The bitcoin (BTC) bull, as soon as confidently gazing into the long run, is reconsidering its long-term bullish conviction.

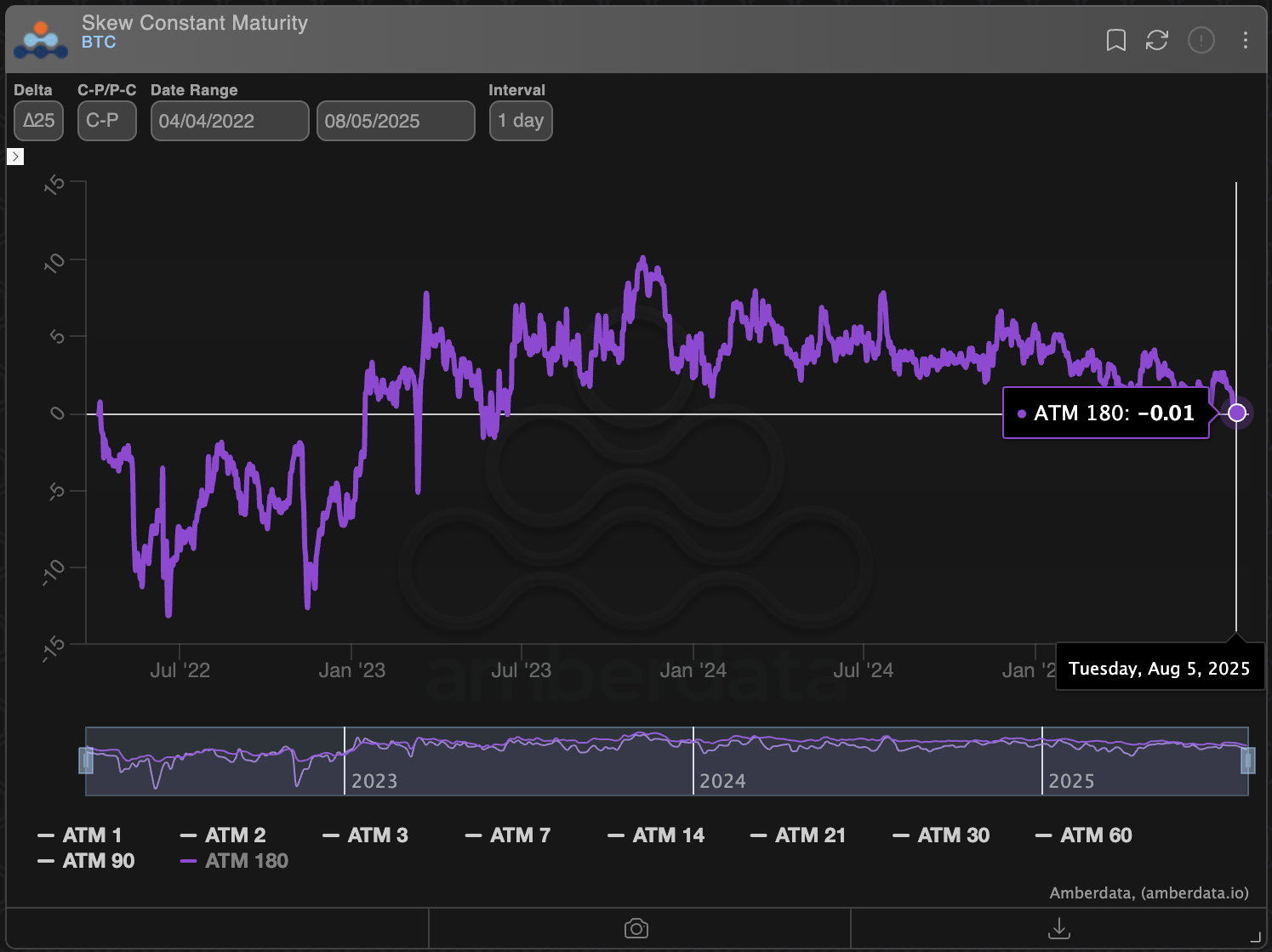

That is evident from the 180-day skew, measuring the distinction in implied volatility (pricing) between Deribit-listed out-of-the-money name and put choices. The metric has just lately retreated to zero, in line with knowledge supply Amberdata, indicating that long-term market sentiment has shifted from bullish to impartial. The shift comes as some analysts warn of a bear market in 2026.

An analogous reset occurred on the onset of the earlier bitcoin bear market, in line with Griffin Ardern, head of choices buying and selling and analysis at crypto monetary platform BloFin.

“I’ve seen a moderately worrying signal with the latest market pullback. Bitcoin’s bullish sentiment for the far-month choices has vanished, and it’s now firmly impartial,” Ardern instructed CoinDesk. “This implies the choices market believes it is troublesome for BTC to determine a long-term uptrend, and the chance of latest highs within the coming months is reducing.”

“An analogous scenario final occurred in Jan and Feb 2022,” he added.

A put choice provides insurance coverage in opposition to value drops within the underlying asset, whereas a name gives an uneven bullish publicity. A optimistic skew implies a bias in direction of calls, indicating bullishness available in the market, whereas a unfavourable skew suggests the alternative.

The impartial shift within the 180-day skew might be partly pushed by structured merchandise promoting larger strike name choices to generate extra yield on prime of the spot market holdings.

The recognition of the so-called lined name technique might be driving the decision implied volatility decrease relative to places.

Macro jitters

BTC fell over 4% final week, almost testing its former document excessive of $11,965, because the core PCE, the Fed’s most well-liked inflation measure, rose in June, whereas nonfarm payrolls disenchanted, stoking considerations concerning the financial system.

The value drop has pushed short-term skews under zero, an indication of merchants in search of draw back safety by places.

In keeping with Ardern, the inflationary results of “provide chain impulses” are already displaying up in financial knowledge.

“Though falling auto costs within the final CPI report offset rising costs for different items, one factor is plain: the impulse from the West Coast of the Pacific has reached the East Coast, and retailers are already attempting to cross on tariffs and a number of related prices to shoppers. Whereas wholesalers and commodity buying and selling corporations are working to clean provide chains, value will increase will nonetheless happen, albeit extra reasonably or “delayed by a number of months,” Ardern famous, explaining the renewed neutrality of the long-term BTC choices.

In keeping with JPMorgan, President Donald Trump’s tariffs are more likely to elevate inflation within the second half of the 12 months.

“World core inflation is projected to extend to three.4% (annualized price) within the second half of 2025, largely resulting from a tariff-related U.S. spike,” analysts on the funding financial institution famous, including that price pressures will doubtless be concentrated within the U.S.

An uptick in inflation might make it tougher for the Fed to chop charges. Trump has repeatedly criticized the central financial institution for preserving charges elevated at 4.25%.

Merchants will obtain the ISM non-manufacturing PMI later Tuesday, offering insights into inflation within the service sector, which accounts for a good portion of the U.S. financial system. It is going to be adopted by July CPI and PPI releases later this week.

Learn extra: Bitcoin Still on Track for $140K This Year, But 2026 Will Be Painful: Elliott Wave Expert