By Omkar Godbole (All instances ET except indicated in any other case)

Because the crypto market reels below U.S. stagflation concerns, merchants on the decentralized platform Polymarket are seeing a greater than 50% probability of bitcoin (BTC) costs dropping into 5 figures earlier than year-end.

Shares within the Sure facet of Polymarket’s “Will bitcoin dip beneath $100K earlier than 2026” contract traded at 55 cents, implying a 55% chance. That pricing appears justified in opposition to the backdrop of latest financial information.

“With each manufacturing and providers ISMs now weaker than probably the most bearish forecasts, the market is coming to phrases with one thing darker: Job development might be rolling over exhausting,” Stephen Innes, managing associate at SPI Asset Administration, wrote in a post on FXStreet.

“In case you weigh these surveys collectively by their financial footprint, the implications are staggering — potential NFP prints dropping by over 100,000. Not simply tender, however recessionary-soft. But the kicker? Inflation’s nonetheless sticky the place it counts.”

Curiosity-rate merchants have already ramped up bets on a Fed discount. Nonetheless, observers are divided on whether or not fee cuts fueled by financial weak spot bode properly for danger property, together with cryptocurrencies.

Whereas decrease charges usually make riskier property extra enticing, Wall Road seems to anticipate some ache, and momentum merchants have shifted to promoting, based on Innes. The identical is true of bitcoin, with Deribit-listed short-term places now costing greater than calls, reflecting draw back considerations.

Even so, the choices market sees a decrease probability of a sub-$100K bitcoin by year-end than Polymarket. That is evident from the -0.25 delta of the December expiry $100K put. Delta refers back to the sensitivity of the choice’s value to a change within the underlying asset and represents the chance of the choice expiring in revenue.

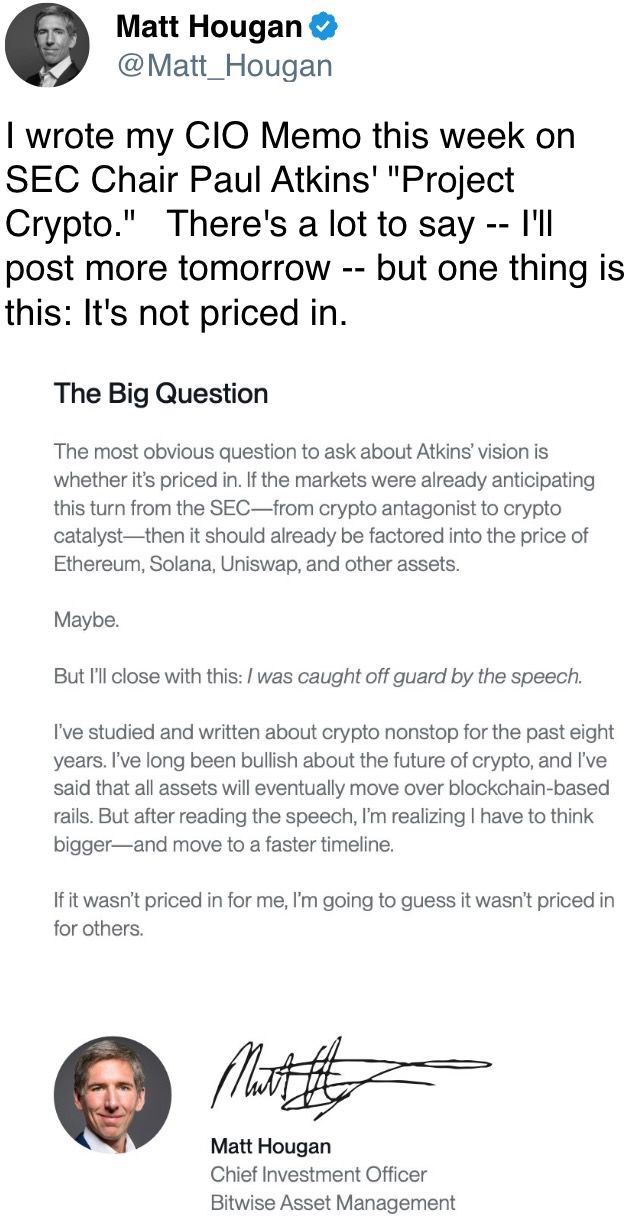

The outlook for ether (ETH) appears extra constructive because the SEC stated staking actions and the receipt of tokens, below sure circumstances, don’t represent securities choices. The steering clears the way in which for the regulatory approval of spot ether ETFs with staking, which is anticipated to spice up the cryptocurrency’s attraction as a kind of web bond.

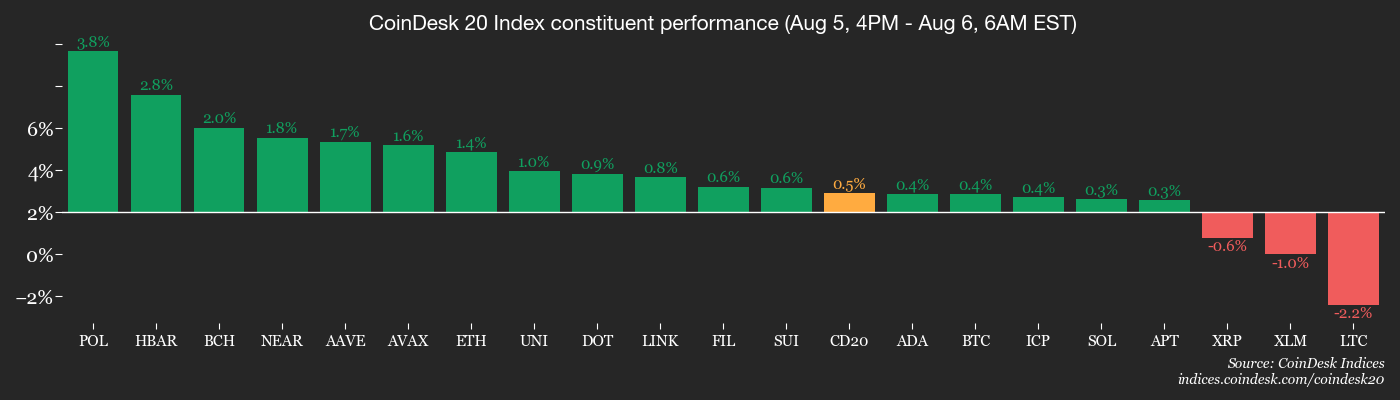

Talking of the broader market, altcoins appeared weak in contrast with majors. The CoinDesk 80 Index traded 2.9% decrease over 24 hours, barely greater than CoinDesk 20 Index‘s 2.3%.

In different information, Japan’s largest financial institution, SBI, introduced an ETF tied to bitcoin and XRP. A governance proposal circulating within the Metamask neighborhood revealed the pockets’s plan to launch a “MetaMask USD” stablecoin by a partnership with Stripe’s fee infrastructure.

In conventional markets, futures tied to the S&P 500 traded 0.2% increased, indicating a slightly constructive open on Wall Road whereas the greenback index was flat round 98.70. Keep alert!

What to Watch

- Crypto

- Aug. 7, 10 a.m.: Circle will host a webinar, “The GENIUS Act Period Begins,” that includes Dante Disparte and Corey Then. The session will focus on the primary U.S. federal fee stablecoin framework and its affect on crypto innovation and regulation.

- Aug. 15: Document date for the next FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Basic Unsecured and Comfort Claims who meet pre-distribution necessities.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 6, 2 p.m.: Fed Governor Lisa D. Cook dinner will ship a speech titled “U.S. and International Economic system”. Livestream link.

- Aug. 7, 12:01 a.m.: New U.S. reciprocal tariffs outlined in President Trump’s July 31 executive order develop into efficient for a broad vary of buying and selling companions that didn’t safe offers by the Aug. 1 deadline. These tariffs vary from 15% to 41%, relying on the nation.

- Aug. 7, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases July client value inflation information.

- Core Inflation Fee MoM Prev. 0.39%

- Core Inflation Fee YoY Prev. 4.24%

- Inflation Fee MoM Prev. 0.28%

- Inflation Fee YoY Prev. 4.32%

- Aug. 7, 3 p.m.: Mexico’s central financial institution, Banco de México, broadcasts its financial coverage determination.

- In a single day Interbank Goal Fee Est. 7.75% vs. Prev. 8%

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation turns into efficient, creating an early emptiness on the Board of Governors that enables President Trump to appoint a successor.

- Earnings (Estimates primarily based on FactSet information)

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Motion (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

Token Occasions

- Governance votes & calls

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for 2 extra years, beginning September 2025. The proposal consists of $6 million in funding and 15 million ARB for incentives for Entropy to give attention to treasury administration, incentive design, information infrastructure, and ecosystem development. Voting ends Aug. 7.

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards and launching month-to-month buybacks utilizing 20% of protocol income. Voting ends Aug. 10.

- 1inch DAO is voting on a $1.88 million grant to fund its participation in 9 international crypto occasions by late 2025. The proposal goals to spice up developer engagement, develop institutional ties and develop adoption throughout ecosystems like Ethereum and Solana. Voting ends Aug. 10.

- Aug. 6, 1 p.m.: Livepeer to host a fireside on Twitter and Discord.

- Aug. 7, 12 p.m.: Celo to host a governance call.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a town hall on Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide price $12.32 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating provide price $48.18 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating provide price $36.87 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating provide price $14.77 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating provide price $15.92 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating provide price $35.82 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating provide price $91.4 million.

- Token Launches

- Aug. 6: Worldcoin (WLD) to be listed on Binance.US.

Conferences

The CoinDesk Policy & Regulation conference (previously often known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that enables normal counsels, compliance officers and regulatory executives to satisfy with public officers answerable for crypto laws and regulatory oversight. Area is proscribed. Use code CDB10 for 10% off your registration by Aug. 31.

- Day 3 of three: The Science of Blockchain Conference 2025 (Berkeley, California)

- Day 1 of two: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Day 1 of 5: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

Token Discuss

By Shaurya Malwa

- Pump.enjoyable reclaimed the lead in Solana token launches with 13,690 new tokens in 24 hours, barely forward of LetsBonk.enjoyable’s 13,392, based on Dune Analytics data.

- Regardless of trailing in token rely, LetsBonk retained the sting in each day buying and selling quantity at $87.7 million, in contrast with Pump’s $82.4 million.

- The resurgence in Pump’s exercise coincides with renewed momentum for its native PUMP token, which has rebounded 17.8% over the previous week to $0.003247. It is nonetheless down 52% from its post-ICO peak.

- Pump raised $600 million in 12 minutes throughout final months’ ICO and has begun a multimillion-dollar buyback, based on on-chain information — a transfer that could be stabilizing sentiment.

- LetsBonk, backed by the Bonk neighborhood and built-in with Raydium’s LaunchLab, channels half of its payment income into BONK token burns, whereas additionally supporting BONKsol and different Solana ecosystem initiatives.

- Solana, for its half, faces aggressive strain from Base, the place token launch exercise has surpassed Solana in uncooked numbers. That is pushed by the Base App’s integration of Zora and Farcaster, which mechanically mints social posts as ERC-20 tokens.

- Whereas Solana nonetheless leads in memecoin buying and selling quantity, Base’s fast development indicators a shifting dynamic, notably in experimentation and social-driven token creation.

Derivatives Positioning

- Futures open curiosity within the high 10 cash excluding BTC dropped 4% to 10% previously 24 hours, indicating capital outflows from the market. BTC’s open curiosity held flat.

- Funding charges nonetheless stay above an annualized 5% for many main tokens indicating a dominance of bullish lengthy bets. It additionally means potential for lengthy liquidations ought to costs proceed to drop.

- Bitcoin’s CME futures additionally point out capital outflows, with open curiosity in customary contracts (sized at 5 BTC) at lowest since late April. The premise in BTC and ETH futures stays locked between 5% and 10%, displaying no indicators of enchancment.

- On Deribit, BTC and ETH choices danger reversals now present bearish (put) bias out to October expiry. Block flows on OTC desk Paradigm featured rollover of BTC places.

Market Actions

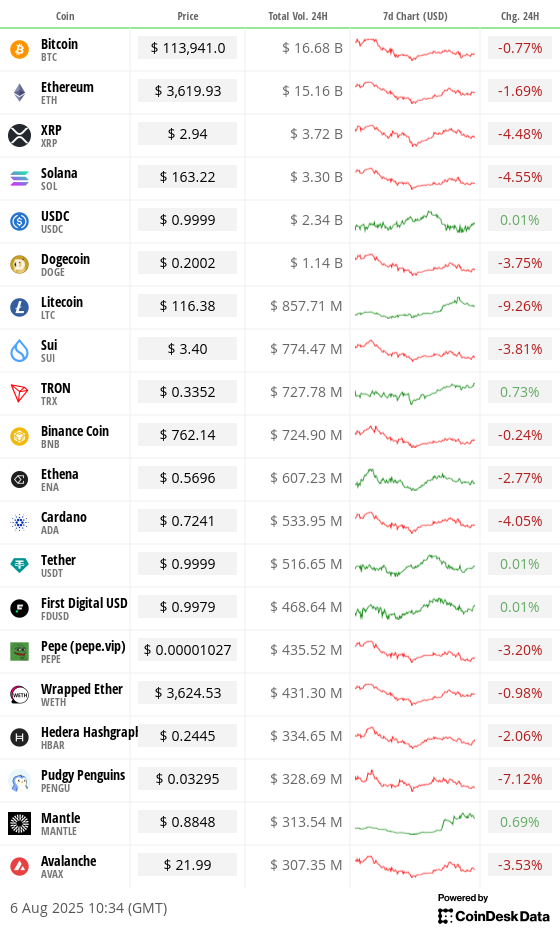

- BTC is up 0.237% from 4 p.m. ET Tuesday at $114,105.72 (24hrs: -0.55%)

- ETH is up 1.39% at $3,626.69 (24hrs: -1.34%)

- CoinDesk 20 is up 0.78% at 3,768.88 (24hrs: -2.33%)

- Ether CESR Composite Staking Fee is up 7 bps at 2.93%

- BTC funding fee is at 0.0086% (9.3699% annualized) on Binance

- DXY is unchanged at 98.73

- Gold futures are down 0.56% at $3,415.60

- Silver futures are unchanged at $37.80

- Nikkei 225 closed up 0.6% at 40,794.86

- Cling Seng closed unchanged at 24,910.63

- FTSE is up 0.22% at 9,162.81

- Euro Stoxx 50 is up 0.28% at 5,264.22

- DJIA closed on Tuesday down 0.14% at 44,111.74

- S&P 500 closed down 0.49% at 6,299.19

- Nasdaq Composite closed down 0.65% at 20,916.55

- S&P/TSX Composite closed up 2.03% at 27,570.08

- S&P 40 Latin America closed up 0.71% at 2,590.51

- U.S. 10-Yr Treasury fee is up 4.3 bps at 4.239%

- E-mini S&P 500 futures are up 0.23% at 6,339.50

- E-mini Nasdaq-100 futures are unchanged at 23,141.75

- E-mini Dow Jones Industrial Common Index are up 0.31% at 44,374.00

Bitcoin Stats

- BTC Dominance: 61.82% (unchanged)

- Ether to bitcoin ratio: 0.03177 (+0.38%)

- Hashrate (seven-day transferring common): 952 EH/s

- Hashprice (spot): $56.64

- Whole Charges: 3.67 BTC / $418,957

- CME Futures Open Curiosity: 137,790 BTC

- BTC priced in gold: 33.7 oz

- BTC vs gold market cap: 9.53%

Technical Evaluation

- The ether-bitcoin (ETH/BTC) pair has fashioned a bull flag sample on the each day chart. The sample represents a brief pause within the preliminary uptrend that normally refreshes increased.

- A transfer by the higher finish of the flag would sign the resumption of the ether rally relative to bitcoin.

Crypto Equities

- Technique (MSTR): closed on Tuesday at $375.46 (-3.54%), +0.87% at $378.71 in pre-market

- Coinbase International (COIN): closed at $297.99 (-6.34%), +1.41% at $302.18

- Circle (CRCL): closed at $153.93 (-6.61%), -1.3% at $151.93

- Galaxy Digital (GLXY): closed at $27.68 (-4.19%), -0.58% at $27.52

- MARA Holdings (MARA): closed at $15.62 (-2.62%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $11.13 (-2.54%), unchanged in pre-market

- Core Scientific (CORZ): closed at $14.08 (+3.15%), -0.43% at $14.02

- CleanSpark (CLSK): closed at $10.83 (+1.98%), +0.37% at $10.87

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.85 (+0.08%)

- Semler Scientific (SMLR): closed at $34.87 (-1.41%)

- Exodus Motion (EXOD): closed at $28.9 (-2.27%), +0.69% at $29.10

- SharpLink Gaming (SBET): closed at $20.23 (+5.69%), -1.33% at $19.96

ETF Flows

Spot BTC ETFs

- Every day web flows: -$196.2 million

- Cumulative web flows: $53.63 billion

- Whole BTC holdings ~1.29 million

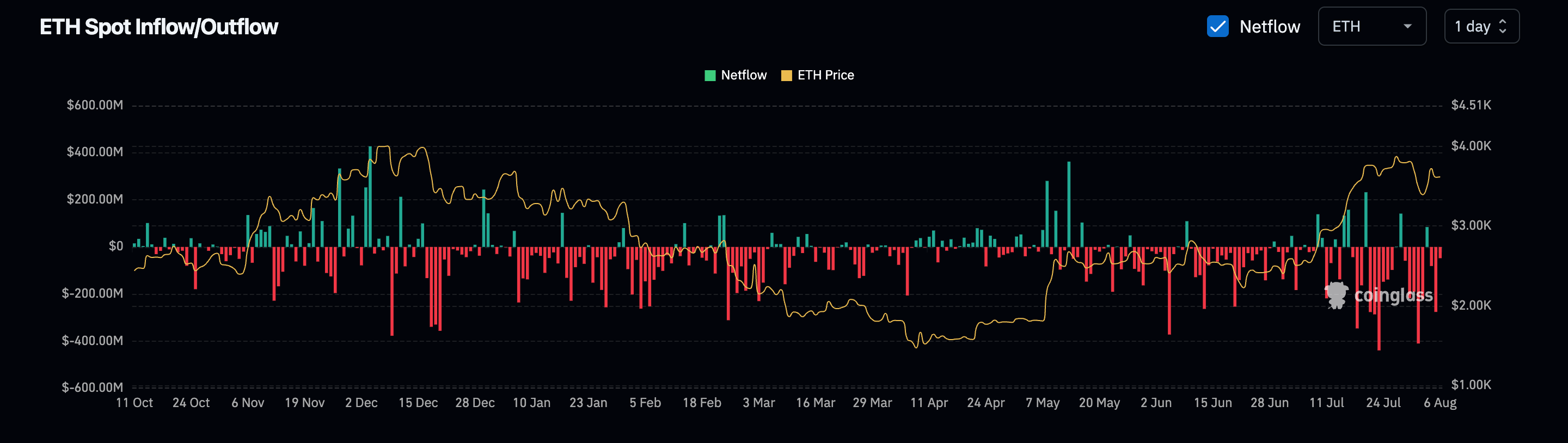

Spot ETH ETFs

- Every day web flows: $73.3 million

- Cumulative web flows: $9.12 billion

- Whole ETH holdings ~5.57 million

Supply: Farside Investors

In a single day Flows

Chart of the Day

- The chart exhibits each day web influx of ether into centralized exchanges.

- Just lately, there have been massive outflows, an indication of buyers accumulating the cryptocurrency on the dip.

Whereas You Had been Sleeping

- Bitcoin ETFs Bleed Millions for 4th Straight Day as U.S. Stagflation Fears Weigh on BTC and Stocks (CoinDesk): Tuesday’s U.S. ISM providers PMI confirmed tariff-driven inflation, weak employment and commerce disruptions — indicators of stagflation, a worst-case situation for danger property like tech shares and crypto.

- Swiss President Set to Meet Rubio on Wednesday to Avert Tariffs (Bloomberg): Talks are sophisticated by a $38 billion U.S. commerce deficit pushed by gold and prescription drugs, with analysts warning the proposed 39% tariff may threaten as much as 1% of Swiss financial output.

- Leveraged Bearish Strategy ETF Surges 19%, Signals Dour Outlook for MSTR and Bitcoin (CoinDesk): The Defiance 2x Brief MSTR ETF, up 19% final week, has seen a web influx of $16.3 million previously six months, whereas its bullish counterpart skilled important outflows.

- China Warns Worldcoin-Style Iris Scanning a National Security Threat (CoinDesk): China’s Ministry of State Safety warned that incentivized iris scans may enable international corporations to exfiltrate biometric information, elevating considerations about surveillance abuse and deepfake-enabled infiltration by intelligence providers.

- India’s Central Bank Holds Rates Amid Rising Tariff Tensions With Donald Trump (Monetary Instances): The RBI stored its repo fee at 5.5%, citing tariff uncertainty and the still-unfolding affect of 100 foundation factors in cuts this yr because the U.S. threatens extra tariffs over India’s Russian oil imports.

- Trump Just Got a Fresh Shot at Bending the Fed to His Will (The Wall Road Journal): Adriana Kugler’s early resignation lets the president appoint a rate-setter now, doubtlessly one who can strain Chair Jerome Powell, advocate fee cuts and sign succession plans, relying on whether or not the choose is strategic or short-term.