Yesterday, July thirtieth, was the 10-year anniversary of Ethereum’s launch. In at this time’s Crypto for Advisors e-newsletter, Alec Beckman from Psalion writes about Ether’s rising function as a treasury reserve asset and highlights rising traits.

Then, Eric Tomaszewski from Verde Capital Administration solutions questions on Ether as an funding in Ask an Skilled.

Thanks to our sponsor of this week’s e-newsletter, Grayscale. For monetary advisors: register for the upcoming Minneapolis event on September 18th.

Ethereum: The Rising Treasury Asset Reshaping Company Finance

Ether, the cryptocurrency of the Ethereum blockchain, is quickly being adopted by public corporations as a strategic treasury asset, an evolution that’s serving to to reshape company finance and shift ETH’s market dynamics.

Bitcoin has lengthy dominated the digital treasury conversation. Its capped provide and decentralized nature make it a hedge towards inflation and a retailer of worth. Ether is catching up, due to its yield potential, economics, real-world utility, and maturing institutional infrastructure.

Why Ethereum Appeals to Treasuries

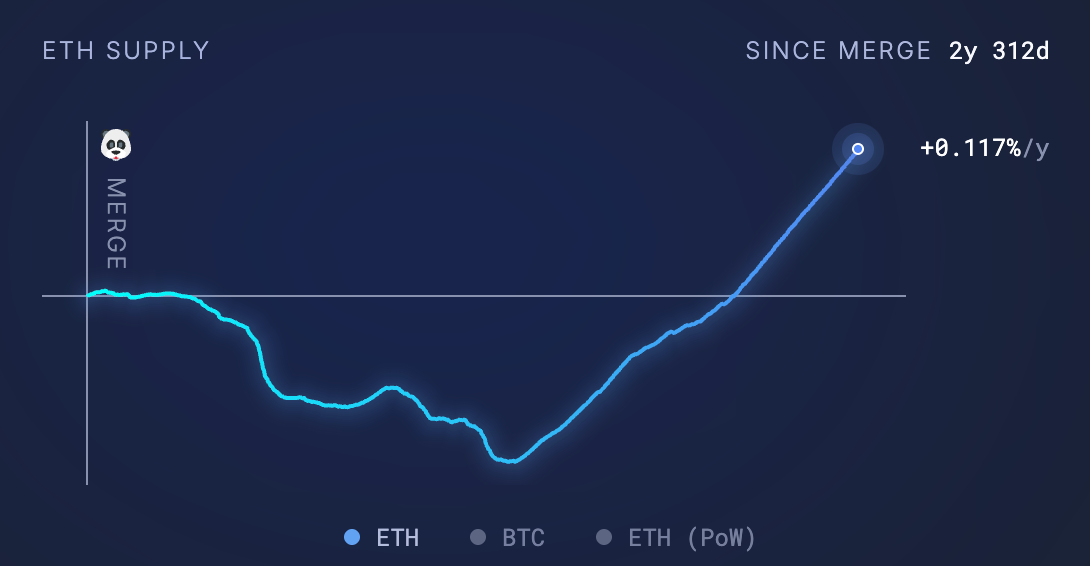

Ethereum’s 2022 transition to proof-of-stake enabled holders to earn annual staking yields between 2% and 4%, making a passive earnings layer that Bitcoin doesn’t provide. The asset has additionally been deflationary at occasions, with extra ETH burned than issued, supporting a store-of-value thesis.

On the identical time, Ethereum powers an ecosystem of decentralized purposes, tokenized belongings, and good contracts. For companies, it might probably operate not solely as a reserve asset but additionally as capital for deploying providers and infrastructure.

The ETH Treasury Wave

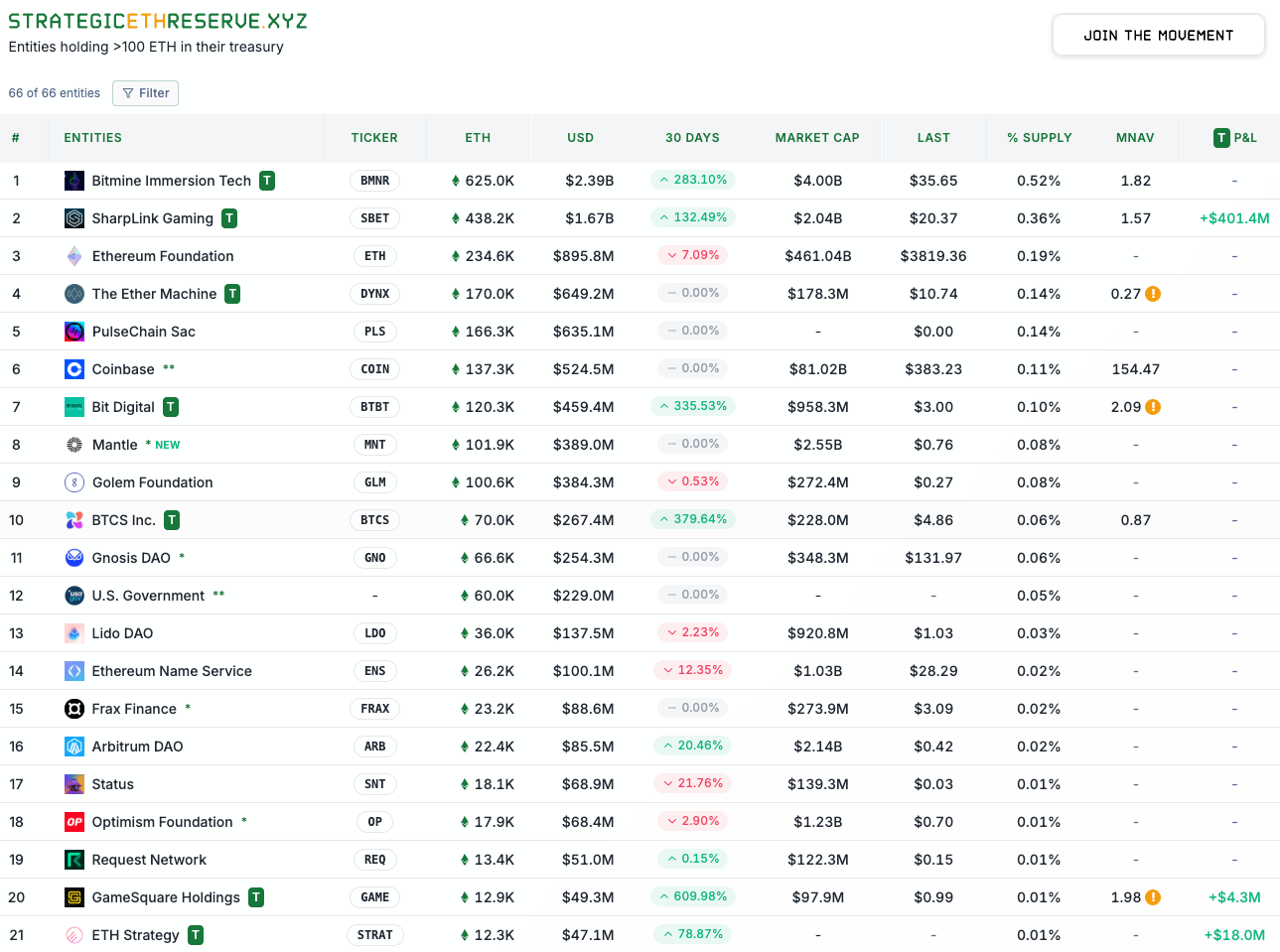

A number of public companies are now building treasury strategies round ETH, following early movers like MicroStrategy in Bitcoin:

- Bit Digital holds over 120,300 ETH and stakes its total allocation. CEO Sam Tabar calls it a “flywheel mannequin,” the place staking yield funds operations. They plan to add more to the tune of > $1b.

- BTCS lately elevated its holdings to over 70,000 ETH and was among the many first public companies to stake ETH as a treasury technique.

- Bitmine Immersion is aiming to acquire 5% of total ETH supply. Backed by vital funding and led by Tom Lee, it now holds over 625,000 ETH.

- Sharplink Gaming holds greater than $1.67 billion in ETH, including almost 80,000 cash in a single week and pursuing staking as a core technique. Joe Lubin is a board member and operating their ETH acquisition technique.

- Gamesquare has allotted an preliminary $30 million in ETH with approval to scale to $250 million. It additionally plans to combine DeFi and NFT-based yield as differentiators. GameSquare sees the Ethereum Community as Manhattan, with a Monetary District (DeFi), an artwork district (NFTs), and extra. Investing in it at this time is essential for future worth and use.

- The Ether Machine, a SPAC-backed automobile spun out from Publicly Traded Dynamix, is focusing on $1.5 billion in ETH because it prepares to go public.

The businesses listed above all plan so as to add considerably extra. Different corporations have simply introduced their holdings reminiscent of ETHzilla.

These corporations aren’t simply shopping for… they’re signaling long-term conviction and, in lots of instances, constructing merchandise and income streams instantly on Ethereum. One instance is GameSquare, whose technique intently aligns with their viewers within the gaming, media, and leisure industries and sees the reference to on-chain merchandise constructed on Ethereum. It is very important them to foster monetary alignment with their viewers.

BTCS is implementing the same technique to align with its viewers, as block building and staking create a vertical stack on the Ethereum Community, leading to efficiencies in transactions and staking.

The Demand–Provide Imbalance

ETH’s value has climbed steadily in latest months, and public firm purchases are one of many major catalysts for this enhance. In a latest 30-day span, over 32 times more ETH was purchased than issued. That features shopping for from treasury allocators, staking automobiles, and newly accepted ETFs. A continuation of this development will create a provide shock.

In contrast to Bitcoin, the place miners usually should promote their bitcoin to cowl operational prices, Ethereum’s shift to proof-of-stake reduces sell-side strain and aligns holders with securing the community.

Conclusion

Ethereum is now not only a platform for builders; it’s now a monetary asset that public corporations are adopting at scale. With built-in yield, deflationary dynamics, and rising institutional demand, ETH is rising as a cornerstone of company treasury technique. As extra companies transfer from “” to “allotted,” this new wave of ETH consumers might assist outline the following section of the crypto cycle.

Particular thanks to Sam Tabar, CEO of Bit-Digital, Charles Allen, CEO of BTCS, Justin Kenna, CEO of GameSquare and Rhydon Lee, managing accomplice of Goff Capital (affiliated with GameSquare) on sharing their insights with me on ETH Treasury Firms, differentiation, and the Ethereum community normally.

– Alec Beckman, vice president of growth, Psalion

Ask an Skilled

Q: Why is ETH being mentioned as a strategic reserve asset?

A: Ethereum has quietly grow to be monetary infrastructure, not only a speculative asset.

In contrast to bitcoin (which is usually a “retailer of worth” ), ETH powers an actual financial system that ties to good contracts, tokenized belongings, stablecoin transactions, and decentralized monetary providers. As extra financial exercise settles on Ethereum, ETH is being thought of a reserve asset by establishments, fintech companies, DAOs, and even sovereign actors.

The reason being that ETH is the gas that makes the system work. It is just like holding oil in an vitality financial system or treasuries in a greenback system.

Q: Ought to company treasuries deal with ETH like a money equal, long-duration tech-oriented fairness, or a type of intangible infrastructure?

A: In apply, I see this as a brand new sleeve within the portfolio that I’d name a “digital infrastructure reserve.” It carries tech beta and regulatory danger, but additionally presents operational utility (smart-contract escrow, settlement, tokenization rails). That’s neither money nor fairness.

Q: How do you translate “ETH as a strategic reserve” into sensible implications?

A: For establishments and treasuries:

- ETH serves because the money and collateral for operating on-chain companies.

- It generates yield (staking) like T-bills.

- It’s held on stability sheets, declared in treasury insurance policies, and audited.

For people & households:

- ETH is handled as a long-term strategic asset.

- Allotted thoughtfully (a minimum of 1 — 5%) and separated from short-term wants.

- Used to earn staking earnings, hedge towards fiat devaluation, and achieve publicity to Ethereum’s rising function in finance and tokenized infrastructure.

Q: What would show that ETH deserves to be handled like a severe reserve asset over the following 10 years?

A: If extra of the world’s monetary exercise like tokenized actual property, stablecoins, and enormous worldwide funds are settling instantly on Ethereum, it exhibits rising belief within the community. As Ethereum turns into core infrastructure for international worth switch, ETH strikes from hypothesis to a authentic strategic reserve.

Strategicethreserve.xyz is a good supply for gauging development. Past that, it is useful to observe the innovation and creativity of names like Robinhood and The Ether Machine, to call just a few.

– Eric Tomaszewski, financial advisor, Verde Capital Management

Maintain Studying

- The White Home launched its first Digital Asset Policy Report on Wednesday, July thirtieth.

- Billionaire Ray Dalia recommends a 15% bitcoin exposure in portfolios to hedge towards fiat debasement.

- Samsung has partnered with Coinbase to combine crypto payments for Samsung customers.