Jim Chanos, the veteran investor who made his title shorting Enron, is betting on bitcoin (BTC) commerce whereas shorting Technique (MSTR), the most important company holder of the most important cryptocurrency.

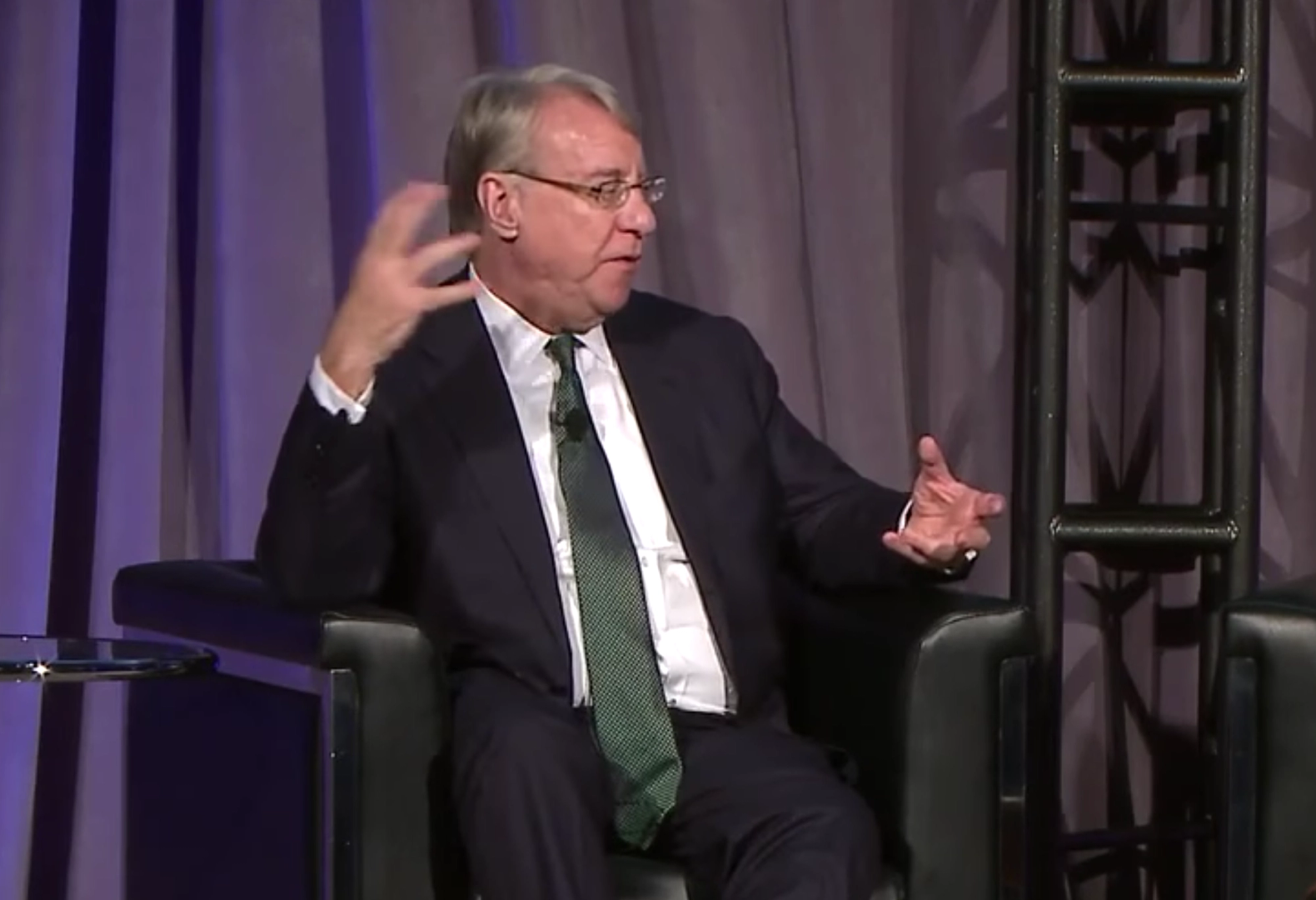

In an interview on the Sohn Funding Convention in New York with CNBC, Chanos detailed the guess. “We’re promoting MicroStrategy inventory and shopping for bitcoin,” Chanos stated, calling it an arbitrage transfer: “Principally shopping for one thing for $1, promoting it for $2.50.”

Technique began buying bitcoin in 2020 and has since morphed right into a bitcoin proxy for traders. The agency has issued debt and fairness to build up the cryptocurrency, and now has a 568,840 BTC hoard purchased at a median price of $69,287 per coin.

The aggressive bitcoin accumulation, backed by Wall Street analysts, has made its inventory delicate not simply to bitcoin’s worth, but in addition to investor urge for food for danger. Technique’s shares are up 3,500% within the final 5 years to now commerce at $416 a chunk, giving it a $115 billion market capitalization.

To Chanos, Technique’s valuation doesn’t make sense as MSTR shares have surged greater than the worth of bitcoin.

The fund supervisor argues that this rise displays retail hypothesis greater than fundamentals, a theme he believes is echoed by different corporations now making an attempt to duplicate Technique’s bitcoin accumulation technique.