Dogecoin (DOGE) recovered from an intraday low of $0.164 to shut close to $0.171, posting a 4.7% bounce consistent with broader market weak spot. The transfer suggests institutional consumers could also be quietly accumulating at decrease ranges as market individuals brace for continued volatility.

Information Background

- Dogecoin’s rebound comes within the wake of intense promoting stress sparked by escalating geopolitical tensions between Israel and Iran. The sharp market-wide correction, which triggered mass liquidations, briefly pushed DOGE down greater than 7% intraday on Wednesday.

- In the meantime, macroeconomic headwinds persist. The U.S. Federal Reserve continues to keep up restrictive financial coverage, protecting charges at 4.25%–4.50% whereas actively decreasing its steadiness sheet — a dynamic that has traditionally weighed on riskier bets equivalent to DOGE.

- Nonetheless, the memecoin stays probably the most liquid property within the crypto area, with day by day turnover close to $1.37 billion and market cap holding above $24.7 billion.

- Elsewhere, technical indicators present DOGE coming into oversold territory, and social sentiment knowledge from LunarCrush reveals an 86% optimistic tone throughout 16,000+ mentions, suggesting continued group conviction even amid value volatility.

DOGE’s near-term outlook could hinge on regulatory developments, together with a possible U.S. spot ETF choice, in addition to continued adoption on DeFi platforms equivalent to Coinbase’s Base community the place wrapped DOGE is gaining traction.

Worth Motion

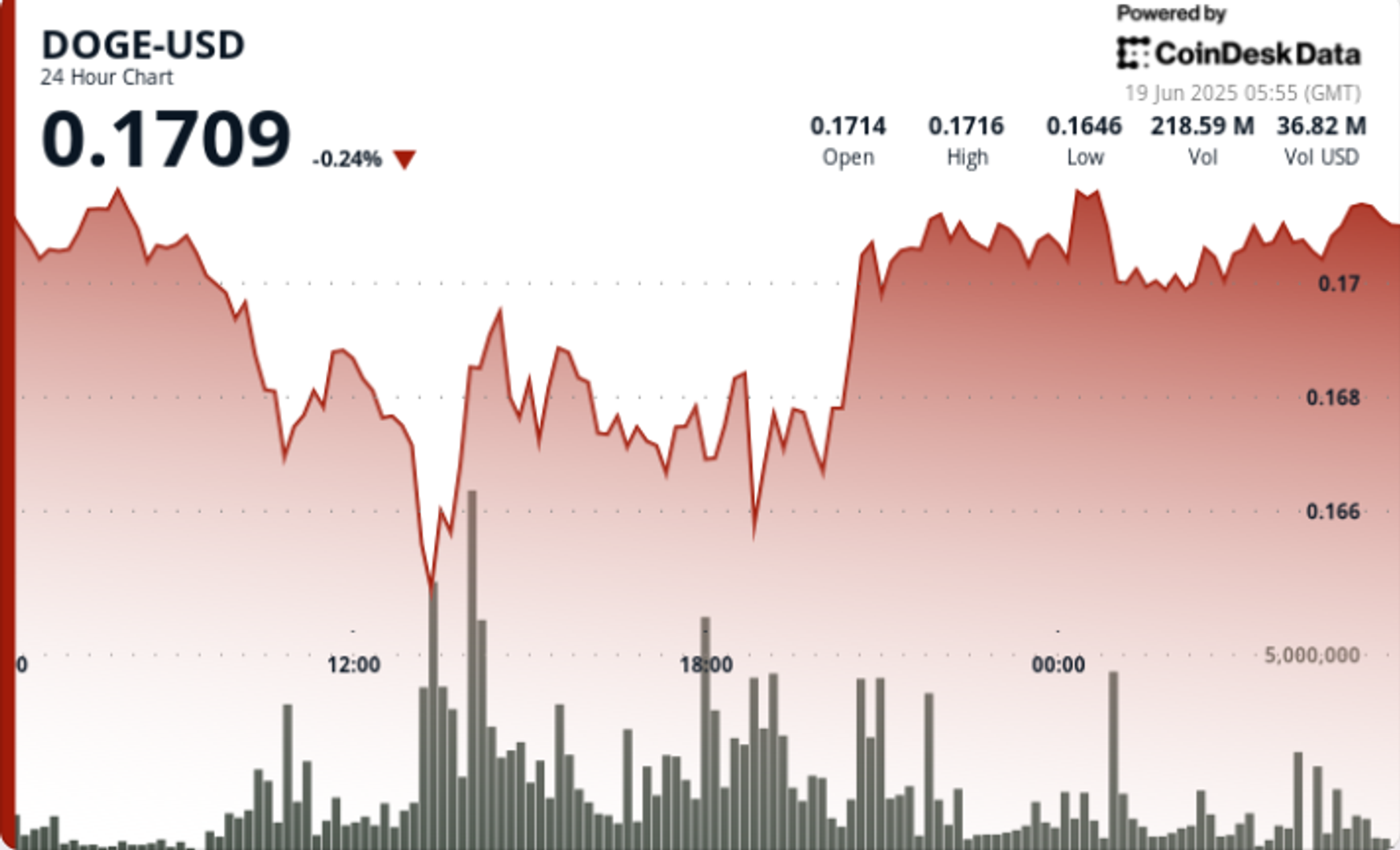

DOGE noticed its sharpest decline throughout the 13:00 hour, dropping to $0.164 on a 591M quantity spike — the best of the day.

The sturdy bounce that adopted pushed costs again above $0.171, the place the memecoin discovered near-term equilibrium.

Worth motion has since consolidated in a good band between $0.170 and $0.1696, with small quantity bursts suggesting accumulation at decrease ranges.

Technical Evaluation Recap

- DOGE posted a 4.7% restoration, rising from $0.164 to $0.171.

- Main liquidation-driven selloff occurred at 13:00, with quantity peaking at 591M models.

- Quantity-based help established at $0.164; resistance stays agency close to $0.172.

- Current candles present indicators of accumulation, significantly throughout the 02:00–02:02 interval (3.4M quantity).

- RSI at 33.29 suggests DOGE could also be nearing oversold territory.

- Worth is consolidating simply above short-term help of $0.1696.

- If DOGE breaks above $0.1750, the following resistance zone lies at $0.1820; failure to take action may set off a retest of $0.1640 and even $0.150 in a risk-off setting.

- Technical patterns level to a descending triangle — usually a bearish sign — however diminished volatility suggests stabilization.

Disclaimer: Parts of this text had been generated with the help of AI instruments and reviewed by CoinDesk’s editorial group for accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.