By Francisco Rodrigues (All occasions ET until indicated in any other case)

Bitcoin (BTC) rose to the best this month, touching $116,430 and establishing itself extra firmly above the $115,000 degree on renewed demand for threat property because the implications from Friday’s weaker-than-expected jobs market knowledge sink in.

The Federal Reserve is now extensively anticipated to chop charges by 25 foundation factors in September, with the CME’s FedWatch software weighing a 93.4% likelihood of that taking place. On Polymarket, merchants are barely much less satisfied, seeing a 79% likelihood of a minimize. Merchants are positioning for reductions on the following two conferences as nicely.

Add in robust earnings from main corporations and a weakening U.S. greenback, and the outlook is wanting a bit of stronger for equities and different threat property. The Nikkei 225 rose 0.65% as we speak, the Euro Stoxx 50 is up 1.2% and the S&P 500 closed up 0.73% on Wednesday. The Nasdaq Composite closed up 1.2% on information of chip tariff exemptions and President Trump signaling he might appoint dovish members to the Fed.

In an indication of long-term institutional curiosity, the State of Michigan Retirement System (SMRS) stated boosted its bitcoin exposure by means of spot ETFs within the second quarter.

But the actual story could also be how little BTC is shifting. The cryptocurrency’s 30-day implied volatility, as tracked by the BVIV index from Volmex, has dropped to 36.5%, a level not seen since October 2023, when bitcoin traded below $30,000.

The sample resembles Wall Road’s bull markets, the place implied volatility tends to shrink as optimism grows. In earlier cycles, bitcoin’s worth and volatility moved in tandem.

Structured crypto tasks that permit buyers to promote out-of-the-money name choices to generate yield could also be enjoying an element in lowering the volatility.

Nonetheless, geopolitical threat is not going to go away. Trump levied a further 25% tariff on India over its Russian oil purchases, which might result in a “mini crunch in provides if Delhi attracts on different crude sources as an alternative,” Hargreaves Lansdown stated in an emailed word. That will seemingly pressure OPEC+ members to amp up manufacturing to keep away from a disaster, Hargreaves Lansdown stated.

On prime of that, whereas peace talks on Ukraine have been advancing, current nuclear rhetoric suggests there’s a protracted approach to go. Keep alert!

What to Watch

- Crypto

- Aug. 7, 10 a.m.: Circle will host a webinar, “The GENIUS Act Period Begins,” that includes Dante Disparte and Corey Then. The session will focus on the primary U.S. federal cost stablecoin framework and its affect on crypto innovation and regulation.

- Aug. 15: Report date for the next FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Common Unsecured and Comfort Claims who meet pre-distribution necessities.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 7, 7 a.m.: The U.Okay.’s central financial institution, the Financial institution of England (BoE), broadcasts its financial coverage determination.

- Financial institution Fee Est. 4% vs. Prev. 4.25%

- Aug. 7, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June producer worth inflation knowledge.

- PPI MoM Prev. -1.29%

- PPI YoY Prev. 5.78%

- Aug. 7, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases July client worth inflation knowledge.

- Core Inflation Fee MoM Est. 0.3% vs. Prev. 0.39%

- Core Inflation Fee YoY Est. 4.23% vs. Prev. 4.24%

- Inflation Fee MoM Est. 0.28% vs. Prev. 0.28%

- Inflation Fee YoY Est. 3.53% vs. Prev. 4.32%

- Aug. 7, 3 p.m.: Mexico’s central financial institution, Banco de México, broadcasts its financial coverage determination.

- In a single day Interbank Goal Fee Est. 7.75% vs. Prev. 8%

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation turns into efficient, creating an early emptiness on the Board of Governors that permits President Trump to appoint a successor.

- Aug. 7, 7 a.m.: The U.Okay.’s central financial institution, the Financial institution of England (BoE), broadcasts its financial coverage determination.

- Earnings (Estimates primarily based on FactSet knowledge)

- Aug. 7: Hut 8 (HUT), pre-market, -$0.07

- Aug. 7: Block (XYZ), post-market, $0.63

- Aug. 7: CleanSpark (CLSK), post-market, $0.30,

- Aug. 7: Coincheck Group (CNCK), post-market, N/A

- Aug. 7: Cipher Mining (CIFR), pre-market, -$0.07

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Motion (EXOD), post-market, $0.12

- Aug. 12: Bitfarms (BITF), pre-market, -$0.02

- Aug. 12: Fold Holdings (FLD), post-market, N/A

Token Occasions

- Governance votes & calls

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for 2 extra years, beginning September 2025. The proposal contains $6 million in funding and 15 million ARB for incentives for Entropy to concentrate on treasury administration, incentive design, knowledge infrastructure, and ecosystem progress. Voting ends Aug. 7.

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards, and launching month-to-month buybacks utilizing 20% of protocol income. Voting ends Aug. 10.

- 1inch DAO is voting on a $1.88 million grant to fund its participation in 9 international crypto occasions by means of late 2025. The proposal goals to spice up developer engagement, develop institutional ties and increase adoption throughout ecosystems like Ethereum and Solana. Voting ends Aug. 10.

- Aug. 7, 12 p.m.: Celo to host a governance call.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a town hall on Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide price $12.66 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating provide price $48.18 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating provide price $37.2 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating provide price $15.40 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating provide price $16.52 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating provide price $36.52 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating provide price $91.4 million.

- Token Launches

- Aug. 7: TaleX (X) to be listed on Binance Alpha, BingX, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (previously often known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits basic counsels, compliance officers and regulatory executives to fulfill with public officers liable for crypto laws and regulatory oversight. House is proscribed. Use code CDB10 for 10% off your registration by means of Aug. 31.

- Day 2 of two: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Day 2 of 5: Rare EVO (Las Vegas)

- Day 1 of two: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

Token Discuss

By Shaurya Malwa

- The Solana-based Troll memecoin has surged over 1,050% in two weeks, leaping from a $16 million to $184 million market cap. It is now ranked No. 32 amongst all meme tokens, in line with CoinGecko.

- However Carlos Ramirez, the artist behind the unique Trollface meme, says he needs nothing to do with it, calling the token’s hype a “cursed proposition” in his first interview in a decade.

- Ramirez informed Decrypt he’s always provided Troll-related token allocations, however refuses to take part, saying he’d both be caught holding nugatory provide or blamed for a crash if he offered.

- Nonetheless, Ramirez promoted a separate Troll token earlier this 12 months — and once more this week — resulting in confusion over his stance.

- He criticized the memecoin economic system as profit-driven and artistically hole, saying the monetary incentives undermine genuine expression and cut back artwork to hypothesis.

- Ramirez added that a minimum of 30 completely different Troll tokens have been minted throughout platforms like Baggage, none along with his blessing — a sample he sees as exploitative and indifferent from the unique spirit of the meme.

- The saga highlights the rising rigidity between viral web tradition and tokenized financialization, particularly as legacy creators push again in opposition to involuntary meme monetization in Web3.

Derivatives Positioning

- Bitcoin futures open curiosity stays agency at $78.5 billion, with CME main at $16.24 billion (a 21% market share). This confirms persistent institutional engagement, particularly as CME’s BTC foundation rose to three.6% — among the many highest throughout venues — hinting at spot-driven curiosity or hedged lengthy publicity.

- ETH futures open curiosity rose to $48.18 billion, a 3.57% improve over the previous week. CME’s ETH OI rose 4.56% previously 24 hours alone, alongside a foundation of two.6%, displaying that establishments are re-entering ETH positioning aggressively — seemingly tied to ETF hypothesis and technical breakout setups.

- Altcoin positioning is again in focus, with XRP OI up 1.6% each day to $7.33 billion. CME’s XRP foundation is a standout at 8.4%, far exceeding different venues and suggesting leveraged lengthy urge for food or premium pricing for compliant publicity. XRP open curiosity is now concentrated throughout Bybit and Binance, indicating retail-trader skew.

- Funding charges stay elevated throughout majors, with BTC, ETH, DOGE and XRP all capped on the 0.03% each day restrict (about 11% annualized). SOL funding is much less aggressive round 0.006%, however the 30-day common sits on the cap, implying longer-term leveraged bias even when short-term flows are cooling.

- The derivatives quantity stays concentrated, with Binance and Bybit collectively holding 29% of BTC OI, whereas CME continues to develop. For ETH, CME now accounts for almost 12% of complete open curiosity, a key institutional marker that wasn’t true even two months in the past.

- Threat-reward asymmetry could also be constructing, as sustained long-heavy funding, rising CME premiums, and relative flatness in altcoin open curiosity recommend an setting ripe for volatility. The following transfer — whether or not a breakout or a flush — is prone to be aggressive, given the numerous directional leverage now in place.

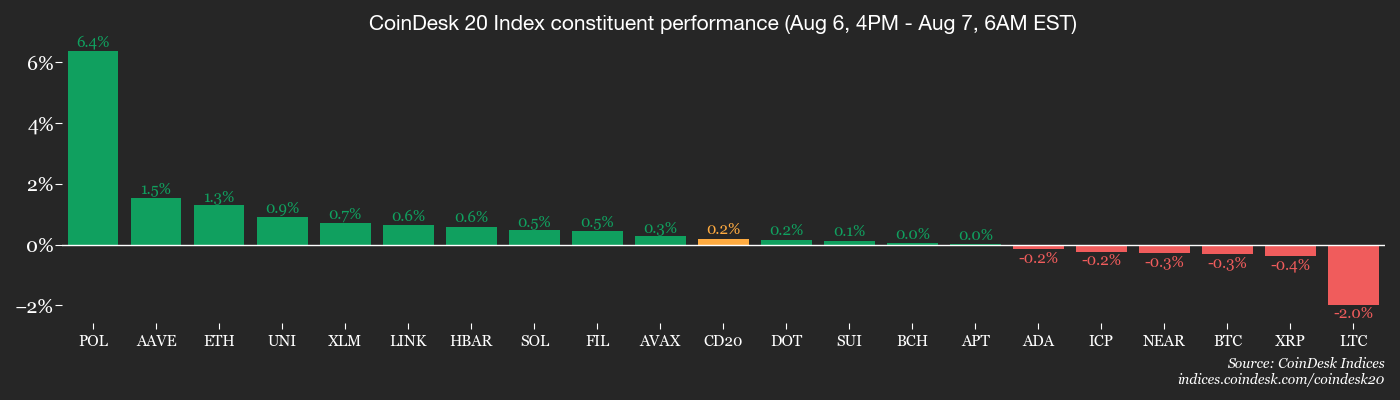

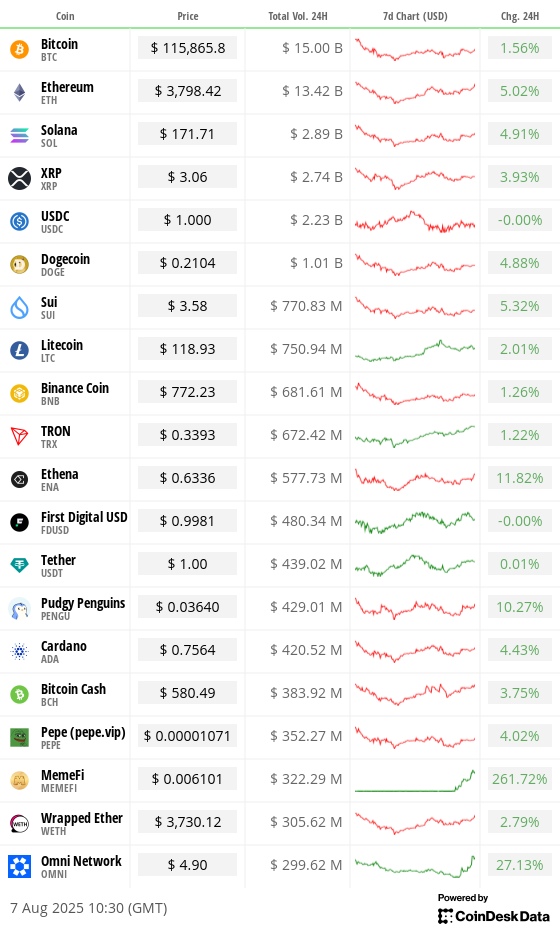

Market Actions

- BTC is unchanged from 4 p.m. ET Wednesday at $115,030.54 (24hrs: +1.29%)

- ETH is up 1.41% at $3,727.41 (24hrs: +4.97%)

- CoinDesk 20 is up 0.67% at 3,846.17 (24hrs: +2.98%)

- Ether CESR Composite Staking Fee is unchanged at 2.9%

- BTC funding fee is at 0.0095% (10.4386% annualized) on Binance

- DXY is unchanged at 98.13

- Gold futures are up 0.52% at $3,451.20

- Silver futures are up 1.29% at $38.39

- Nikkei 225 closed up 0.65% at 41,059.15

- Hold Seng closed up 0.69% at 25,081.63

- FTSE is down 0.24% at 9,142.34

- Euro Stoxx 50 is up 1.72% at 5,353.88

- DJIA closed on Wednesday up 0.18% at 44,193.12

- S&P 500 closed up 0.73% at 6,345.06

- Nasdaq Composite closed up 1.21% at 21,169.42

- S&P/TSX Composite closed up 1.27% at 27,920.87

- S&P 40 Latin America closed up 0.89% at 2,613.50

- U.S. 10-Yr Treasury fee is up 0.3 bps at 4.235%

- E-mini S&P 500 futures are up 0.66% at 6,413.00

- E-mini Nasdaq-100 futures are up 0.69% at 23,585.00

- E-mini Dow Jones Industrial Common Index are up 0.45% at 44,511.00

Bitcoin Stats

- BTC Dominance: 61.6% (-0.20%)

- Ether-bitcoin ratio: 0.03239 (1.13%)

- Hashrate (seven-day shifting common): 955 EH/s

- Hashprice (spot): $57.48

- Complete charges: 5.88 BTC / $674,584

- CME Futures Open Curiosity: 138,150 BTC

- BTC priced in gold: 34.0%

- BTC vs gold market cap: 9.63%

Crypto Equities

- Technique (MSTR): closed on Wednesday at $383.41 (+2.12%), +0.13% at $383.89 in pre-market

- Coinbase World (COIN): closed at $303.58 (+1.88%), +1.55% at $308.28

- Circle (CRCL): closed at $161.71 (+5.05%), +2.03% at $165

- Galaxy Digital (GLXY): closed at $27.34 (-1.23%), +2.63% at $28.06

- MARA Holdings (MARA): closed at $15.89 (+1.73%), +0.44% at $15.96

- Riot Platforms (RIOT): closed at $11.66 (+4.76%), +0.69% at $11.74

- Core Scientific (CORZ): closed at $14.11 (+0.21%), +0.28% at $14.15

- CleanSpark (CLSK): closed at $11 (+1.57%), +1% at $11.11

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.73 (+3.54%)

- Semler Scientific (SMLR): closed at $35.66 (+2.27%), +1.65% at $36.25

- Exodus Motion (EXOD): closed at $29.36 (+1.59%)

- SharpLink Gaming (SBET): closed at $22.14 (+9.44%), +3.16% at $22.84

ETF Flows

Spot BTC ETFs

- Each day web flows: $91.6 million

- Cumulative web flows: $53.73 billion

- Complete BTC holdings ~1.29 million

Spot ETH ETFs

- Each day web flows: $35.1 million

- Cumulative web flows: $9.15 billion

- Complete ETH holdings ~5.59 million

Supply: Farside Investors

In a single day Flows

Chart of the Day

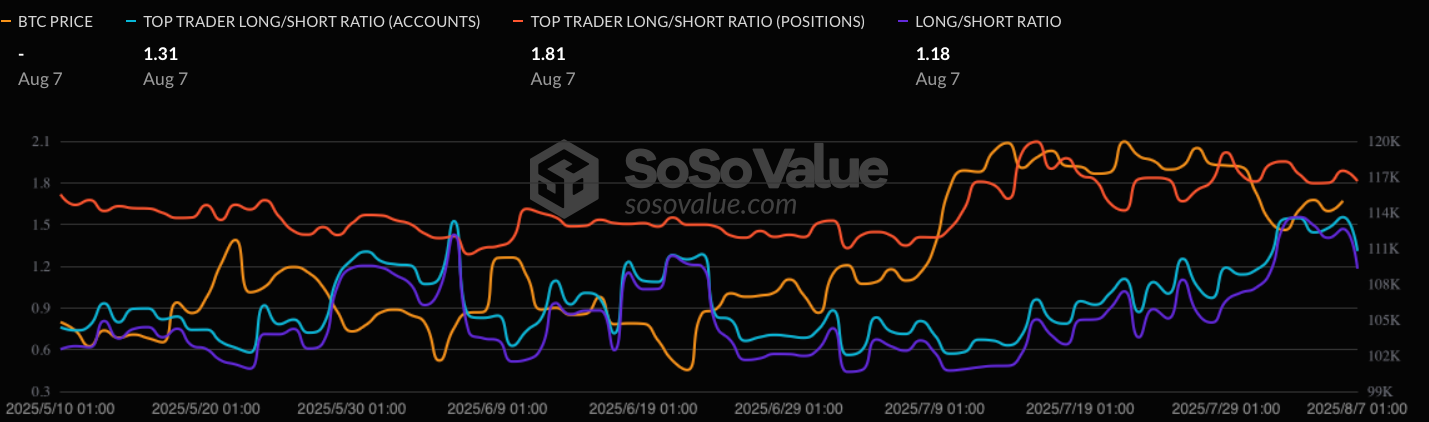

- Prime crypto merchants — the 20% of customers with the best margin steadiness on Binance — turned bullish on BTC earlier than its current restoration, with the ratio of lengthy to brief positions reaching 1.51, indicating a robust lean in direction of longs, SoSoValue knowledge reveals.

- Whereas the highest merchants’ ratio has since risen to 1.81, the general market’s is at 1.18, displaying widespread bullish sentiment, per SoSoValue knowledge.

Whereas You Have been Sleeping

- Bitcoin’s Volatility Disappears to Levels Not Seen Since October 2023 (CoinDesk): Regardless of a 60% rally since November 2024, demand for choices stays subdued, driving 30-day implied volatility — a gauge of anticipated worth swings — to its lowest since October 2023.

- Staggering U.S. Tariffs Begin as Trump Widens Trade War (The New York Occasions): Hours earlier than new levies took impact, Trump floated a 100% tariff on semiconductors, seemingly dismissing stagflation warnings from economists and enterprise issues over unsustainable import prices.

- U.S. Trading Partners Race to Secure Exemptions From Trump’s Tariffs (The Wall Road Journal): A number of commerce companions with signed agreements, together with the EU, Japan and South Korea, are nonetheless urgent for sector-specific reduction whereas unresolved phrases proceed to create confusion round implementation.

- UK Crypto Investors Hail Regulatory Changes as ‘Pivotal Moment’ (Monetary Occasions): U.Okay. retail buyers will acquire entry to 17 bitcoin and ether exchange-traded notes in October because the nation’s monetary regulator lifts its retail ban. U.S.-listed spot crypto ETFs will stay inaccessible.

- Exclusive: Rubio Orders US Diplomats to Launch Lobbying Blitz Against Europe’s Tech Law (Reuters): An Aug. 4 labeled directive from the U.S. State Division, signed by Marco Rubio, known as on embassy officers to push again in opposition to Europe’s Digital Providers Act and defend U.S. tech pursuits.

- With South Korea’s CBDC Plans Dead, KakaoBank Joins Stablecoin Gold Rush (CoinDesk): KakaoBank’s CFO highlighted the agency’s preparedness for stablecoin issuance and custody, pointing to its work on Korea’s shelved CBDC pilot and its monitor report dealing with compliance for crypto exchanges.