By Omkar Godbole (All occasions ET until indicated in any other case)

Bitcoin (BTC) traded little modified round $120,000, struggling to construct on a weekend bounce characterised by constant demand at round $117,000.

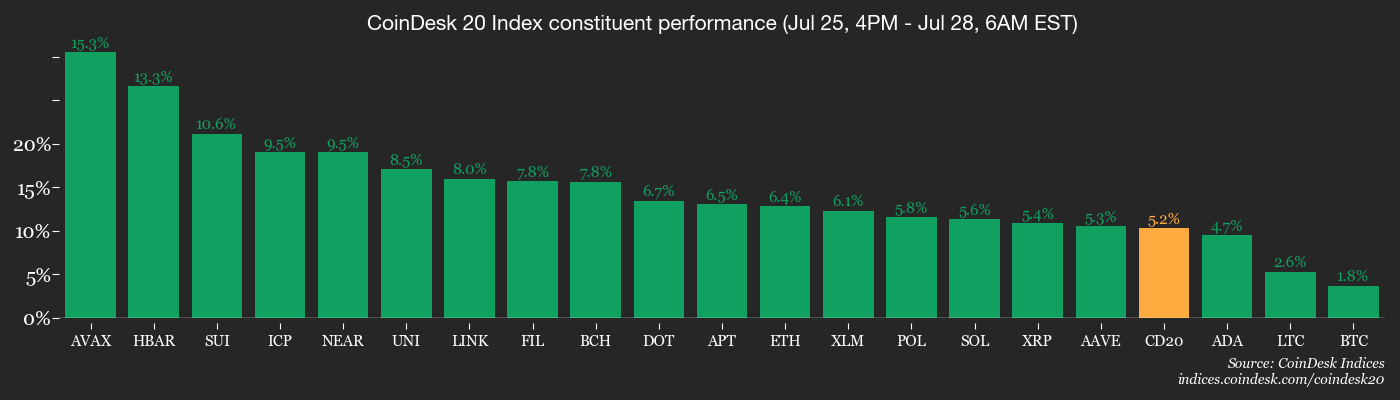

Different tokens have been much less moribund. The CD20 Index, which captures about 80% of the digital asset market, rose 2% over 24 hours whereas the CD80 Index traded 4% larger, pointing to the relative energy of altcoins.

In line with Glassnode, bitcoin dip consumers are including publicity across the $117,000 stage, with 73,000 BTC now held at this value foundation. “Every dip is being absorbed as buyers steadily accumulate on this vary,” Glassnode said.

For these seeking to be a part of the present bull run, one analyst suggests ultimate entry factors both above the $120,000 resistance stage upon a clear breakout or close to the previous resistance-turned-support stage round $111,600, which aligns with the Could excessive.

Company demand for main cryptocurrencies exhibits no indicators of slowing down. Early Monday, Metaplanet said it bought one other 780 BTC at a median worth exceeding $118,000, bringing its whole holdings to 17,132 BTC, valued round $2 billion.

Equally, SharpLink Gaming, the second-largest company holder of ether (ETH), expanded its reserves by one other 77,210 ETH, value $295 million. In line with Extremely Sound Cash, this acquisition notably outstripped ether’s 30-day internet issuance of 72,795 ETH, suggesting sturdy underlying demand. Nonetheless, ether’s latest rally notably lacks on-chain help, with lively addresses and different utilization metrics failing to maintain tempo with the worth surge. (See Chart of the Day for extra on that.)

In broader altcoin information, Aptos, a layer-1 proof-of-stake blockchain, surpassed Solana to grow to be the third-largest chain by whole worth of real-world property (RWA) on its community, now trailing solely zkSync and Ethereum.

For its half, the Ethena Foundation reportedly acquired 83 million ENA tokens between July 22 and July 25 via a third-party market maker as a part of its buyback program. In the meantime, blockchain sleuth Lookonchain reported a whale transaction involving the alternate of 1.75 million FARTCOIN for 790.4 million PUMP.

Trying forward, merchants are keenly awaiting the White Home’s digital asset report, scheduled for launch on July 30, anticipating that it might function a big catalyst for cryptocurrency markets.

On the macroeconomic entrance, stories of a possible 90-day extension to U.S.-China tariffs pause and the announcement of the U.S.-EU commerce deal didn’t spur notable features in risk-sensitive currencies such because the Australian greenback or U.S. inventory index futures, indicating a cautious world market sentiment. Keep alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.

- July 31, 12 p.m.: A stay webinar that includes Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo talk about bitcoin’s potential as the subsequent world reserve forex amid dedollarization traits. Registration link.

- Aug. 1: The Helium Network (HNT), now operating on Solana, undergoes its halving event, slicing annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing regime to control stablecoin actions within the metropolis.

- Aug. 1: New Bretton Woods Labs will launch BTCD, which it says is the primary absolutely bitcoin-backed stablecoin, on the Elastos (ELA) mainnet — a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Basis.

- Aug. 15: Document date for the next FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Common Unsecured and Comfort Claims who meet pre-distribution necessities.

- Macro

- Day 1 of two: U.S. and Chinese language officers meet in Stockholm for his or her third spherical of commerce talks. Treasury Secretary Scott Bessent and Chinese language Vice Premier He Lifeng lead discussions centered on stopping additional tariff escalations. Whereas extending the tariff truce set to run out Aug. 12 is a key purpose, the assembly additionally goals to put the groundwork for future negotiations and a doable leaders’ summit later this yr.

- July 28, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases June unemployment price information.

- Unemployment Fee Prev. 2.7%

- July 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases June U.S. labor market information (the JOLTS report).

- Job Openings Est. 7.35M vs. Prev. 7.7691M

- Job Quits Prev. 3.293M

- July 29, 10 a.m.: The Convention Board (CB) releases July U.S. shopper confidence information.

- CB Shopper Confidence Est. 95.5 vs. Prev. 93

- July 30, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases (preliminary) Q2 GDP development information.

- GDP Progress Fee QoQ Prev. 0.2%

- GDP Progress Fee YoY Prev. 0.8%

- July 30, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases (advance estimate) Q2 GDP information.

- GDP Progress Fee QoQ Est. 2.5% vs. Prev. -0.5%

- GDP Worth Index QoQ Est. 2.4% vs. Prev. 3.8%

- GDP Gross sales QoQ Prev. -3.1%

- PCE Costs QoQ Prev. 3.7%

- Actual Shopper Spending QoQ Prev. 0.5%

- July 30, 9:45 a.m.: The Financial institution of Canada (BoC) broadcasts its financial coverage choice and publishes the quarterly Financial Coverage Report. The press convention follows at 10:30 a.m. Livestream link.

- Coverage Curiosity Fee Est. 2.75% Prev. 2.75%

- July 30, 2 p.m.: The Federal Reserve broadcasts its financial coverage choice; federal funds charges are anticipated to stay unchanged at 4.25%-4.50%. Chair Jerome Powell’s press convention follows at 2:30 p.m.

- July 30, 5:30 p.m.: Brazil’s central financial institution, Banco Central do Brasil, broadcasts its financial coverage choice.

- Selic Fee Prev. 15%

- Aug. 1, 12:01 a.m.: New U.S. tariffs take impact on imports from buying and selling companions that fail to safe a commerce deal by this date. These elevated duties might vary from 10% to as excessive as 70%, impacting a variety of products.

- Earnings (Estimates based mostly on FactSet information)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase International (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Occasions

- Governance votes & calls

- Lido DAO is voting on a new system that lets validator exits be triggered robotically via the execution layer, not simply by node operators. It consists of instruments for various authorization pathways, emergency controls and constructed‑in limits to stop misuse. The replace is anticipated to make staking extra decentralized, safer and extra responsive. Voting ends July 28.

- GnosisDAO is voting on a proposal to provide $30 million a year, paid quarterly, to Gnosis Ltd., now a non-profit, to maintain its 150‑particular person staff constructing vital Gnosis Chain infrastructure, merchandise (like Gnosis Pay and Circles), enterprise improvement and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding three new features for the official decentralized utility: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- Steadiness DAO is voting on deploying Balancer v3 on HyperEVM. Voting ends July 29.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators should approval the proposal for it to go, and if that’s the case it might be applied by late Q3. Voting ends Aug. 1

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst call.

- Unlocks

- July 28: Jupiter (JUP) to unlock 1.78% of its circulating provide value $32.35 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating provide value $26.26 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating provide value $188.54 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating provide value $28 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide value $14.85 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating provide value $55.87 million.

- Token Launches

- July 28: NERO Chain (NERO) and Spheron Community (SPON) to be listed on Gate.io, Bitget, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (previously referred to as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits basic counsels, compliance officers and regulatory executives to satisfy with public officers answerable for crypto laws and regulatory oversight. Area is proscribed. Use code CDB10 for 10% off your registration via Aug. 31.

- Day 1 of two: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

Token Speak

By Shaurya Malwa

- Believe App’s API v2 permits crypto tasks to construct self-reinforcing tokenomic flywheels, the place automated actions like burns, airdrops and future buybacks are triggered by particular mission occasions.

- The core worth lies in enabling optimistic suggestions loops wherein one bullish set off results in automated, on-chain actions that reinforce momentum (e.g., a spike in buying and selling quantity triggering a buyback-to-burn-to-airdrop pipeline).

- All flywheel actions are powered by base cash, secured by way of a dual-signature multisig pockets. Meaning they require each Consider and the mission’s approval to execute, including sturdy safety towards misuse.

- Tasks can configure day by day motion limits, and all flywheel exercise is publicly clear by way of a vault tackle, enabling neighborhood participation in contributing funds to energy the flywheel.

- Every transaction consists of an on-chain JSON memo for proof, providing auditable, clear and regulatory-aligned documentation for each motion taken.

- Authentication is straightforward: Generate an API key from the Consider Internet App and go it with each request utilizing the x-believe-api-key header.

- Consider App-linked LAUNCHCOIN might be one to observe as such flywheel mechanisms go stay, accruing worth to the token.

Derivatives Positioning

- Cumulative open curiosity in bitcoin CME futures and offshore normal and perpetual futures rose to 742,180 BTC on Saturday, the very best since October 2022. Although the determine’s pulled again barely since then, the elevated stage suggests worth volatility.

- Open curiosity in ether futures has reached a lifetime excessive of 15.53 million ETH, alongside optimistic funding charges in perpetual futures. The mixture factors to bullish market sentiment.

- On Deribit, BTC and ETH danger reversals present name bias throughout all tenors, with bullishness extra pronounced in ETH.

- Block flows featured a big brief positions within the $105,000 strike name expiring on Aug. 15.

- The one-year call-put skew on BlackRock’s IBIT ETF has jumped to 1.60, displaying the strongest name bias in two months.

Market Actions

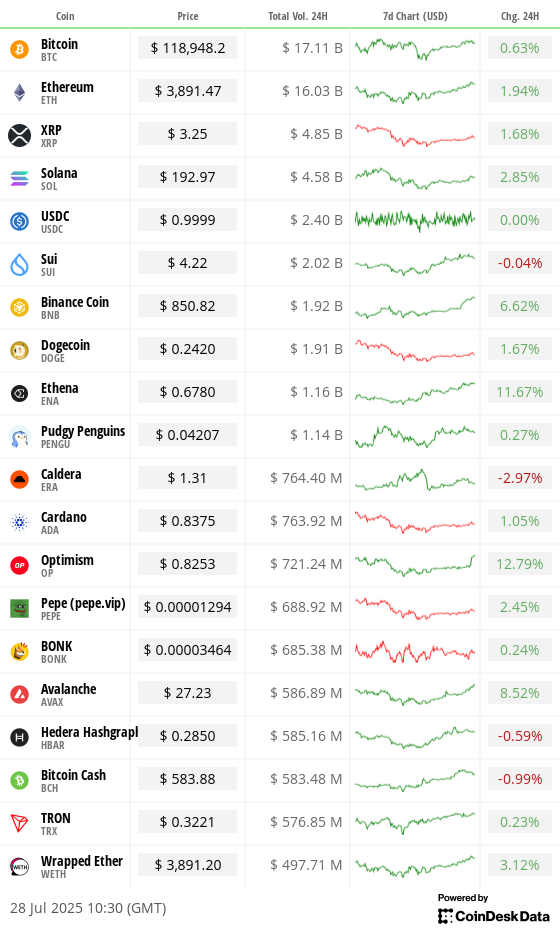

- BTC is up 1.55% from 4 p.m. ET Friday at $118,871.47 (24hrs: +0.61%)

- ETH is up 5.6% at $3,891.41 (24hrs: +1.91%)

- CoinDesk 20 is up 4.58% at 4,113.88 (24hrs: +1.65%)

- Ether CESR Composite Staking Fee is down 10 bps at 2.86%

- BTC funding price is at 0.0044% (4.818% annualized) on KuCoin

- DXY is up 0.56% at 98.19

- Gold futures are unchanged at $3,337.30

- Silver futures are down 0.26% at $38.26

- Nikkei 225 closed down 1.1% at 40,998.27

- Dangle Seng closed up 0.68% at 25,562.13

- FTSE is up 0.12% at 9,131.39

- Euro Stoxx 50 is up 0.85% at 5,397.41

- DJIA closed on Friday up 0.47% at 44,901.92

- S&P 500 closed up 0.4% at 6,388.64

- Nasdaq Composite closed up 0.24% at 21,108.32

- S&P/TSX Composite closed up 0.45% at 27,494.35

- S&P 40 Latin America closed down 0.42% at 2,616.48

- U.S. 10-Yr Treasury price is down 1.2 bps at 4.374%

- E-mini S&P 500 futures are up 0.26% at 6,442.00

- E-mini Nasdaq-100 futures are up 0.45% at 23,527.50

- E-mini Dow Jones Industrial Common Index are up 0.17% at 45,160.00

Bitcoin Stats

- BTC Dominance: 60.79% (-0.39%)

- Ether to bitcoin ratio: 0.03266 (0.71%)

- Hashrate (seven-day shifting common): 933 EH/s

- Hashprice (spot): $59.08

- Complete Charges: 4.12 BTC / $488,258

- CME Futures Open Curiosity: 147,525 BTC

- BTC priced in gold: 35.1 oz

- BTC vs gold market cap: 9.93%

Technical Evaluation

- Bitcoin money’s (BCH) day by day chart exhibits that costs have topped the extended sideways channel formation, suggesting a resumption of the uptrend from the June 2023 lows.

- The following large resistance is seen at $800, the swing excessive registered in September 2021.

Crypto Equities

- Technique (MSTR): closed on Friday at $405.89 (-2.18%), +3.08% at $418.41 in pre-market

- Coinbase International (COIN): closed at $391.66 (-1.27%), +1.95% at $399.30

- Circle (CRCL): closed at $192.86 (-0.11%), +3.04% at $198.72

- Galaxy Digital (GLXY): closed at $30.59 (-4.08%), +5.1% at $32.15

- MARA Holdings (MARA): closed at $17.25 (-0.06%), +3.36% at $17.83

- Riot Platforms (RIOT): closed at $14.54 (-1.02%), +0.41% at $14.60

- Core Scientific (CORZ): closed at $13.76 (+0.51%), +0.94% at $13.89

- CleanSpark (CLSK): closed at $11.82 (-4.21%), +2.79% at $12.15

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.56 (-2.03%), +2.41% at $27.20

- Semler Scientific (SMLR): closed at $38.08 (-2.08%), +0.18% at $38.15

- Exodus Motion (EXOD): closed at $33.02 (-1.76%)

- SharpLink Gaming (SBET): closed at $21.99 (-5.7%), +6.64% at $23.45

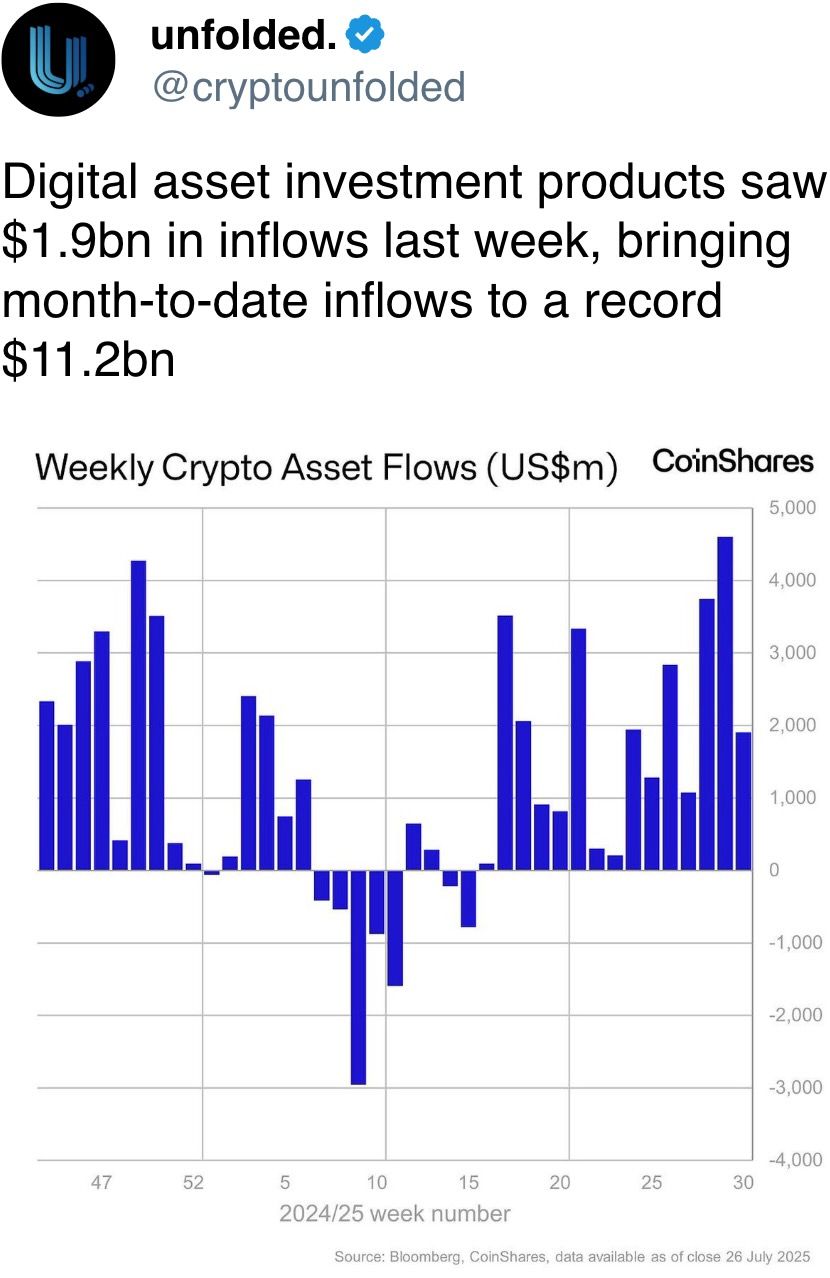

ETF Flows

Spot BTC ETFs

- Each day internet circulate: $130.8 million

- Cumulative internet flows: $54.79 billion

- Complete BTC holdings ~ 1.29 million

Spot ETH ETFs

- Each day internet circulate: $452.8 million

- Cumulative internet flows: $9.35 billion

- Complete ETH holdings ~ 5.51 million

Supply: Farside Investors

In a single day Flows

Chart of the Day

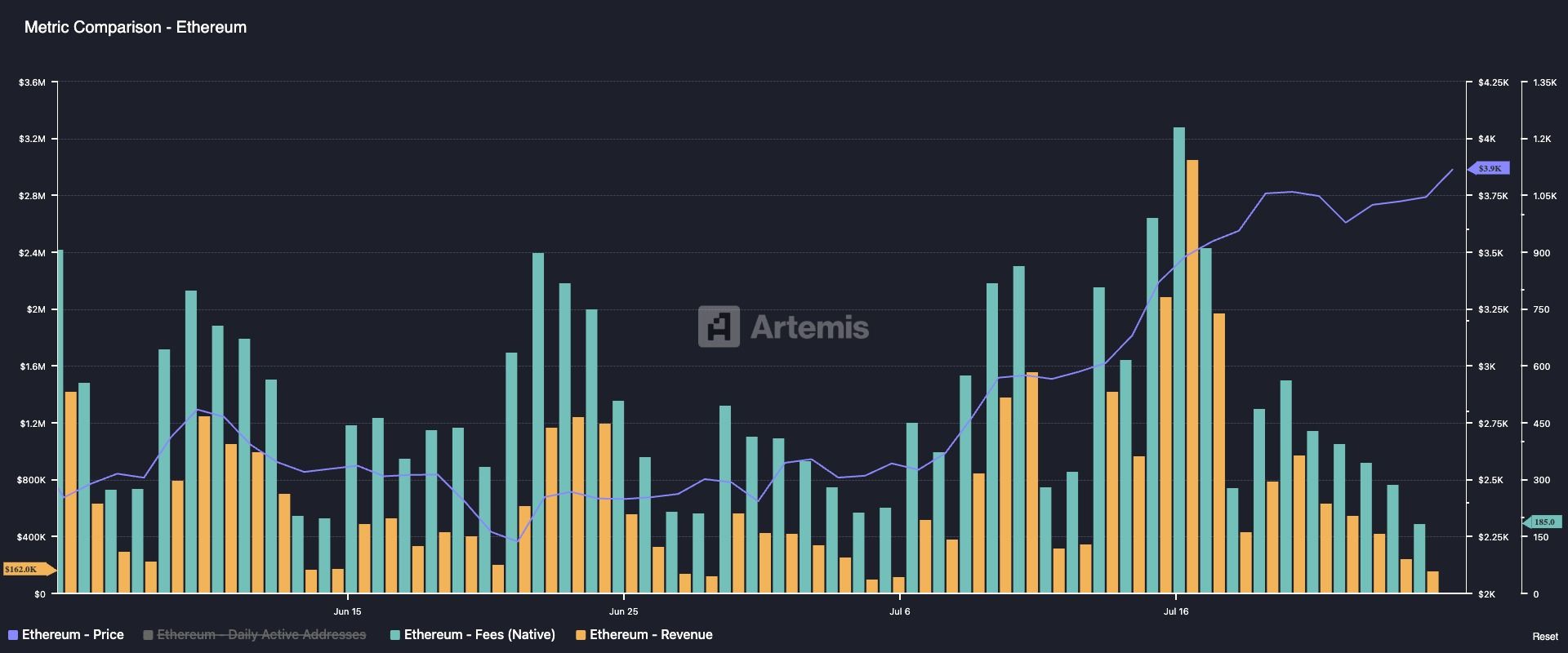

- Ethereum’s native charges, the transaction prices paid in ether (ETH) to validators for executing transactions, and whole income have declined, decoupling from the 56% surge in ether’s spot worth.

- The divergence raises a query: Will ETH’s rally maintain up if the company treasury demand weakens?

Whereas You Had been Sleeping

- U.S. and China Meet as Trade Truce Nears Expiration (The New York Instances): The 2 days of talks in Stockholm are looking for to increase the tariff ceasefire earlier than Aug. 12, when U.S. import duties on Chinese language items are set to rise 10 share factors.

- Brazil to Double Down on BRICS in Defiance of Donald Trump (Monetary Instances): To counter U.S. strain over its home affairs, Brazil is deepening ties with different BRICS nations, Europe and South America, together with efforts to revive the Mercosur-EU commerce pact and develop regional integration.

- Cambodia, Thailand Agree to ‘Immediate and Unconditional Ceasefire’ (BBC): The midnight native time ceasefire follows U.S. strain linking decision to commerce talks after lethal border clashes since July 24.

- Here Is the Bitcoin Price Level That Could Be an Attractive Entry Point for BTC Bulls (CoinDesk): For merchants hesitant to purchase now, 10x Analysis’s Markus Thielen says ready for a pullback to Could’s former resistance, now help, worth beneath $112,000, could be the very best technique.

- Clearmatics’ New DeFi Derivatives Let Traders Bet on Anything, but It’s Not a Prediction Market (CoinDesk): In contrast to prediction markets like Polymarket that resolve on binary occasions, Clearmatics’ on-chain futures observe real-world metrics reminiscent of inflation and temperatures, enabling ongoing publicity and danger hedging.

- Metaplanet Buys 780 More Bitcoin, Increases Stash to 17,132 BTC (CoinDesk): The Japanese firm made its workout plans buy at a median worth of 17.5 million yen ($118,176) per BTC. Its shares rose 5% on Monday, outperforming the Nikkei 225, which fell 1.1%.

- EU Reaches Tariff Deal With US to Avert Painful Trade Blow (Bloomberg): To safe a 15% base tariff, excluding metal and aluminum, efficient Aug. 1, the EU agreed to spice up U.S. power purchases, develop army imports and make investments $600 billion extra in America.