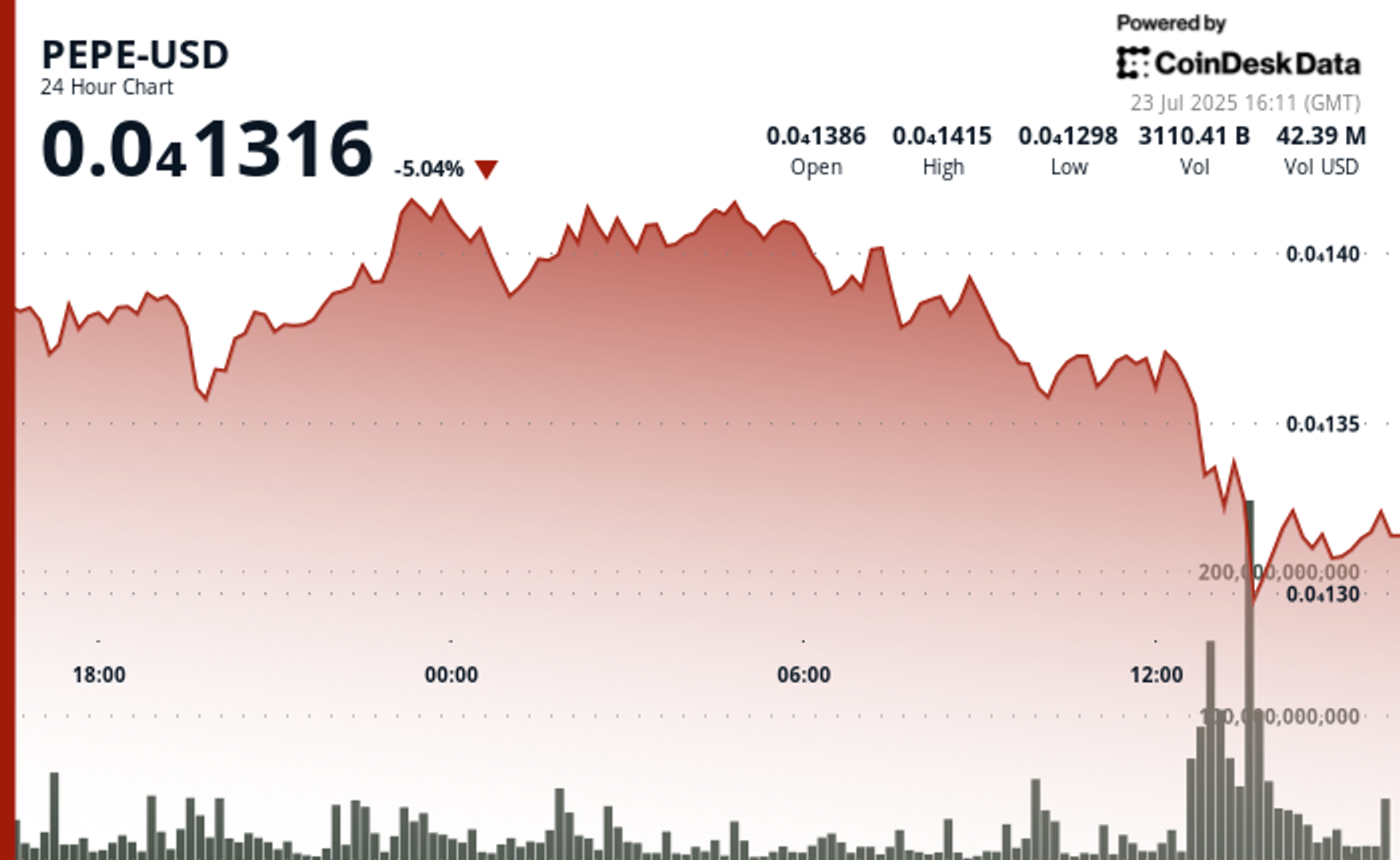

PEPE fell greater than 5% within the final 24-hour interval, dropping from a session excessive close to $0.000014167 to a low of $0.000012915, earlier than seeing a slight recovering.

Buying and selling quantity reached 13.02 trillion tokens an hour through the sell-off, greater than 4 instances the session common of three.2 trillion, in response to CoinDesk Analysis’s technical evaluation knowledge mannequin.

Regardless of the selloff, a number of market indicators counsel deeper investor curiosity. Google search queries for PEPE jumped on July 22, peaking shortly earlier than the crash, in response to Google Trends.

In the meantime, whale pockets holdings on Ethereum, measured by the highest 100 addresses, grew by 3.2% over the previous 30 days. PEPE tokens on exchanges dropped by 2.5% over the identical interval, in response to Nansen knowledge, suggesting there’s much less obtainable provide.

By the top of the session, PEPE had clawed again a few of its losses, stabilizing round $0.0000131. Restoration quantity stayed elevated, averaging between 300 and 400 billion tokens per hour, displaying renewed shopping for curiosity within the aftermath of the drawdown.

Technical Evaluation Overview

Value motion through the session was outlined by sharp swings and clear ranges of resistance and help. PEPE constantly failed to interrupt via the $0.000014150 vary, forming a ceiling that turned patrons away a number of instances.

On the draw back, the $0.000013 mark acted as a flooring the place costs repeatedly bounced again.

Essentially the most intense promoting got here as hourly quantity spiked, suggesting pressured exits and large-scale profit-taking. However by session shut, regular buy-side exercise, averaging 300 to 400 billion tokens per hour, hinted at a possible rebound.

Whereas the rally misplaced steam, the underlying buying and selling conduct displays a sample acquainted in memecoin markets: hype-driven surges adopted by sharp corrections, with long-term holders seizing volatility as an entry level.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our standards. For extra info, see CoinDesk’s full AI Policy.