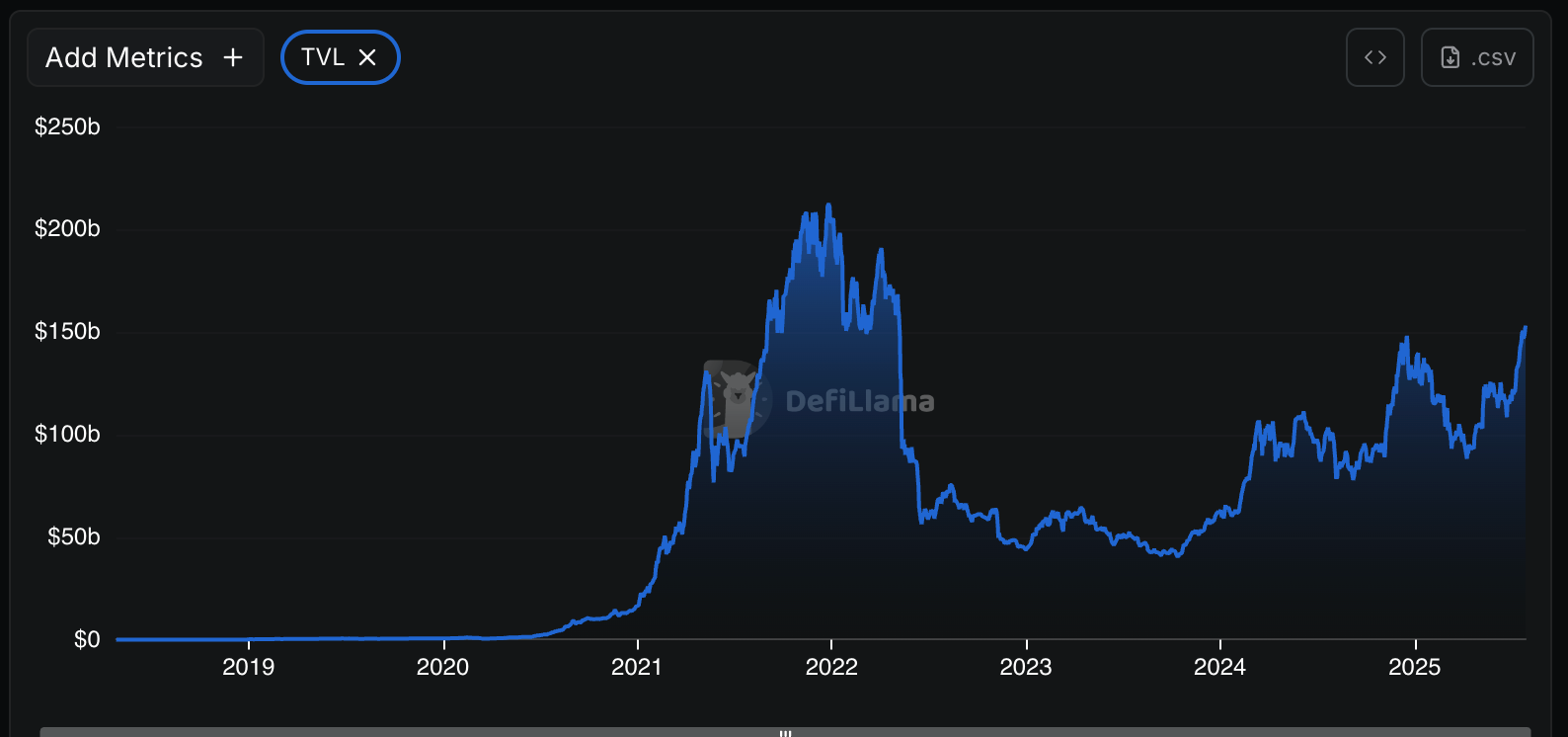

The decentralized finance (DeFi) market ballooned to a three-year excessive of $153 billion on Monday, spurred by ETH’s ascent towards $4,000 and important inflows into restaking protocols.

DefiLlama data exhibits that the uptick in inflows and asset costs over the previous week lifted the sector above its December 2024 excessive to its highest level since Might 2022, on the time of $60 billion collapse of Do Kwon’s Terra network.

ETH has risen 60% from $2,423 to $3,887 over the previous 30 days following a wave of institutional funding together with a $1.3 billion treasury investment from Sharplink Gaming and BitMine’s $2 billion acquisition.

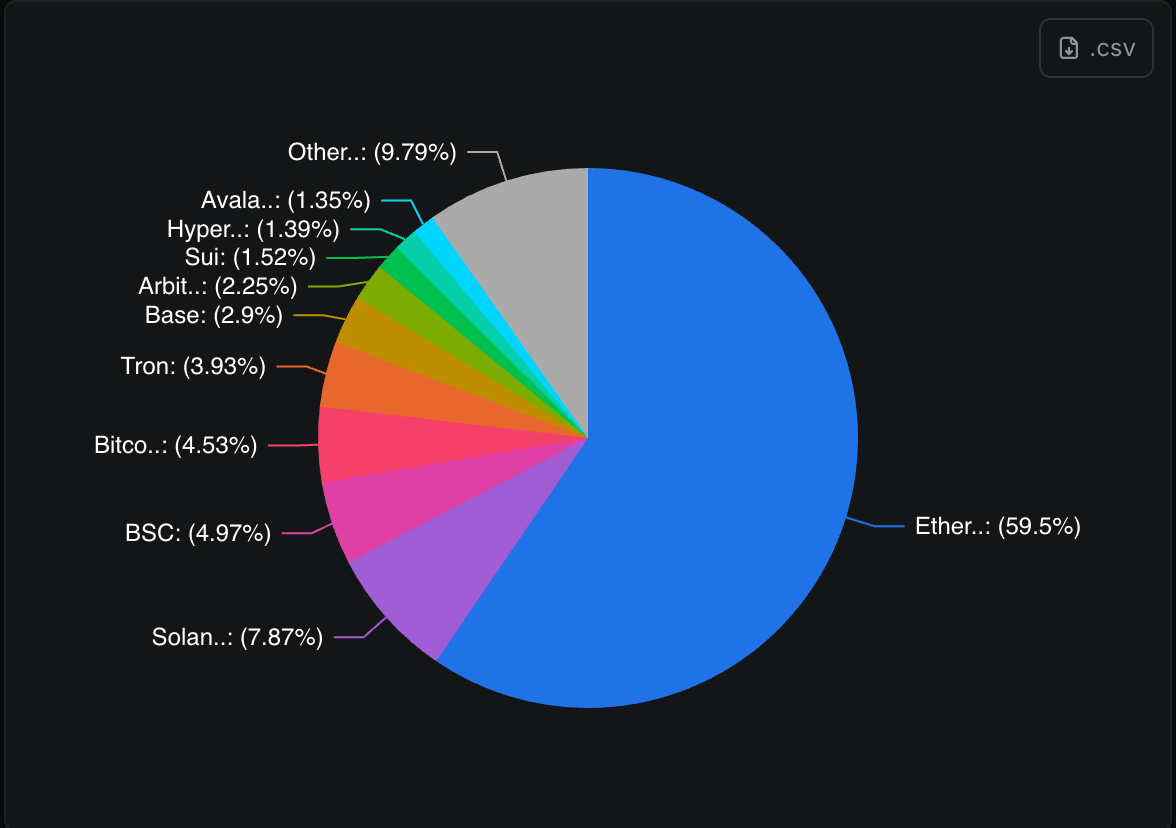

Ethereum nonetheless instructions the monopoly over DeFi complete worth locked (TVL) with 59.5% of all capital locked on-chain, nearly all of which might be attributed to liquid staking protocol Lido and lending platform Aave, each of which have between $32 billion and $34 billion in TVL.

The yield farming battle

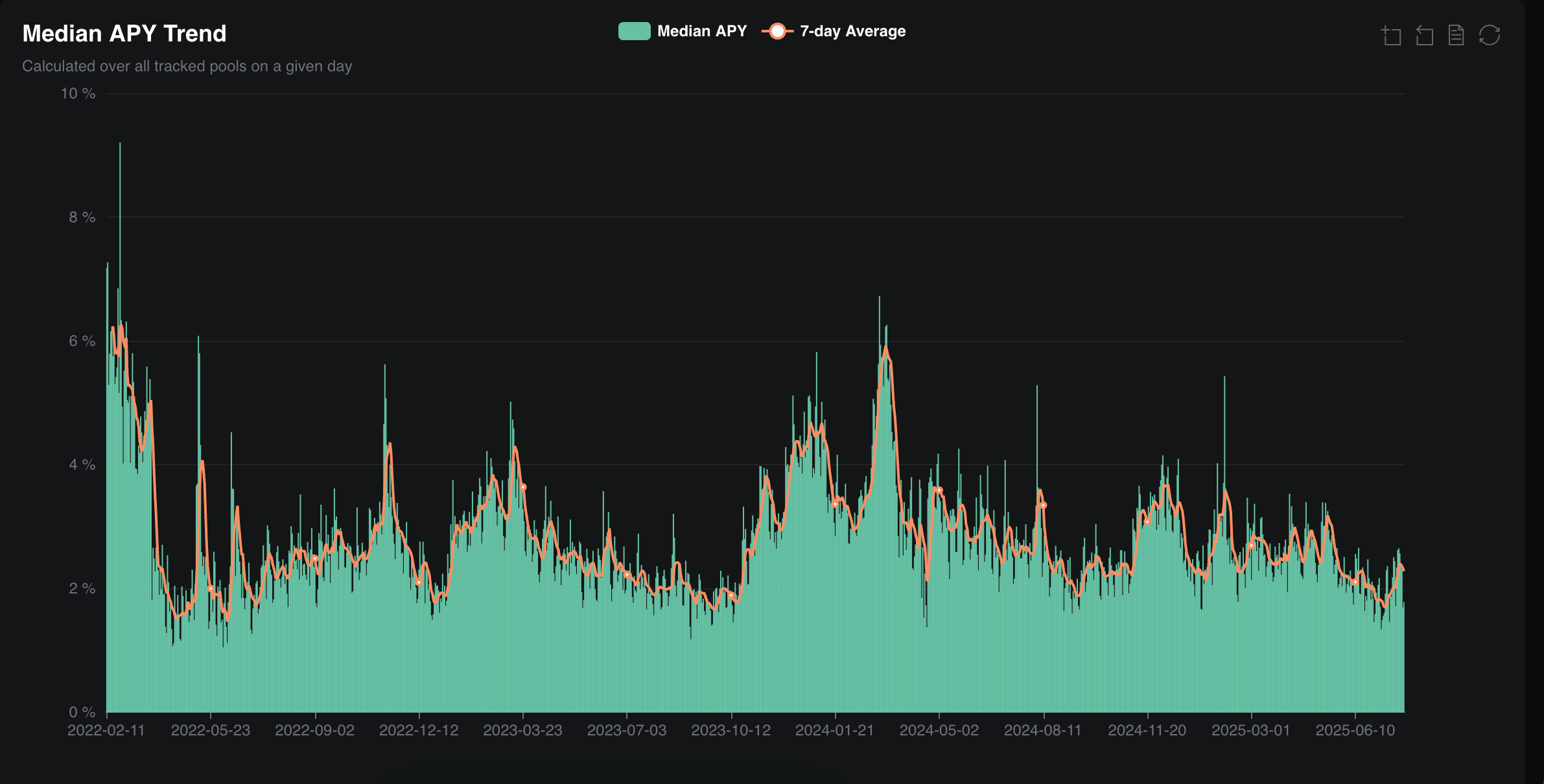

Establishments buying property like ether is one a part of the equation, the opposite is securing a yield on high of that funding.

Buyers can stake ETH immediately and earn a modest annual yield between 1.5% and 4%, or they will go one step additional and use a restaking protocol, which is able to award native yield and a liquid staking token that can be utilized elsewhere throughout the DeFi ecosystem for added yield.

X consumer OlimpioCrypto revealed a extra advanced technique that may safe an annual return of as much as 25% with on USDC and sUSDC with low danger and full liquidity. It loops property between Euler and Spark on Unichain: customers provide USDC on Euler, borrow sUSDC, re-supply it, and repeat. Incentives from Spark (SSR + OP rewards) and Euler (USDC subsidies, rEUL) increase returns.

A better however much less worthwhile various begins by minting sUSDC by way of Spark and looping with USDC borrow/lend on Euler. Regardless of UI discrepancies, each strategies are reportedly yielding robust returns, doubtless lasting a few week until incentives change.

Solana and different blockchains

Whereas a lot of the eye is understandably on the Ethereum Community, Solana’s TVL has grown by 23% up to now month to $12 billion, with protocols like Sanctum, Jupiter and Marinade all outperforming the broader SOL ecosystem with important inflows, in keeping with DefiLlama.

Buyers have additionally been pouring capital into Avalanche and Sui, each of that are up 33% and 39% respectively when it comes to TVL this month. The Bitcoin DeFi ecosystem has been extra muted, rising by simply 9% to $6.2 billion regardless of a current drive to new report highs at $124,000.