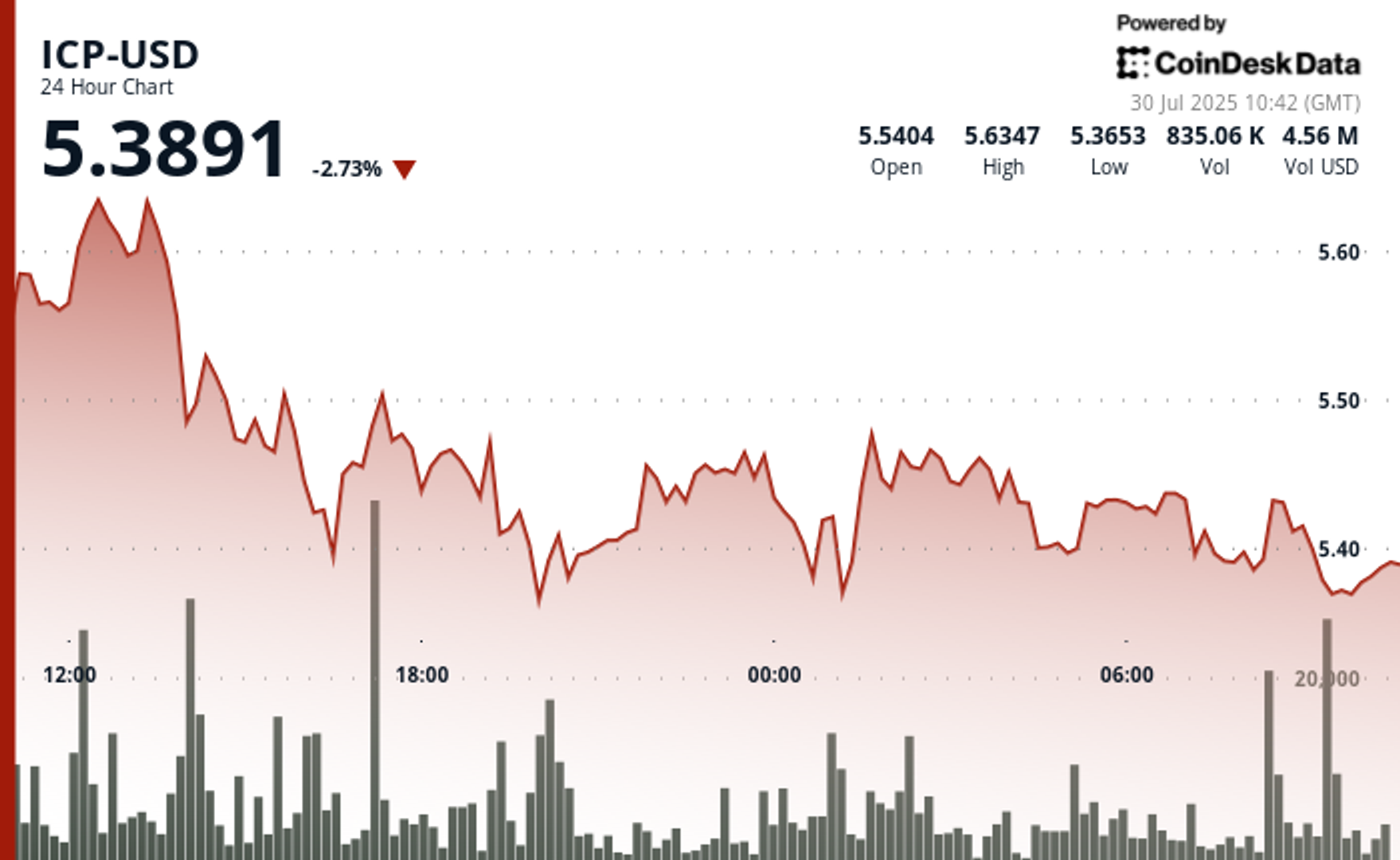

Web Pc Protocol’s native token ICP declined 4.77% over the previous 24 hours, slipping from $5.66 to $5.39 as sellers overwhelmed consumers throughout a interval of intensified downward strain.

The asset traded inside a $0.33 vary between $5.68 and $5.35, reflecting 5.3% volatility, in keeping with CoinDesk’s technical evaluation information mannequin.

Essentially the most decisive breakdown occurred between the early European morning and mid-afternoon on Tuesday, when the token breached the essential $5.55 help degree amid a surge of quantity to 647,663 contracts, nicely above the each day common of 356,394.

Regardless of a quick stabilization section close to $5.38 towards the tip of the window, restoration momentum didn’t materialize. From 07:06 to 08:05 on July 30, ICP pulled again 0.92%, falling from $5.44 to $5.39 in uneven commerce. Repeated checks of the $5.38 help degree occurred throughout the 07:40–07:55 window, highlighting ongoing bearish management over short-term value motion.

ICP’s weak point comes even because the DFINITY Basis advances ecosystem growth. The launch of Internet Computer 2.0, which introduces instruments for creating purposes utilizing pure language prompts with out coding expertise, displays the community’s continued push towards usability and developer accessibility.

Nonetheless, these long-term improvements have but to translate into sustained bullish value motion.

Technical Evaluation Highlights

- Worth declined 4.77% from $5.66 to $5.39 between July 29 at 09:00 and July 30 at 08:00 UTC.

- Buying and selling vary spanned $0.33 (5.3%) from excessive of $5.68 to low of $5.35.

- Main breakdown occurred at $5.55 with quantity surging to 647,663 contracts.

- Help at $5.38 examined a number of instances throughout early July 30 buying and selling window.

- Resistance fashioned at $5.44 amid declining quantity and fading upward momentum.

- Consolidation vary noticed between $5.38 and $5.44 as value motion flattened.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our standards. For extra data, see CoinDesk’s full AI Policy.