Bitcoin’s (BTC) value rally might have stalled currently, however bullish conviction actually hasn’t, as whales proceed to guess tens of millions on an prolonged market rally.

Just lately, one such whale executed a major bullish choices play concentrating on $200,000 by the yr’s finish. The technique concerned the simultaneous buy of three,500 contracts of the Deribit-listed $140,000 December name choice and the brief sale (or writing) of three,500 contracts of the $200,000 December name choice.

This advanced commerce, a bull name unfold, resulted in an preliminary internet debit of $23.7 million. As Deribit Insights noted, “The Dec 140-200k Name unfold dominates, shopping for low Dec 140k IV, funded by increased IV 200k Calls.”

The technique will obtain most revenue if BTC settles at or above the upper strike value, $200,000 on this case, by the expiration date.

This technique generates a internet debit as a result of the premium paid for the decrease strike name choice (the acquisition) exceeds the premium obtained from promoting the upper strike name. The unfold gives restricted positive aspects for a restricted danger, capping upside at $200,000 whereas making certain the utmost potential loss is contained to the preliminary debit.

Choices are derivatives used for hypothesis or hedging towards value actions. A name choice provides the purchaser the precise, however not the duty, to purchase the underlying asset at a predetermined value on or earlier than a specified future date. A name purchaser is implicitly bullish in the marketplace, whereas a put purchaser is bearish.

Bitcoin’s spot value reached a report excessive of over $123,000 on July 14 and has since consolidated in a slender vary between $116,000 and $120,000.

Report choices exercise

BTC’s value rally and rising institutional curiosity in structured merchandise, which contain volatility promoting, have boosted exercise within the choices market.

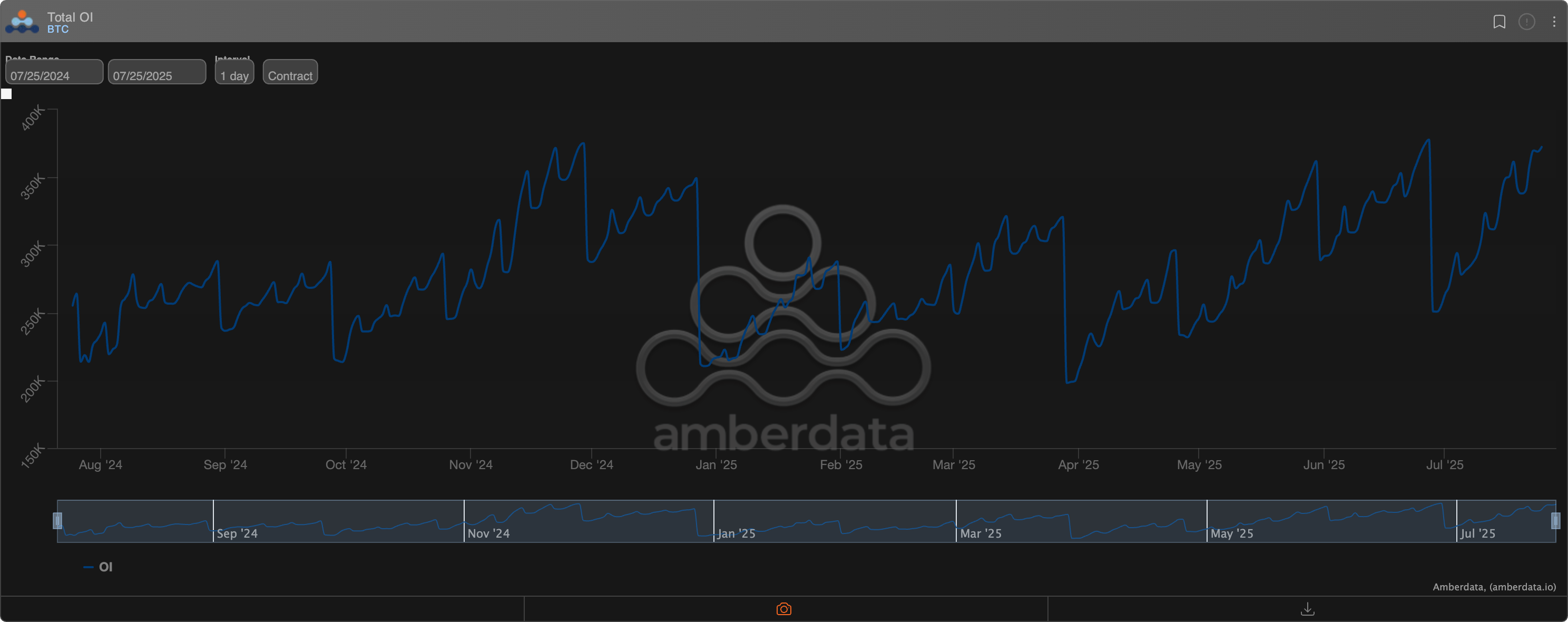

On Deribit, which accounts for over 80% of the worldwide choices exercise, the BTC choices open curiosity, or the variety of open choices contracts, was 372,490 BTC as of writing – simply shy of the report excessive of 377,892 set in June.

In the meantime, open curiosity in ether choices has hit a report excessive of two,851,577 ETH, in response to information supply Amberdata. On Deribit, one choices contract represents one BTC or ETH.