Binance Coin (BNB) is displaying resilience after a stormy week for monetary markets, as Israel attacked Iran in a bid to restrict its nuclear program and missile capabilities, resulting in a large-scale missile assault in response.

The battle noticed buyers flee threat property and led to greater than $700 million in liquidations within the crypto market in simply 24 hours, in response to CoinGlass. BNB, nevertheless, managed to take care of a slender buying and selling vary of simply over 1%, resisting a broader altcoin pullback.

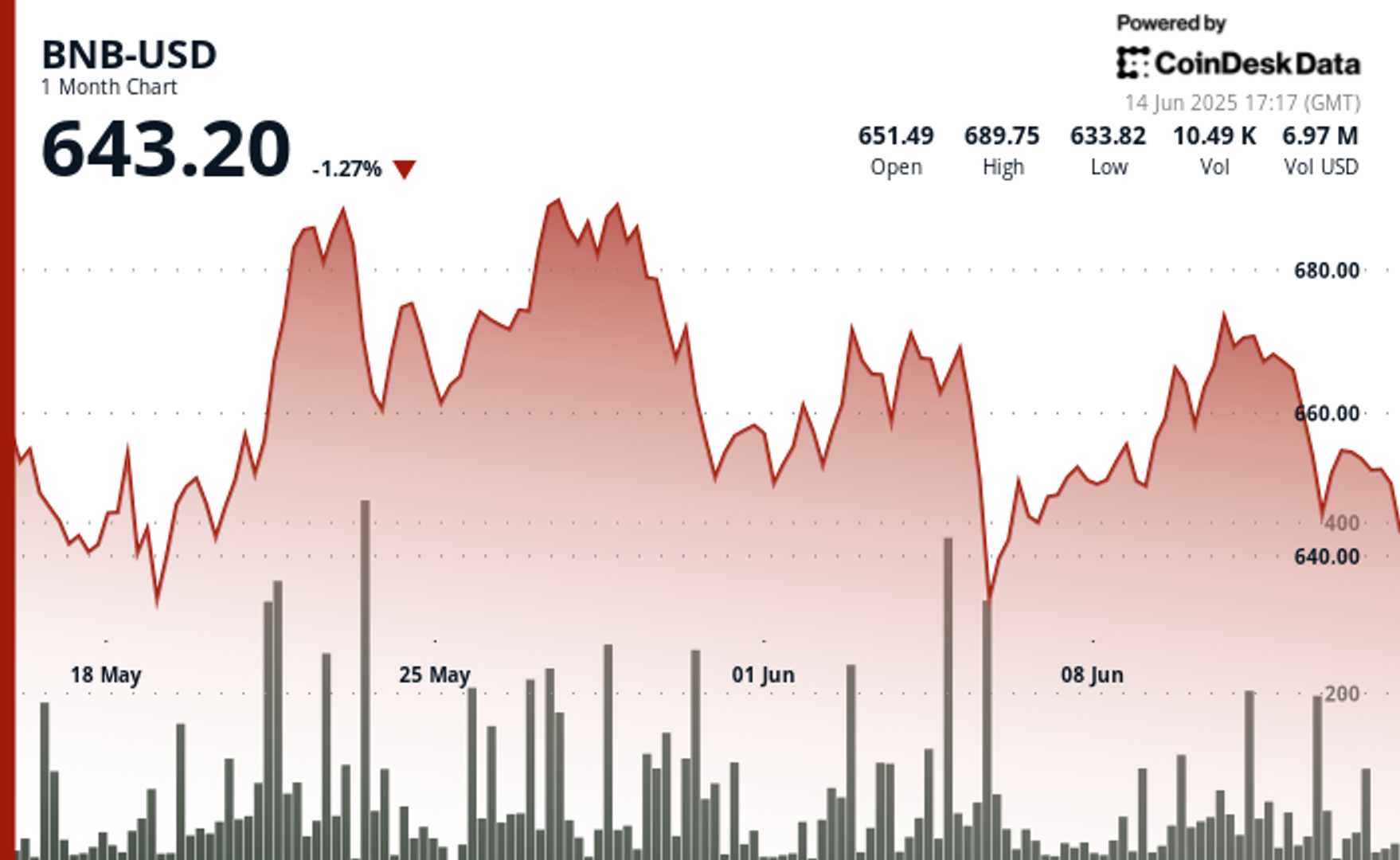

BNB, after the sell-off, failed to interrupt above $660, its fast resistance stage in response to CoinDesk Analysis’s technical evaluation information mannequin, and has since been consolidating inside a symmetrical triangle sample.

Regardless of the setback, the coin has stayed above key assist at $640, a zone aligned with the 78.6% Fibonacci retracement stage. Buying and selling quantity evaluation suggests sellers dominate close to $655.5, whereas a purchaser base varieties round $649, the mannequin reveals.

Technicals sign a blended image. The Transferring Common Convergence Divergence (MACD) turned adverse, and the Relative Power Index (RSI) sits just below 50, hinting at fading momentum.

But the 50/200-day shifting averages are nearing a golden cross, and the Chaikin Cash Circulate indicator stays optimistic, a setup that has traditionally preceded upward reversals, in response to the mannequin.

However sentiment round BNB isn’t all bullish. Internet Taker Quantity, a gauge of aggressive promote strain, hit a multi-week low of -$197 million.

In the meantime, at the same time as Binance Sensible Chain’s perpetual buying and selling quantity rose exponentially month-over-month, this exercise doesn’t seem to have sparked new demand for BNB. Futures open interest stays down greater than 30% from its December peak.