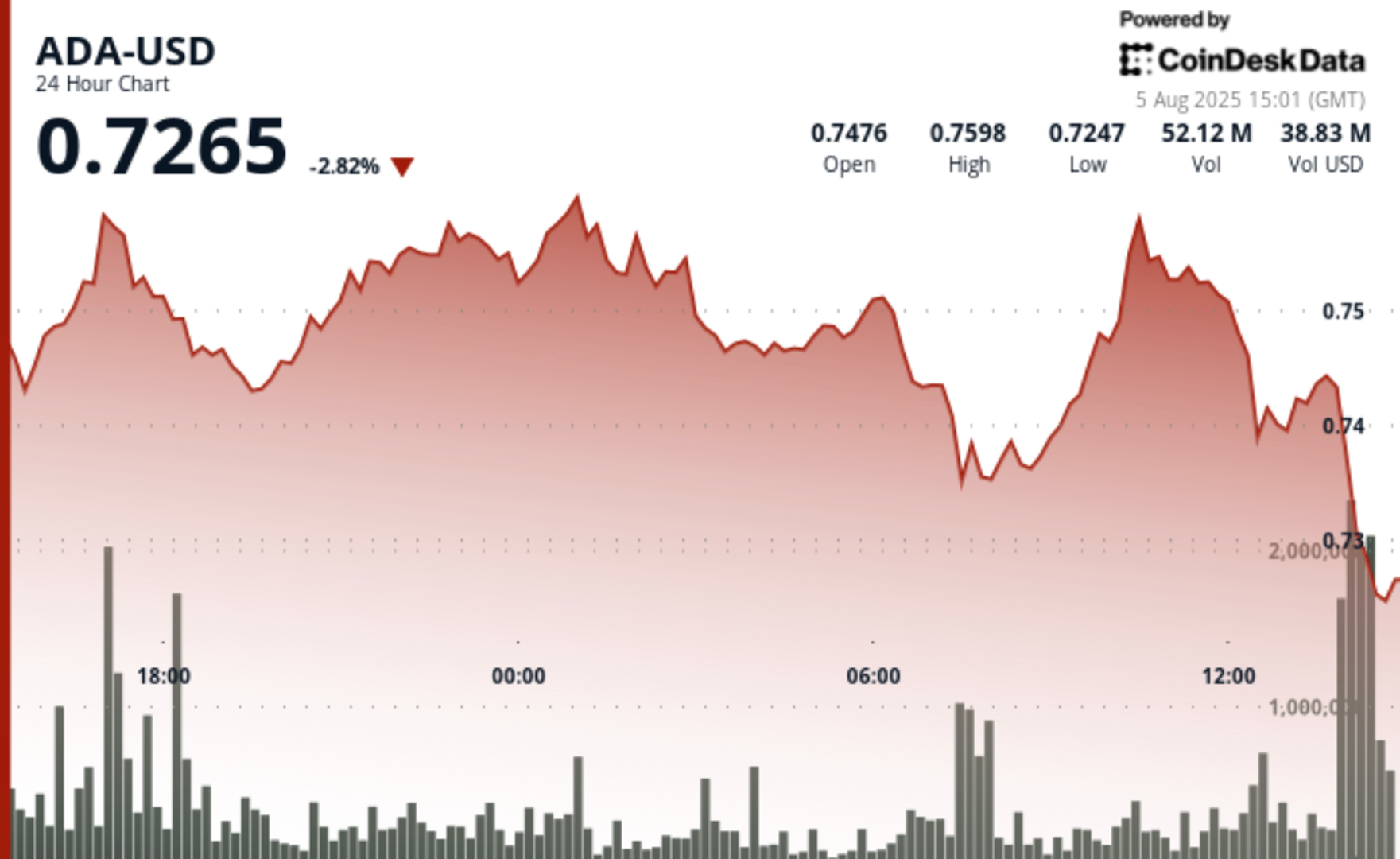

Cardano (ADA) fell about 3% prior to now 24 hours as a part of a seamless crypto market sell-off for the reason that finish of final week. It was recenlty buying and selling at $0.72.

ADA witnessed substantial volatility throughout the interval, displaying a 3.47% fluctuation from the session low of $0.734 to the excessive of $0.760, in accordance with CoinDesk Analysis’s technical evaluation mannequin.

The digital asset rose from $0.745 to as excessive as $0.760 bolstered by heightened buying and selling exercise, earlier than assembly resistance and retreating to $0.735 with quantity of 59.03 million.

It rebounded to $0.755 earlier than confronting extra promoting curiosity, finally settling at $0.739, implying that bearish forces could persist as ADA battles to protect stability above the vital $0.740 threshold.

The general crypto market, as measured by the CoinDesk 20 Index, is down about 1.7%, barely lower than ADA. Bitcoin (BTC) is roughly the identical proportion decrease.

Earlier right now, Midnight — a privacy-focused blockchain constructed on Cardano — began distributing its NIGHT token by means of an airdrop dubbed the Glacier Drop. Wallets tied to XRP addresses acquired about 2.62 billion tokens, roughly 11% of the overall allocation. The remaining tokens are earmarked for holders of ether (ETH), sol (SOL), Binance coin (BNB), Avalanche’s AVAX (AVAX), and fundamental consideration token (BAT).

In a current interview, Cardano founder Charles Hoskinson mentioned the Midnight venture has drawn curiosity from main monetary companies.

“We’ve met with all the massive guys,” he mentioned, claiming that some had been intrigued by the potential for nameless crypto buying and selling on the platform.

Individually, Cardano’s core growth group, Enter Output International (IOG), acquired approval on Monday for a $71 million treasury proposal to fund 12 months of upgrades to the Cardano community. The on-chain vote drew scrutiny from some neighborhood members who raised issues about transparency and the way the funds might be spent.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Policy.