For over a decade, the mantra for bitcoin holders has been clear: “not your keys, not your cash.” However as bitcoin matures right into a globally acknowledged asset, that mindset is now not adequate for whales managing tons of of tens of millions in BTC. The recent movement of over 80,000 BTC from eight Satoshi-era wallets — the most important such switch in bitcoin’s historical past – has reignited consideration round how legacy holders handle and ultimately unwind huge positions. Holding spot bitcoin straight, particularly in giant portions, exposes traders to avoidable threat, operational complications and regulatory friction — to not point out the type of custody nightmares that may preserve even probably the most seasoned holders up at evening.

Another exists within the type of regulated bitcoin exchange-traded merchandise (ETPs) — a confirmed, equity-like construction with a powerful monitor document. Bodily backed crypto ETPs have been out there in Europe for over seven years.These merchandise mix the transparency and safeguards of conventional markets with the innovation of digital belongings — providing stronger safety frameworks, improved liquidity entry, tax and compliance efficiencies and the power to make use of them as collateral for loans. For giant holders, the case to maneuver into regulated wrappers is changing into too sturdy to disregard.

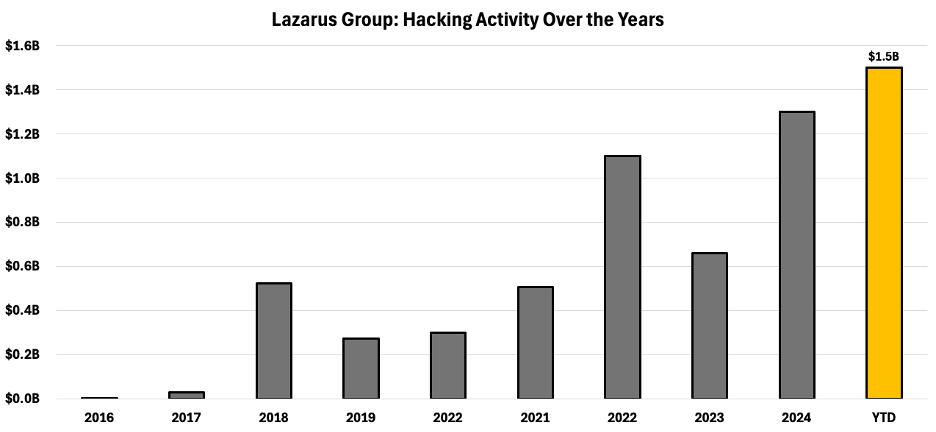

Liquidity is a significant concern. Giant holders who need to unwind a place typically face vital slippage and counterparty threat on centralized exchanges. Alternatively, they have to appoint exterior corporations to handle the method, triggering time delays as a result of onboarding and KYC and infrequently paying a premium in execution. With an ETP, the executive hurdles are front-loaded; as soon as onboarded, the investor has entry to the ETP’s liquidity pool, simplifying and accelerating exit methods when timing issues. Many whales imagine that self-custody maximizes safety. In actuality, managing giant spot positions is extremely complicated. Key administration, chilly storage logistics, succession planning and inner controls require infrastructure that few people — and even crypto-native funds — can preserve securely at scale. Regulated ETPs sidestep this totally by providing professionally managed custody options — combining segregated accounts, insurance coverage protection and direct oversight from monetary regulators. European constructions go even additional with bankruptcy-remote frameworks and authorized title to the underlying BTC. This isn’t about giving up possession, in reality, it’s an improve to how that possession is held: securely, transparently and with institutional-grade safeguards to keep away from loss and fraud. For instance, the Lazarus Group, considered one of North Korea’s most infamous hacking organizations, has been answerable for a big variety of crypto-related breaches, ensuing within the theft of $1.5 billion this yr alone.

Determine 1: Whole worth of crypto-hacks in USD over the previous a number of years

Supply: Chainalysis

European ETPs permit in-kind transfers which allow traders to maneuver bitcoin straight into and out of the fund with out triggering a taxable occasion. That is particularly beneficial in jurisdictions like Switzerland and Germany, the place long-term holders can optimize capital beneficial properties remedy. For whales pondering long run, the pliability of in-kind move is a significant improve. It additionally unlocks new monetary optionality; moderately than promoting their bitcoin throughout a significant life occasion like shopping for a house, traders can borrow in opposition to their ETP holdings and entry liquidity with out ever parting with the underlying asset and triggering capital beneficial properties.

Self-custody will at all times have a spot, particularly for customers in unstable areas or these needing monetary sovereignty. However for whales with scale, the trade-offs of holding spot BTC are more and more onerous to justify. Bitcoin ETPs are merely much less of a headache: they scale back threat, enhance liquidity entry, simplify compliance and supply long-term infrastructure for severe capital allocators, permitting massive traders to sleep straightforward at evening. The way forward for bitcoin possession isn’t about whether or not you can maintain your keys, it’s about whether or not you ought to.