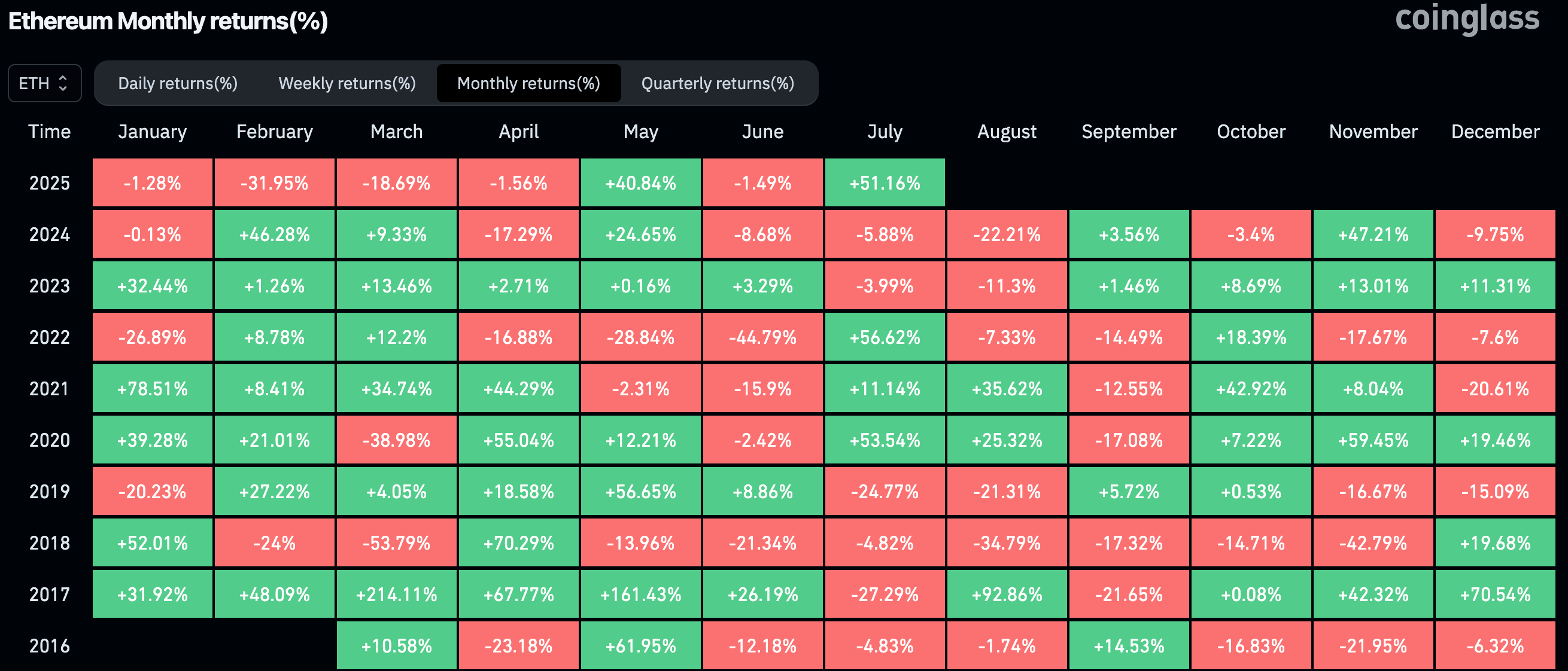

Ether (ETH), the native token of the Ethereum blockchain that turned 10, simply had its finest July efficiency in three years.

The second largest cryptocurrency climbed greater than 50% in July, peaking at $3,940 earlier than easing beneath $3,800 in the direction of the top of the month.

The final time ETH rose this a lot in a single month was July 2022, rebounding from the depths of the crypto crash marked by high-profile implosions of Terra-Luna, Three Arrows Capital and Celsius.

This time, the rally has a unique driver with cash pouring in from capital markets.

U.S.-listed spot ETH exchange-traded funds (ETFs) absorbed $5.4 billion of web inflows by way of the month, their strongest streak because the merchandise debuted final yr, SoSoValue data exhibits.

Company steadiness sheets are additionally following swimsuit. As a part of the digital asset treasury frenzy, public corporations have devoured up $6.2 billion value of ETH, in response to information gathered by CEX.io. Tom Lee’s Bitmine and Joseph Lubin’s SharpLink are the two most notable players, however the weather disturbance entrants, like ETHZilla and Ether Machine, have already raised giant sums of capital from establishments to deploy for asset purchases.

The value motion got here hand-in-hand with a optimistic narrative shift, positioning ETH as a key proxy for the booming stablecoin and tokenization market.

With the brand new U.S. guidelines for stablecoins beneath the Genius Act and Ethereum internet hosting greater than half of the $250 billion stablecoin provide, that readability might cement its position because the spine of dollar-pegged tokens.

Worth-wise, ETH is presently going through resistance at $4,000, the place a number of makes an attempt to interrupt greater failed final yr. The crypto market can be getting into a traditionally quiet section, which might see the rally cool off in a consolidation section.

Nonetheless, ETH might need some “juice within the tank” to push as excessive as $4,700 as a part of its present run, well-followed crypto investor Bob Loukas mentioned in an X post.

Learn extra: Ethereum Could Win the War, But Lose the Prize