Singapore-based developer of bitcoin mining ASIC chips and rigs Canaan (CAN) has had a tough run, however may very well be a five-bagger, suggests Benchmark analyst Mark Palmer.

Palmer on Tuesday initiated protection of the ADRs with a purchase ranking and a $3 value goal. The shares closed yesterday at $0.62, decrease by 72% year-to-date.

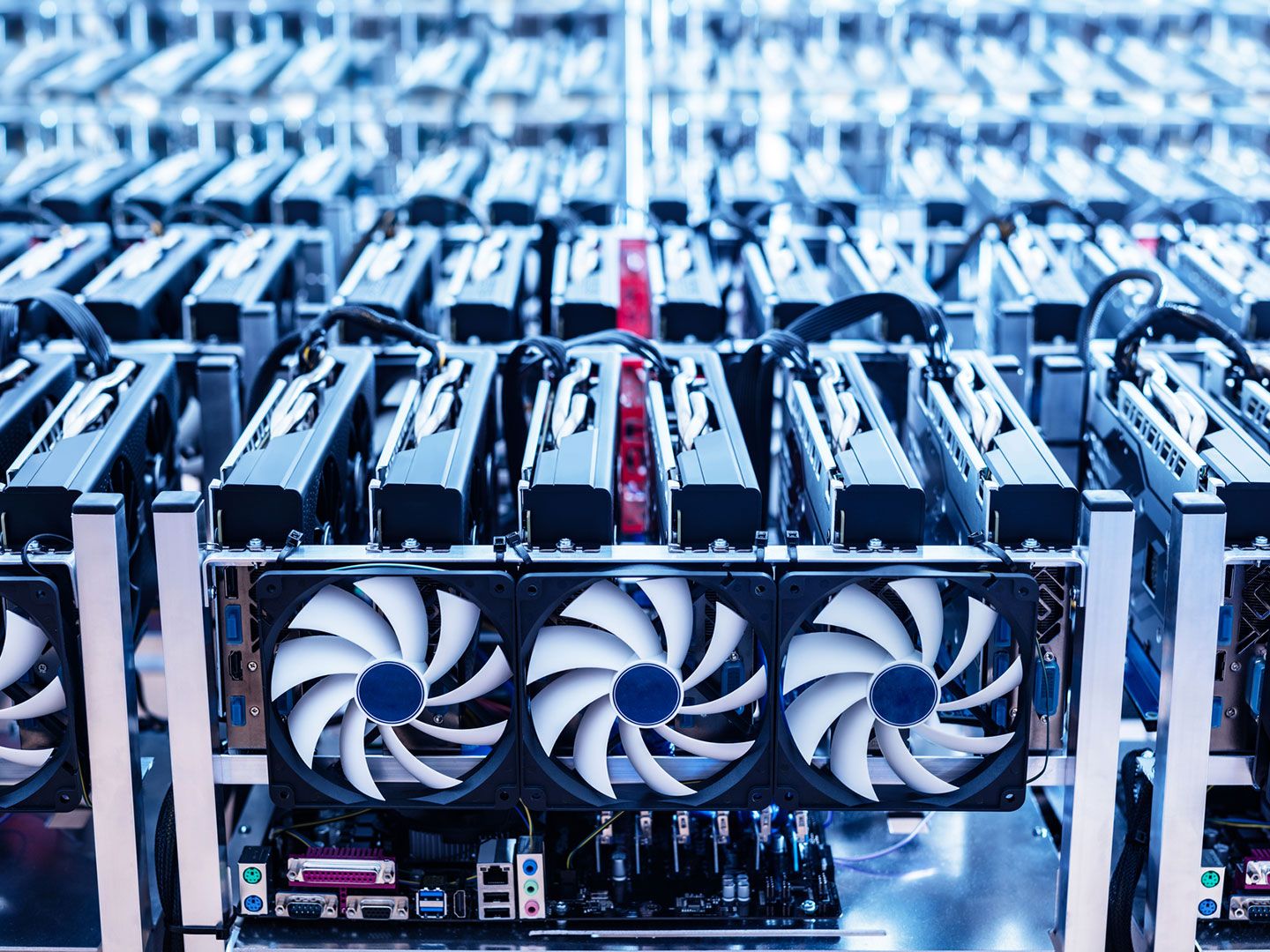

Canaan’s twin technique is targeted on the event of ASIC bitcoin chips and rigs, and the growth of its self-mining operations, particularly in america, mentioned Palmer.

“CAN’s vertically built-in method differentiates it throughout the bitcoin mining area whereas positioning it to capitalize on each chip/rig gross sales and proprietary mining revenues,” he wrote.

Canaan’s push into house mining rigs has diversified the corporate’s income, he additional famous.

The gear maker can be rising its self-mining capability within the U.S. and globally.

“Whereas the corporate derived simply 16.3% of its 2024 revenues from its self-mining operations, it intends to extend the whole pc energy driving its self-mining operations by mid-2025 to 10 EH/s in North America and 15 EH/s globally,” Palmer added.

Canaan has a stack of 1,408 bitcoin with a present worth of round $133 million, or practically 70% of its present market cap, mentioned Palmer. That must be supportive of the corporate’s valuation.

Learn extra: Bitcoin Miners With HPC Exposure Underperformed BTC for Third Straight Month: JPMorgan