It is turn out to be dearer to make use of derivatives to insure in opposition to a decline in ether (ETH) than in bitcoin (BTC), indicating that market sentiment has shifted in opposition to the second-largest cryptocurrency by market cap, knowledge from Deribit reveals.

The sentiment shift comes after weeks of huge cash favoring ether over its bigger peer.

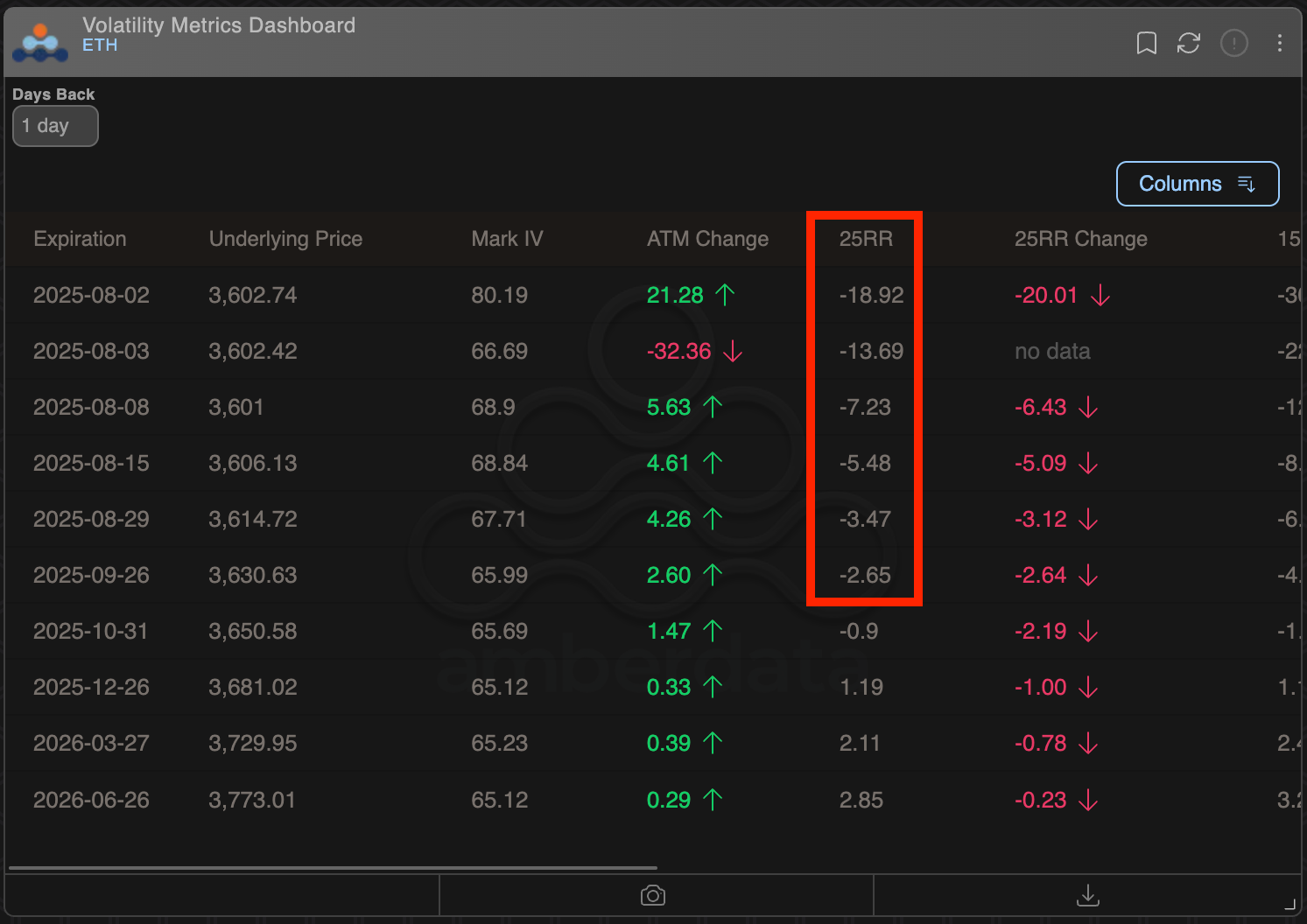

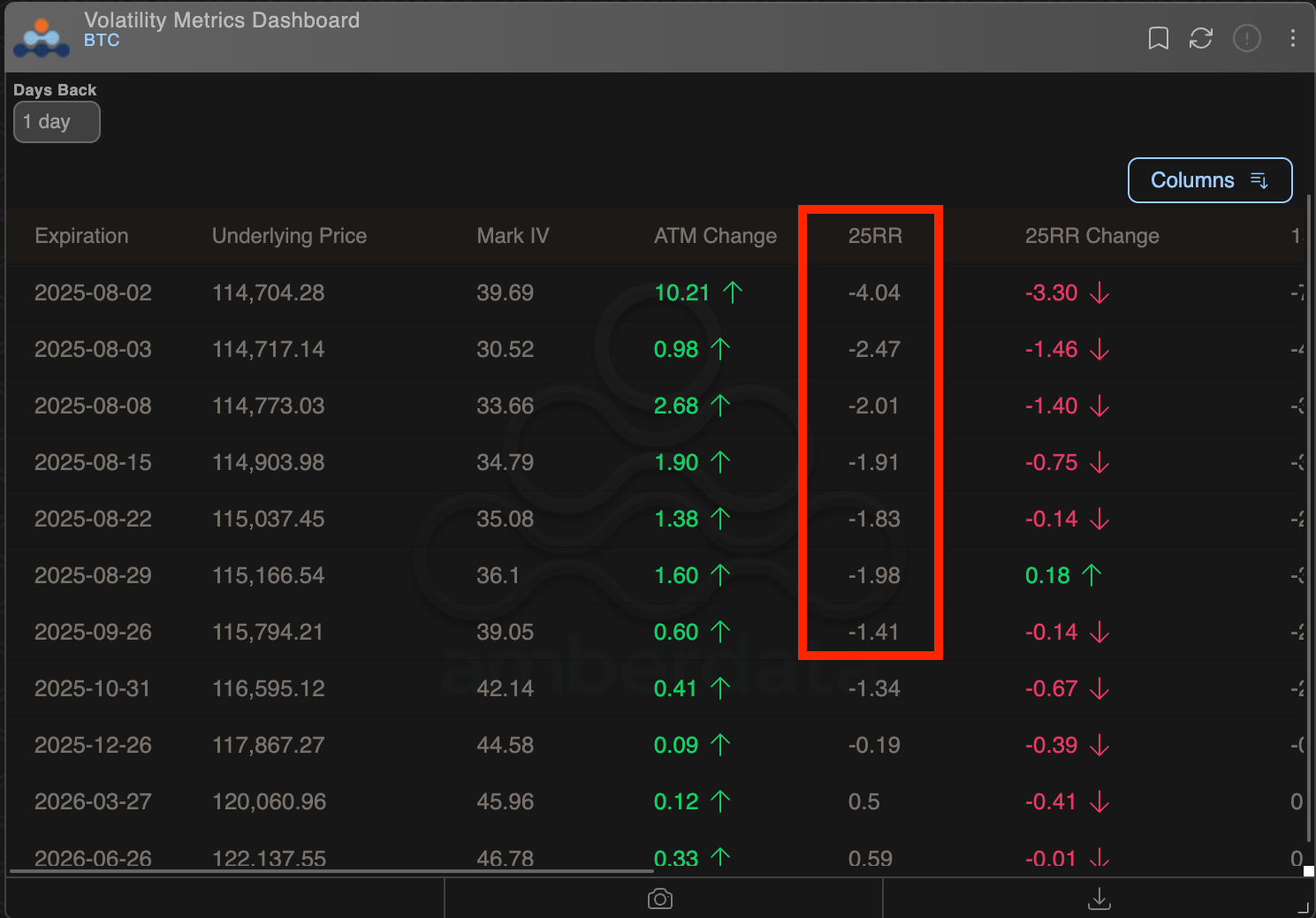

In response to knowledge from Amberdata, ether’s 25-delta threat reversals for choices expiring in August and September have been buying and selling at -2% to -7%. Which means put choices, which offer safety in opposition to drops in value, carry a 2% to 7% premium over name choices, reflecting an obvious concern a few potential draw back threat.

As compared, bitcoin’s short-term put choices traded at 1%-2.5% premium to calls, suggesting comparatively restrained draw back fears.

A put possibility provides the purchaser the correct to promote the underlying asset at a predetermined value on or earlier than a specified future date. A put purchaser is implicitly bearish available on the market, in search of to hedge spot market holdings or revenue from a value decline. A name purchaser is implicitly bullish available on the market.

The 25-delta threat reversal is an choices technique that contains an extended put place and a brief name possibility (or vice versa) with a 25% delta, that means the strike value for each choices is comparatively removed from the underlying asset’s market charge.

Threat reversals are broadly tracked within the FX markets to gauge sentiment throughout time frames. Constructive values symbolize bullish sentiment, whereas adverse values recommend the reverse.

Ether, the native token of the Ethereum blockchain surged 48% in July, reaching a seven-month excessive of $3,941 and outperforming BTC’s 8% acquire by a large margin. Many of the advance, nevertheless, occurred within the first half of the month, with the rally shedding steam on issues it stemmed purely from company adoption and lacked support from on-chain exercise.

Ether was lately buying and selling at $3,600, down greater than 6% over 24 hours, whereas bitcoin had misplaced 3% to $114,380, based on CoinDesk data.