over 24 hours, whereas solely three are rising,” Alex Kuptsikevich, chief market analyst at FxPro, mentioned in an e mail.

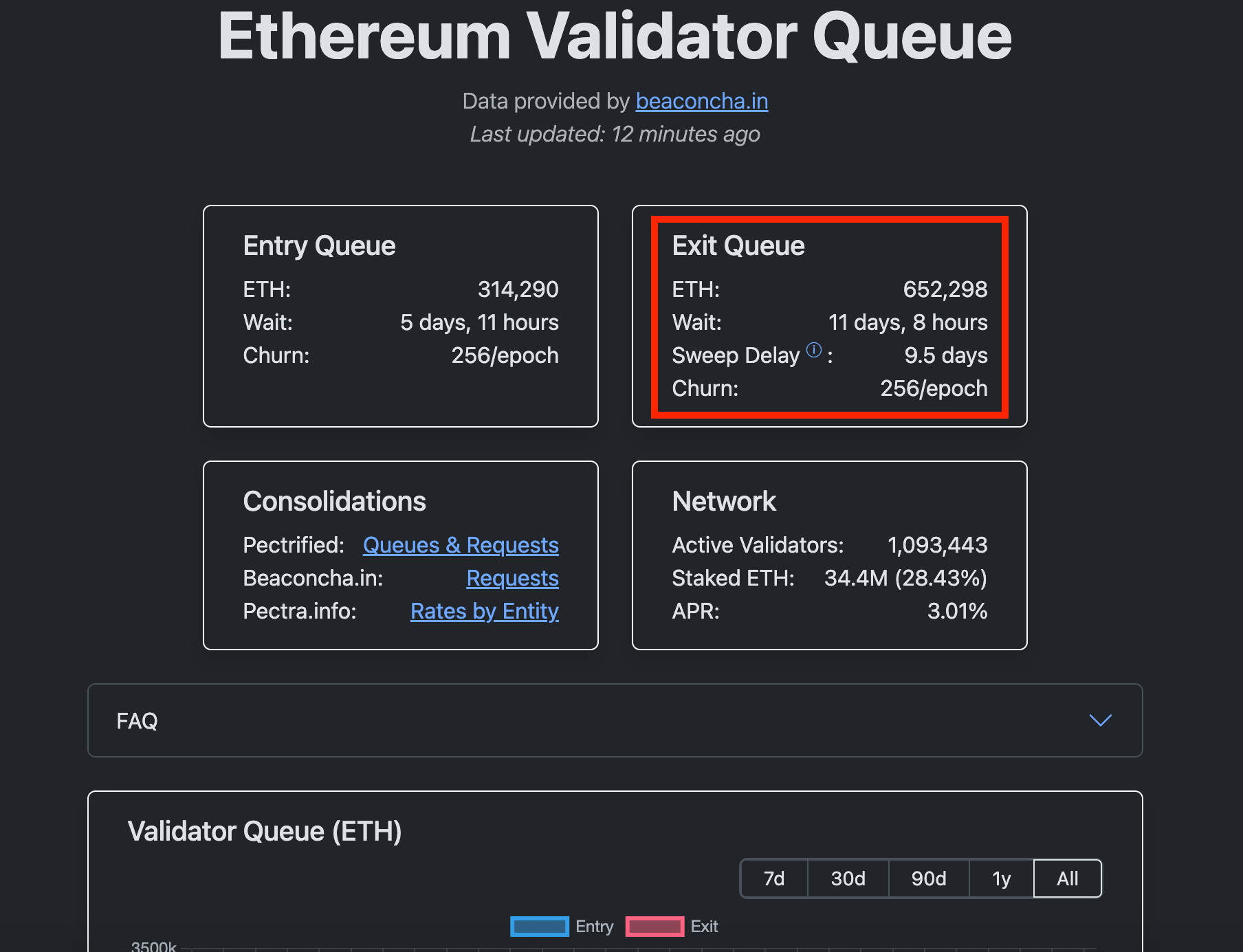

Amid all this, social media is abuzz with posts about some $2 billion price of ether waiting to be unstaked, with over 475 Ethereum validators awaiting exit. (examine chart of the day part). Some are drawing parallels with January 2024, when giant unstaking marked a short lived worth high.

The blockchain assets surge in unstaking seems to be pushed by the hovering ether borrowing charges on decentralized platforms like Aave, which have diminished the attraction of looping methods designed to spice up ether staking yields.

Sometimes, these methods contain customers depositing liquidity staking (LST) or liquid restaking tokens (LRT) as collateral on platforms like AAVE and borrow ETH. The borrowed ETH is once more transformed to LRT and LSTs and redeposited, making a loop. The technique works when staking yields are better than borrowing prices.

Nonetheless, with borrowing prices on the rise, the loop is probably going being reversed, main merchants to hurry to repay loans, exit LST/LRT, and reclaim ETH.

“The actual set off is hovering ETH borrowing charges since July 16 (peaking at 18%). This compelled mass unwinding of ETH leverage loops on Aave, as detrimental yield spreads crushed profitability. Merchants rushed to repay loans, exit LST/LRT positions, and reclaim ETH — inflicting depegs and queue congestion,” pseudonymous observer Degen Station famous on X.

It added that arbitrageurs are actually scooping up LSTs and LRTs at a reduction to redeem them for ether, worsening the difficulty, whereas demand for brand new staking stays sturdy. To chop to the chase, the big queue for unstaking isn’t essentially a bearish sign.

In different key information, Tether CEO Paolo Ardoino said that the corporate is planning to re-enter the U.S. with stablecoin choices for funds, interbank settlements, and buying and selling.

In conventional markets, main currencies traded flat in opposition to the U.S. greenback, apart from the risk-sensitive AUD/USD pair, which crossed above resistance at 0.66. Merchants had been carefully waiting for indicators of sustainability as failure might be a harbinger of broad-based danger aversion.

Keep Alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.

- July 31, 12 p.m.: A reside webinar that includes Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential as the following international reserve forex amid de-dollarization tendencies. Registration link.

- Aug. 1: The Helium Network (HNT), now operating on Solana, undergoes its halving event, slicing annual new token issuance to 7.5 million HNT.

- Aug. 15: File date for the next FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Common Unsecured and Comfort Claims who meet pre-distribution necessities.

- Macro

- July 24, 8:15 a.m.: The European Central Financial institution will announce its rate of interest determination, with President Christine Lagarde’s press convention following half-hour later. Livestream link.

- Most important Refinancing Operations (MRO) price Est. 1.9% vs. Prev. 2.15%

- July 24, 9:45 a.m.: S&P World releases (flash) July U.S. knowledge on manufacturing and providers exercise.

- Composite PMI Prev. 52.9

- Manufacturing PMI Est. 52.6 vs. Prev. 52.9

- Providers PMI Est. 53 vs. Prev. 52.9

- July 24, 4 p.m.: President Donald Trump will visit the Federal Reserve headquarters, highlighting his public disagreements with Chair Jerome Powell and Fed financial coverage.

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured sturdy items orders knowledge.

- Sturdy Items Orders MoM Est. -10.8% vs. Prev. 16.4%

- Sturdy Items Orders Ex Protection MoM Prev. 15.5%

- Sturdy Items Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5%

- Aug. 1, 12:01 a.m.: New U.S. tariffs take impact on imports from buying and selling companions that failed to achieve agreements by the July 9 deadline. These elevated duties may vary from 10% to as excessive as 70%, impacting a variety of products.

- July 24, 8:15 a.m.: The European Central Financial institution will announce its rate of interest determination, with President Christine Lagarde’s press convention following half-hour later. Livestream link.

- Earnings (Estimates based mostly on FactSet knowledge)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase World (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS); pre-market, N/A

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Occasions

- Governance votes & calls

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority will ratify key protocol modifications, together with new transaction designs and a possible income share to the pDAO treasury. Voting ends July 24.

- Aavegotchi DAO is voting on a proposal to sell its treasury of round 16 million GHST at a reduction to VC agency Rongming Funding for round $3.2 million in USDC, dissolve the DAO, and distribute funds to lively members. The VC agency goals to scale Aavegotchi globally whereas Pixelcraft retains IP possession. Voting ends July 25.

- Lido DAO is voting on a new system that lets validator exits be triggered robotically by means of the execution layer, not simply by node operators. It contains instruments for various authorization pathways, emergency controls, and constructed‑in limits to forestall misuse. The replace is predicted to make staking extra decentralized, safe, and responsive. Voting ends July 28.

- GnosisDAO is voting on a proposal to provide $30 million per year, paid quarterly, to Gnosis Ltd., now a non-profit, to maintain its ~150‑particular person workforce constructing essential Gnosis Chain infrastructure, merchandise (like Gnosis Pay and Circles), enterprise growth, and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding three new features for the official decentralized software: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators should approve the proposal for it to cross, and if that’s the case, it might be applied by late Q3. Voting ends Aug. 1.

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst call.

- Unlocks

- July 25: Venom (VENOM) to unlock 2.84% of its circulating provide price $12.36 million.

- July 28: Jupiter (JUP) to unlock 1.78% of its circulating provide price $29.04 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating provide price $21.48 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating provide price $163.66 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating provide price $18.92 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide price $13.36 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating provide price $52.59 million.

- Token Launches

- July 24: Uranium.io (XU3O8) to be listed on KuCoin, MEXC, Gate.io, and others.

- July 24: Aspecta (ASP) to be listed on Binance Alpha, OKX, KuCoin, BingX and others.

- July 24: Lease (REKT) to be listed on Binance.US

Conferences

The CoinDesk Policy & Regulation conference (previously often known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits normal counsels, compliance officers and regulatory executives to satisfy with public officers answerable for crypto laws and regulatory oversight. House is restricted.

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

Token Discuss

By Shaurya Malwa

- PENGU surged to a report $0.044, reclaiming the title of high Solana meme token after overtaking BONK in a rally timed with the fourth anniversary of the Pudgy Penguins NFT assortment.

- The token jumped 21% in 24 hours, extending a multiday rally and overtaking its earlier all-time excessive of $0.042 from January.

- South Korean merchants are driving momentum, with 38% of PENGU quantity now in KRW pairs, up from 32% earlier this month, a big focus of localized demand.

- Open curiosity in PENGU futures is at a report excessive, indicative of expectations of additional volatility.

- The Pudgy Penguins NFT ground worth has nearly doubled to 16.2 ETH, reinforcing the connection between token worth and NFT ecosystem energy.

- PENGU’s rally comes amid weak sentiment round PUMP following its underwhelming post-ICO efficiency, pushing consideration and liquidity towards different Solana memecoins.

- The token is more and more being considered as a proxy for meme market sentiment, combining excessive liquidity, trade entry, cultural mindshare and ties to a top-tier NFT IP.

Derivatives Positioning

- Open curiosity in BTC, ETH, XRP and SOL offshore perpetual has declined together with costs up to now 24 hours. But, funding charges maintain optimistic. This mix signifies that the market swoon is predominantly pushed by the unwinding of bullish bets somewhat than outright shorts.

- On the CME, the annualized three-month foundation in BTC futures has ticked as much as practically 9%, the very best since Could. Nonetheless, open curiosity stays locked in acquainted ranges.

- ETH CME futures open curiosity has pulled again barely from the report 2.08 billion ETH to 1.87 billion ETH. Foundation, in the meantime, has topped 10% for the primary time for the reason that finish of Could, indicating a bullish sentiment.

- On Deribit, the put bias in short-dated BTC danger reversals has strengthened, indicating fears of deeper worth pull again. ETH choices proceed to point out a bullish name bias throughout all tenors. Surprisingly, XRP danger reversals stay bullish regardless of the sharp worth drop up to now 24 hours.

Market Actions

- BTC is up 0.49% from 4 p.m. ET Wednesday at $118,534.04 (24hrs: -0.09%)

- ETH is up 1.9% at $2,607.45 (24hrs: -1.15%)

- CoinDesk 20 is up 0.41% at 3,934.83 (24hrs: -3.55%)

- Ether CESR Composite Staking Price is down 2 bps at 2.95%

- BTC funding price is at 0.0091% (9.9645% annualized) on KuCoin

- DXY is up 0.14% at 97.35

- Gold futures are down 0.86% at $3,368.50

- Silver futures are down 0.32% at $39.38

- Nikkei 225 closed up 1.59% at 41,826.34

- Dangle Seng closed up 0.51% at 25,667.18

- FTSE is up 1.00% at 9,151.80

- Euro Stoxx 50 is up 0.56% at 5,374.36

- DJIA closed on Wednesday up 1.14% at 45,010.29

- S&P 500 closed up 0.78% at 6,358.91

- Nasdaq Composite closed up 0.61% at 21,020.02

- S&P/TSX Composite closed up 0.19% at 27,416.41

- S&P 40 Latin America closed up 1.86% at 2,639.18

- U.S. 10-12 months Treasury price is up 1 bps at 4.398%

- E-mini S&P 500 futures are unchanged at 6,402.00

- E-mini Nasdaq-100 futures are up 0.33% at 23,387.75

- E-mini Dow Jones Industrial Common Index are down 0.30% at 45,078.00

Bitcoin Stats

- BTC Dominance: 62.1% (0.33%)

- Ether to bitcoin ratio: 0.3055 (unchanged)

- Hashrate (seven-day transferring common): 908 EH/s

- Hashprice (spot): $59.59

- Complete charges: 4.19 BTC / $496,766

- CME Futures Open Curiosity: 149,260 BTC

- BTC priced in gold: 35.2 oz.

- BTC vs gold market cap: 9.87%

Technical Evaluation

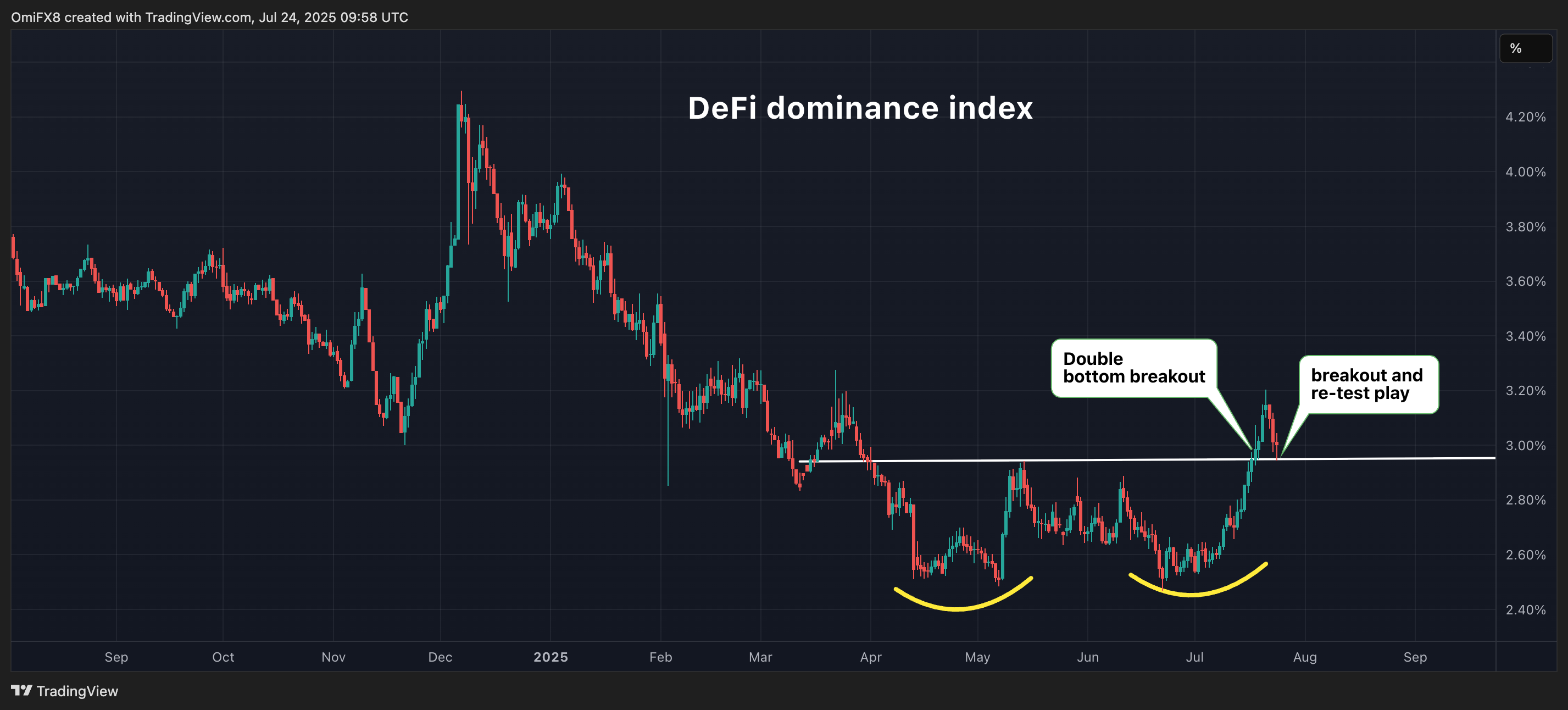

- The DeFi dominance index, which measures the share of decentralized finance cash within the complete crypto market, is at the moment displaying a basic “breakout and re-test” sample.

- This technical setup, characterised by a re-test of the breakout level, usually indicators that the index is consolidating earlier than a possible important rally.

Crypto Equities

- Technique (MSTR): closed on Wednesday at $412.67 (-3.22%), unchanged in pre-market

- Coinbase World (COIN): closed at $397.81 (-1.64%), unchanged in pre-market

- Circle (CRCL): closed at $202.41 (+2.07%), -1.6% at $199.18

- Galaxy Digital (GLXY): closed at $31.03 (+6.6%), -0.1% at $31

- MARA Holdings (MARA): closed at $17.57 (-11.62%), +0.23% at $17.61

- Riot Platforms (RIOT): closed at $14.34 (+0.49%), -0.49% at $14.27

- Core Scientific (CORZ): closed at $13.49 (+0.07%), +0.37% at $13.54

- CleanSpark (CLSK): closed at $12.45 (-3.04%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.34 (-0.8%)

- Semler Scientific (SMLR): closed at $39.32 (-2.16%)

- Exodus Motion (EXOD): closed at $34.21 (-1.5%)

- SharpLink Gaming (SBET): closed at $25.81 (-5.8%), +0.66% at $25.98

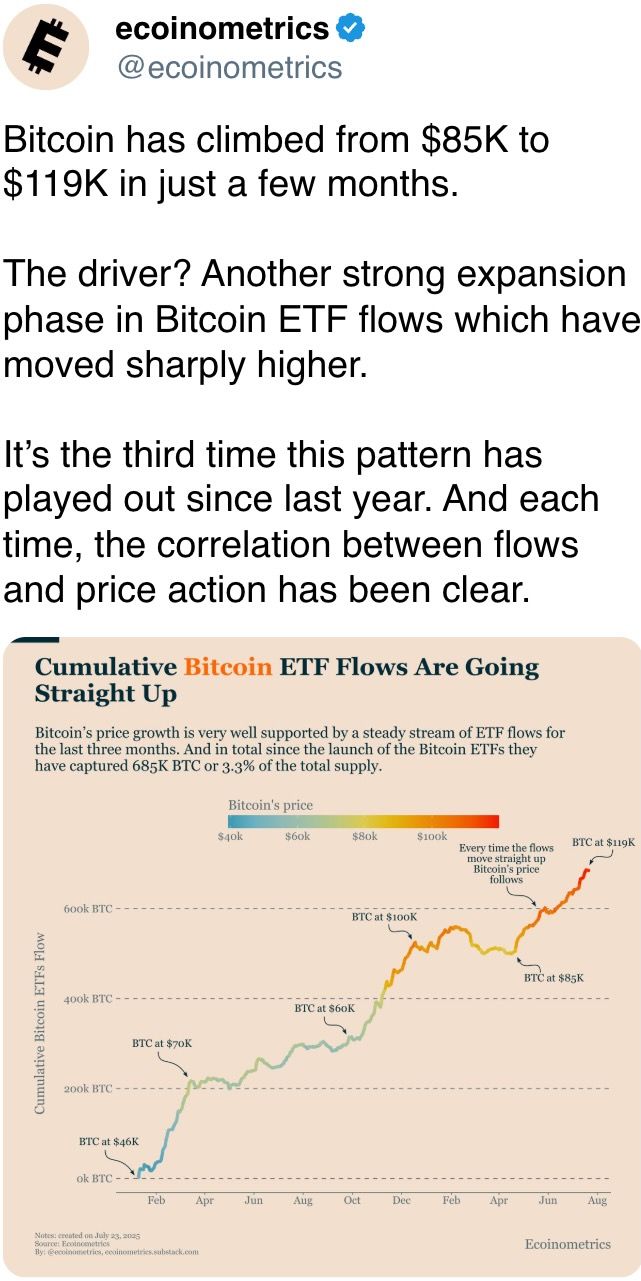

ETF Flows

Spot BTC ETFs

- Each day web flows: -$85.8 million

- Cumulative web flows: $54.44 billion

- Complete BTC holdings ~1.3 million

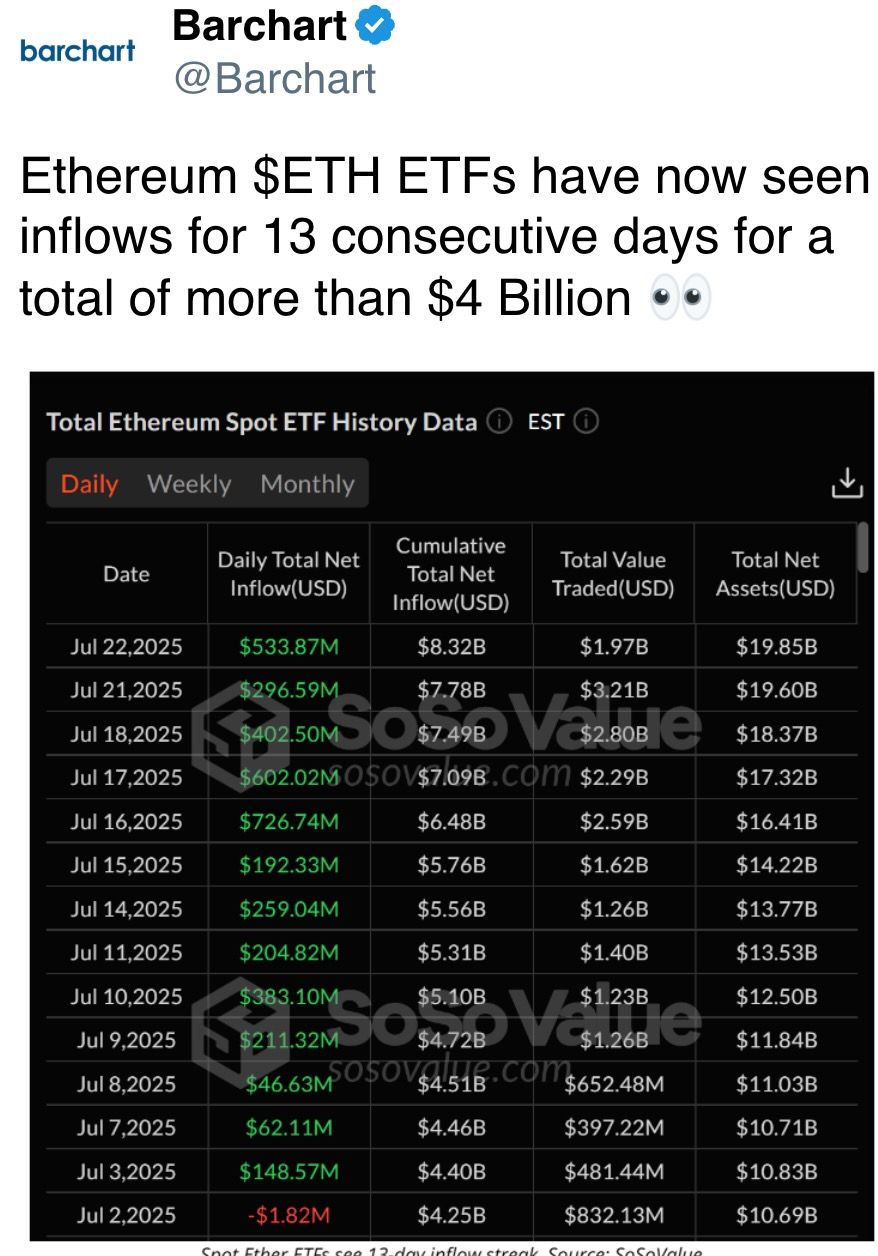

Spot ETH ETFs

- Each day web flows: $332.2 million

- Cumulative web flows: $8.67 billion

- Complete ETH holdings ~5.24 million

Supply: Farside Investors

In a single day Flows

Chart of the Day

- The queue for unstaking ether now consists of 652,298 ETH with ready time of over 11 days.

Whereas You Have been Sleeping

- FTX to Start Next Round of Creditor Repayments on Sept. 30 (CoinDesk): FTX, the bankrupt crypto trade previously led by Sam Bankman-Fried, has repaid practically $6.2 billion to collectors. The following distribution might be dealt with by BitGo, Kraken and Payoneer.

- Crypto Industry Asks President Trump to Stop JPMorgan’s ‘Punitive Tax’ on Data Access (CoinDesk): A plan by JPMorgan to cost corporations like Plaid and MX for linking financial institution accounts to crypto exchanges threatens fiat on-ramps, with Plaid alone going through charges that might wipe out most of its income.

- ‘Wall Streetization’ of Bitcoin: BTC Volatility Index and the S&P 500 VIX Boast Record 90-Day Correlation (CoinDesk): Institutional crypto merchants are mirroring fairness choice methods, reshaping bitcoin’s volatility indicators into sentiment gauges and decoupling them from worth tendencies, resulting in report alignment with Wall Avenue worry metrics.

- BTC, XRP, SOL, ETH Witness ‘Long Squeeze’ as Futures Open Interest Slides With Prices (CoinDesk): Optimistic funding charges and declining futures publicity counsel bullish merchants are being cleared out — not changed — pointing to a leverage reset somewhat than a shift in sentiment.

- Chinese and EU Leaders Are About to Meet — but the U.S. Is Complicating Things (Monetary Occasions): EU officers challenged Beijing over its $142 billion commerce surplus and ties to Moscow, whereas China defended its stance and warned Brussels in opposition to tariffs or limiting market entry by means of provide chain controls.

- How a Chinese Border Town Keeps Russia’s Economy Afloat (The New York Occasions): China’s booming imports of Russian power, timber and grain now feed its manufacturing sector as Beijing replaces Western consumers throughout key sectors of the post-sanctions financial system.