By Omkar Godbole (All occasions ET until indicated in any other case)

The latest TACO tease, implying “Trump All the time Chickens Out” on tariffs, possible did not go down properly with the President, who raised the stakes within the ongoing commerce warfare on Friday, resulting in broad-based danger aversion, which persists as of writing.

On Friday, Trump mentioned that on June 4, the U.S. tariffs on imported aluminum and metal would go from 25% to 50%, triggering a broad-based risk-off transfer throughout world markets. Bitcoin has since traded within the vary of $103,000-$106,000, with little to no pleasure within the broader crypto market. Notably, BlackRock’s spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a chronic inflows streak.

“Tariff tensions will possible dominate the macro narrative by means of June, with significant coverage deadlines solely kicking in from 8 July. Within the absence of contemporary catalysts, BTC may stay rangebound, with the $100k and $110k ranges crucial to look at given their standing as strikes with the very best month-end open curiosity,” Singapore-based buying and selling agency QCP Capital mentioned.

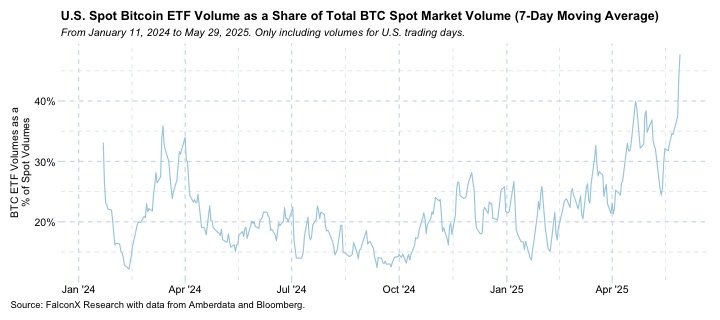

ETFs have gotten more and more vital to the market. Knowledge shared by FalconX’s David Lawant reveals that the cumulative buying and selling quantity within the 11 spot BTC ETFs listed within the U.S. is now well over 40% of the spot quantity. The info helps the “Bitcoin ETFs are the brand new marginal purchaser” speculation, in keeping with Bitwise’s Head of Analysis – Europe, Andre Dragosch.

In the meantime, on-chain knowledge tracked by Glassnode confirmed a drop in momentum consumers alongside a pointy rise in revenue takers final week. “This development usually reveals close to native tops, as merchants start locking in positive aspects as a substitute of constructing publicity,” Glassnode said.

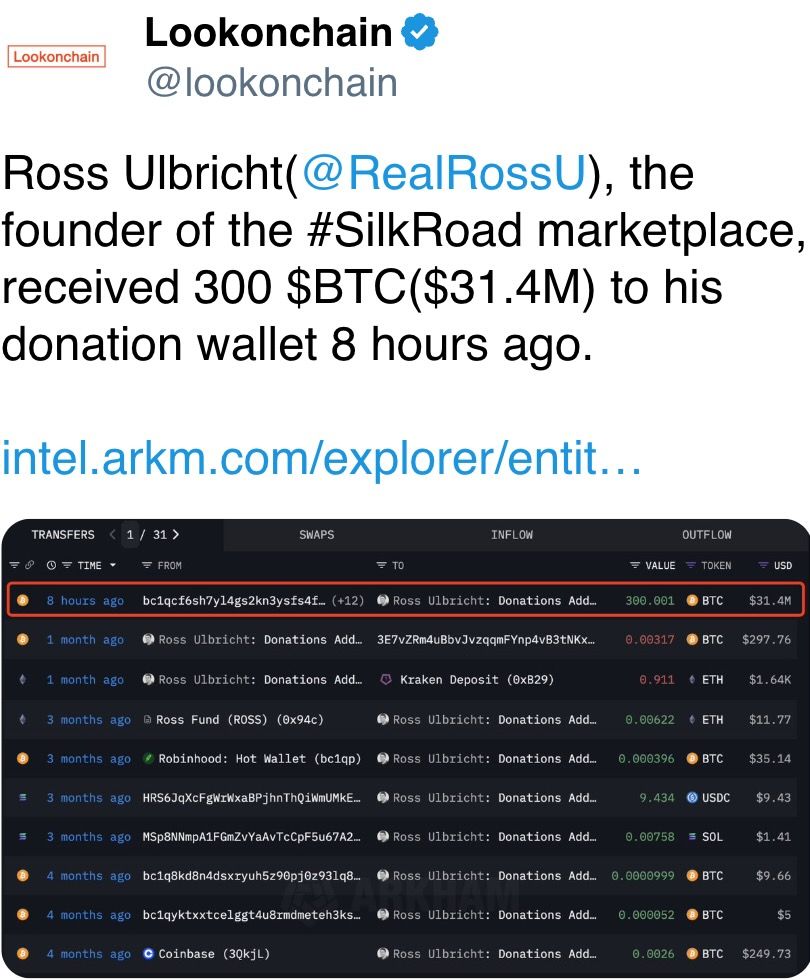

Excessive-stakes crypto dealer James Wynn opened a contemporary BTC lengthy commerce with 40x leverage and a liquidation value of $104,580, in keeping with blockchain sleuth Lookonchain.

In different information, Japan’s “MicroStrategy” Metaplanet announced a further buy of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a brand new XChat with Bitcoin-like encryption.

Binance’s founder CZ said on X that now is likely to be a superb time to develop a darkish pool-style perpetual-focused decentralized alternate, noting that real-time order visibility can result in MEV assaults and malicious liquidations.

In conventional markets, gold appeared to interrupt out of its latest consolidation, hinting on the subsequent leg larger as Bank of America and Morgan Stanley forecast continued greenback weak point. Friday’s U.S. nonfarm payrolls launch shall be carefully watched for indicators of labor market weak point. Keep Alert!

What to Watch

- Crypto

- June 3, 1 p.m.: The Shannon onerous fork community improve will get activated on the Pocket Community (POKT).

- June 4, 10 a.m.: U.S. Home Monetary Providers Committee will maintain a hearing on “American Innovation and the Way forward for Digital Property: From Blueprint to a Useful Framework.” Livestream link.

- June 6: Sia (SC) is about to activate Section 1 of its V2 onerous fork, the biggest improve within the undertaking’s historical past. Section 2 will get activated on July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Job Pressure roundtable on “DeFi and the American Spirit”

- June 10, 10 a.m.: U.S. Home Remaining Providers Committee hearing for Markup of Varied Measures, together with the crypto market construction invoice, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- Macro

- June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell will ship a speech on the Federal Reserve Board’s Worldwide Finance Division seventy fifth Anniversary Convention in Washington. Livestream link.

- June 2, 9:45 a.m.: S&P World releases (Remaining) Might U.S. Manufacturing PMI knowledge.

- Manufacturing PMI Est. 52.3 vs. Prev. 50.2

- June 2, 10 a.m.: The Institute for Provide Administration (ISM) releases Might Manufacturing PMI.

- Manufacturing PMI Est. 49.5 vs. Prev. 48.7

- June 3: South Koreans will vote to choose a new president following the ouster of Yoon Suk Yeol, who was dismissed after briefly declaring martial regulation in December 2024.

- June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market knowledge.

- Job Openings Est. 7.10M vs. Prev. 7.192M

- Job Quits Prev. 3.332M

- June 3, 1 p.m.: Federal Reserve Governor Lisa D. Prepare dinner will ship a speech on financial outlook on the Peter McColough Collection on Worldwide Economics in New York. Livestream link.

- June 4, 12:01 a.m.: U.S. tariffs on imported metal and aluminum will enhance from 25% to 50%, in keeping with a Friday night Truth Social post by President Trump.

- Earnings (Estimates based mostly on FactSet knowledge)

- None within the close to future.

Token Occasions

- Governance votes & calls

- Sui DAO is voting on transferring to recover approximately $220 million in funds stolen from the Cetus Protocol hack through a protocol improve. Voting ends June 3.

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain help in Oku. The objective is to broaden V4 adoption, help hook builders, and enhance instruments for LPs and merchants. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a community call.

- June 10, 10 a.m.: Ether.fi to host an analyst call adopted by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 0.7% of its circulating provide value $14.18 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating provide value $57.11 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating provide value $13.24 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating provide value $17.11 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating provide value $10.64 million.

- Token Launches

- June 3: Bondex (BDXN) to be listed on Binance, Bybit, Coinlist, and others.

- June 16: Advised deadline to unstake stMATIC as a part of Lido on Polygon’s sunsetting course of ends.

- June 26: Coinbase to delist Helium Cellular (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

- Day 1 of 6: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- June 3-5: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Coverage Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Speak

By Shaurya Malwa

- At 11:26 p.m. on Sunday, billionaire tech entrepreneur Elon Musk tweeted “Kekius Maximus pit stage 117, hardcore rank 1,” and meme-coin merchants pounced on frog-themed tokens and low-cap KEKIUS memecoins.

- The Ethereum model surged over 25% in minutes, pushing its market cap to about $33 million. As compared, a Solana-based KEKIUS zoomed as a lot as 30%, displaying the identical “Musk impact” regardless of far decrease liquidity.

- Musk adopted the “Kekius Maximus” persona on New 12 months’s Eve 2024 and has repeatedly juiced the token with profile modifications and gaming references.

- The title fuses crypto-native “Pepe the Frog” lore with Gladiator’s Maximus Decimus Meridius.

- These tokens thrive (and falter) on social media hype; they lack strong fundamentals and may reverse simply as shortly.

Derivatives Positioning

- HBAR, DOT and LTC lead the majors by way of progress in open curiosity in perpetual futures up to now 24 hours.

- Annualized funding charges for majors stays optimistic or bullish, aside from XLM and TON.

- On the CME, one-month annualized foundation within the BTC futures has pulled again to round 6.5% from the latest excessive of 9.5%. ETH’s foundation stays comparatively elevated above 8%.

- On Deribit, BTC and ETH one and two-week choices exhibit draw back fears. Different expiries present name bias.

Market Actions

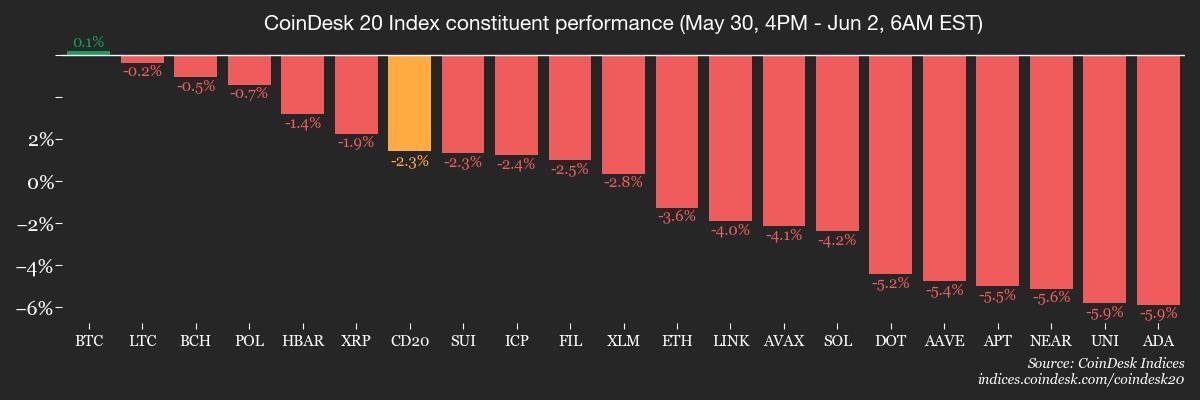

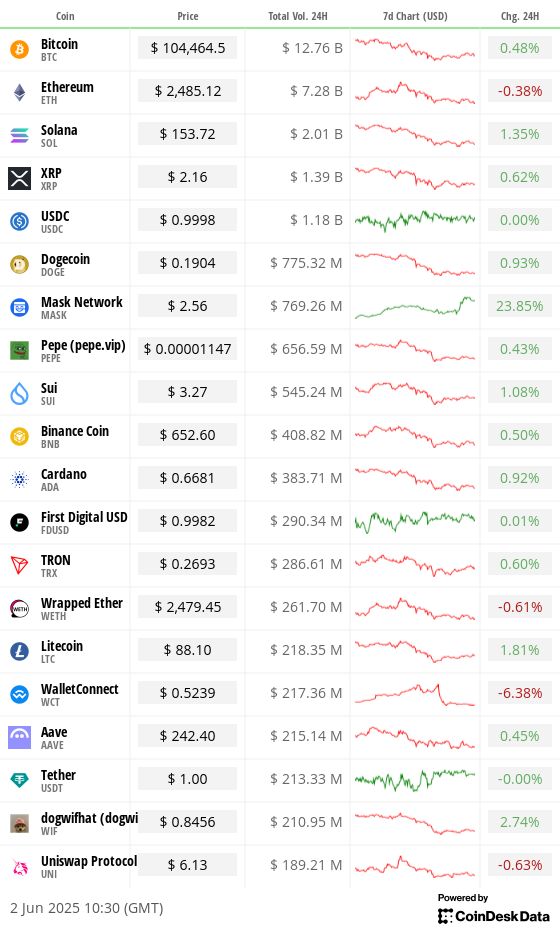

- BTC is unchanged from 4 p.m. ET Friday at $104,642.17 (24hrs: +0.51%)

- ETH is down 3.78% at $2,480.24 (24hrs: +0.47%)

- CoinDesk 20 is down 2.28% at 3,028.20 (24hrs: +0.35%)

- Ether CESR Composite Staking Charge is down 21 bps at 2.97%

- BTC funding charge is at 0.003% (3.2949% annualized) on Binance

- DXY is down 0.51% at 98.82

- Gold is up 2.19% at $3,372.00/oz

- Silver is up 1.65% at $33.44/oz

- Nikkei 225 closed -1.3% at 37,470.67

- Grasp Seng closed -0.57% at 23,157.97

- FTSE is unchanged at 8,768.28

- Euro Stoxx 50 is down 0.74% at 5,327.14

- DJIA closed on Friday +0.13% at 42,270.07

- S&P 500 closed unchanged at 5,911.69

- Nasdaq closed -0.32% at 19,113.77

- S&P/TSX Composite Index closed -0.14% at 26,175.10

- S&P 40 Latin America closed -1.77% at 2,554.48

- U.S. 10-year Treasury charge is up 3 bps at 4.44%

- E-mini S&P 500 futures are down 0.63% at 5,879.00

- E-mini Nasdaq-100 futures are down 0.77% at 21,212.25

- E-mini Dow Jones Industrial Common Index futures are down 0.56% at 42,056.0

Bitcoin Stats

- BTC Dominance: 64.62 (0.21%)

- Ethereum to bitcoin ratio: 0.02375 (-1.17%)

- Hashrate (seven-day transferring common): 931 EH/s

- Hashprice (spot): $52.3

- Whole Charges: 3.47 BTC / $364,001

- CME Futures Open Curiosity: 146,575 BTC

- BTC priced in gold: 31.8 oz

- BTC vs gold market cap: 9.02%

Technical Evaluation

- Gold is seeking to set up a foothold above the higher finish of the falling channel.

- A possible breakout would sign a resumption of the broader uptrend, providing bullish cues to bitcoin.

Crypto Equities

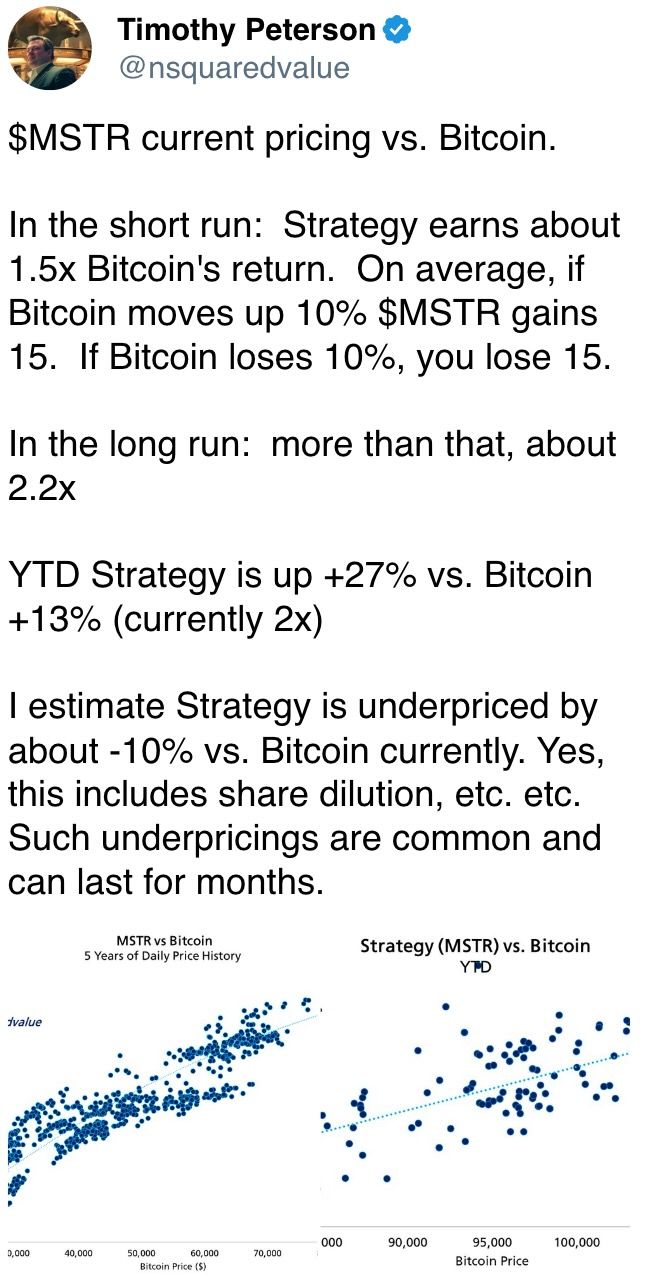

- Technique (MSTR): closed on Friday at $369.06 (-0.42%), unchanged in pre-market

- Coinbase World (COIN): closed at $246.62 (-0.89%), unchanged in pre-market

- Galaxy Digital Holdings (GLXY): closed at C$24.92 (-7.87%)

- MARA Holdings (MARA): closed at $14.12 (-3.35%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $8.07 (-1.34%), -0.25% at $8.05 in pre-market

- Core Scientific (CORZ): closed at $10.65 (-0.37%), -1.5% at $10.49

- CleanSpark (CLSK): closed at $8.63 (-1.71%), -0.35% at $8.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.47 (-2.54%)

- Semler Scientific (SMLR): closed at $40 (-0.2%), +1.72% at $40.69

- Exodus Motion (EXOD): closed at $28.5 (-5.97%), +0.39% at $28.61

ETF Flows

Spot BTC ETFs

- Each day internet circulation: $616.1 million

- Cumulative internet flows: $44.35 billion

- Whole BTC holdings ~ 1.20 million

Spot ETH ETFs

- Each day internet circulation: $70.2 million

- Cumulative internet flows: $3.06 billion

- Whole ETH holdings ~ 3.66 million

Supply: Farside Investors

In a single day Flows

Chart of the Day

- The chart reveals that the cumulative quantity in U.S.-listed spot BTC ETFs as a share of the entire bitcoin spot market quantity has risen to file highs.

- The info helps the “Bitcoin ETFs are the brand new marginal purchaser” speculation.

Whereas You Have been Sleeping

- Metaplanet Acquires 1,088 Bitcoin to Bring BTC Stash to Over $930M (CoinDesk): The Japanese agency paid a median of 15.5 million yen ($108,051) per bitcoin for its partner promotions buy, bringing its whole holdings to greater than 8,888 BTC.

- Post Pectra ‘Malicious’ Ethereum Contracts Are Trying to Drain Wallets, But to No Avail: Wintermute (CoinDesk); EIP-7702 lets Ethereum wallets act like sensible contracts, however over 97% of delegations use similar code tied to wallet-draining assaults, highlighting rising safety considerations.

- Taiwanese Crypto Exchange BitoPro Likely Hacked for $11M in May, ZachXBT Says (CoinDesk): The blockchain analyst claims the tokens allegedly stolen on Might 8 have been funneled by means of Twister Money, Thorchain and Wasabi Pockets to obscure their origin.

- China Hits Back Against Trump Claims That It Broke Trade Truce (The Wall Road Journal): Responding to Trump’s accusation that China violated the Geneva commerce truce, Beijing blamed the U.S. for escalating tensions, citing new export controls and scholar visa restrictions.

- Ukraine and Russia to Meet for Second Round of Talks as Attacks Escalate (The New York Occasions): As Russia and Ukraine meet at this time in Istanbul, each side stay entrenched beneath stress from Trump, with no mutually acceptable phrases for a peace deal prone to emerge.

- Putin’s Central Banker Under Pressure to Cut Record-High Rates (Bloomberg): Officers need charges reduce from 21% as excessive borrowing prices squeeze civilian industries, however with inflation easing primarily because of a stronger ruble, policymakers stay cautious about loosening too quickly.