JPMorgan (JPM) raised its worth targets for quite a few bitcoin

mining firms to replicate first-quarter outcomes and modifications to the bitcoin worth and the community hashrate, the financial institution stated in a report Friday.

The financial institution lifted its CleanSpark (CLSK) worth goal to $14 from $12, its Riot Platforms (RIOT) goal to $14 from $13 and its MARA Holdings (MARA) goal to $19 from $18.

“Our worth targets usually elevated on account of increased bitcoin costs and enhancing mining profitability,” analysts Reginald Smith and Charles Pearce wrote.

JPMorgan stated it tweaked the value targets to replicate a 24% enhance within the financial institution’s spot bitcoin assumption and a 9% enhance to its community hashrate estimate.

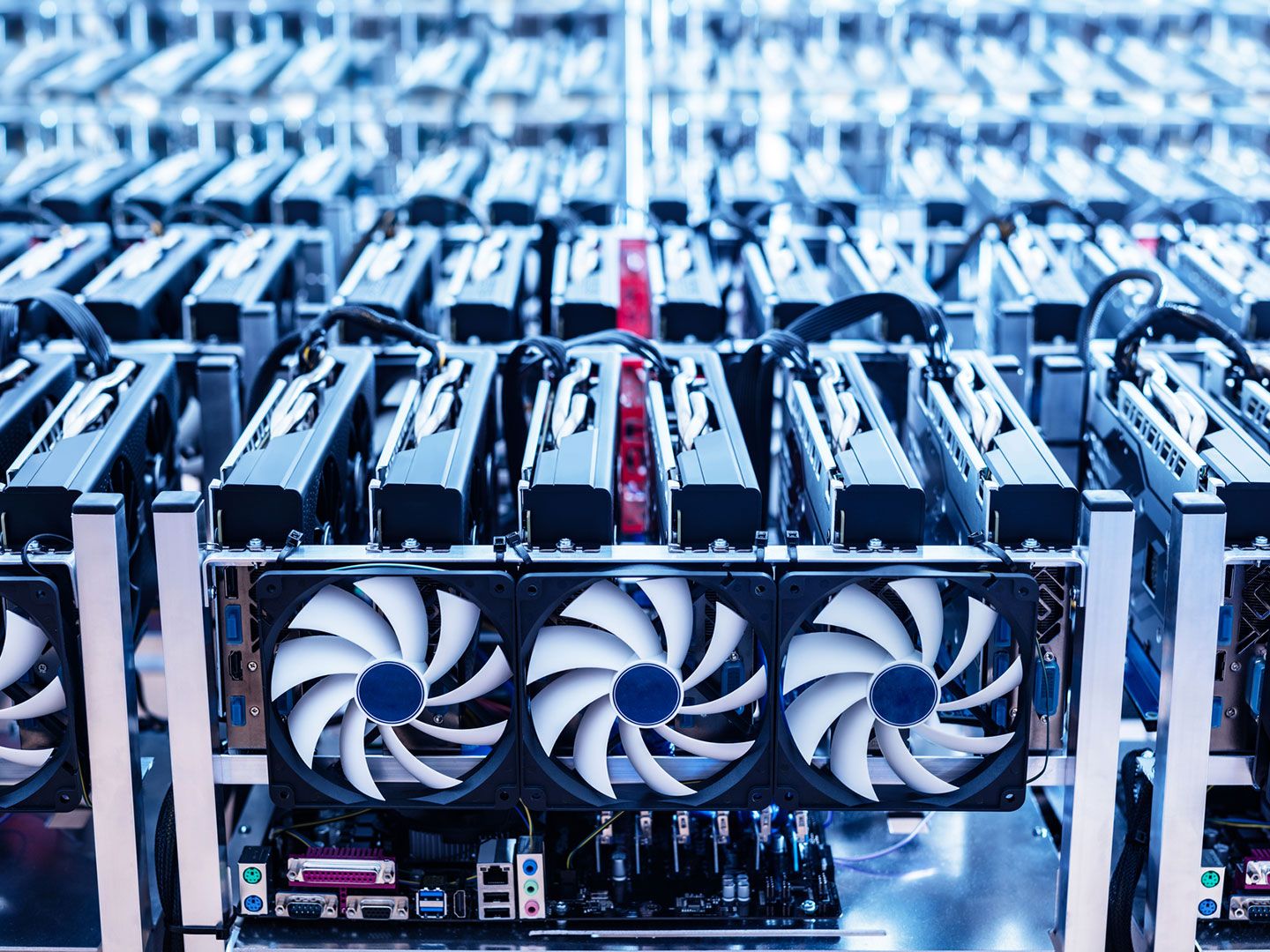

The hashrate refers back to the whole mixed computational energy used to mine and course of transactions on a proof-of-work blockchain, and is a proxy for competitors within the business and mining issue.

JPMorgan reiterated its obese score on CleanSpark, IREN (IREN) and Riot, and its impartial score for Cipher Mining (CIFR) and MARA.

Learn extra: Bitcoin Mining Profitability Improved in May, JPMorgan Says