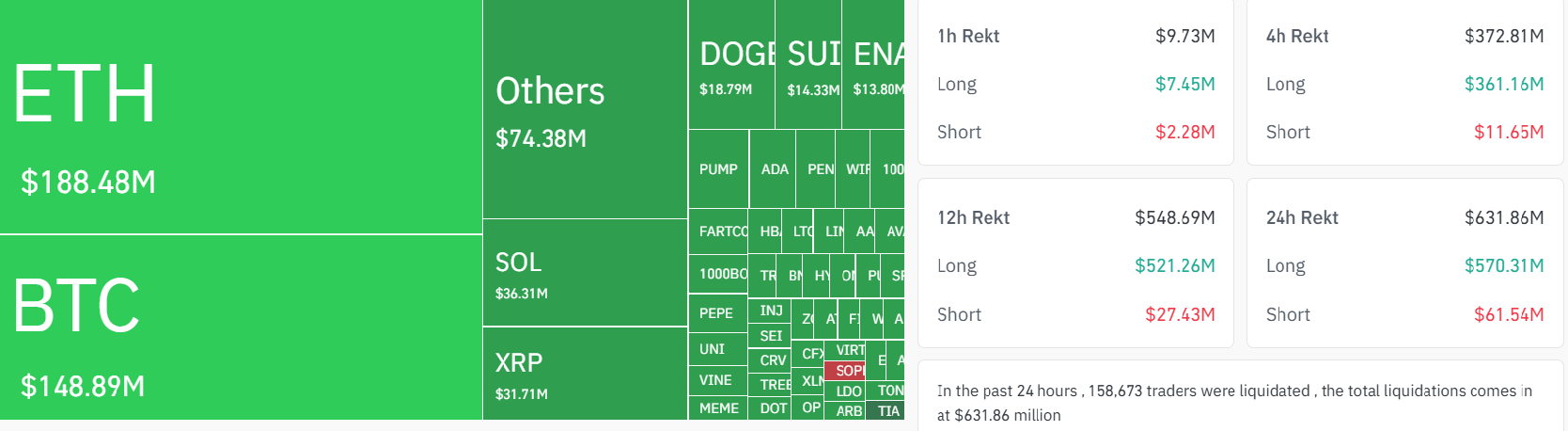

Crypto markets skilled a pointy bout of volatility over the previous 24 hours, with greater than $630 million in leveraged positions liquidated throughout exchanges.

The majority of the injury got here from longs, which accounted for over $580 million of whole liquidations, as merchants have been caught offside throughout an abrupt intraday sell-off.

Bitcoin (BTC) dropped to $115,200, erasing a few of its latest features however nonetheless sustaining a comparatively secure posture in comparison with different majors. Its dominance rose barely as altcoins bore the brunt of the correction.

Ether (ETH) fell to $3,687, whereas XRP (XRP) retraced underneath $3 regardless of sturdy latest headlines. Solana (SOL) pulled again to $170, and BNB (BNB) eased to $780 after a file run final week that punted it above $855.

Coinglass information exhibits the biggest single liquidation was a $13.7 million ETH lengthy on Binance.

Liquidations happen when merchants utilizing leverage (borrowed funds) are forcibly closed out of their positions as a result of their collateral falls under required upkeep thresholds. This usually amplifies value volatility, particularly in brief timeframes, as liquidated positions create sudden promoting or shopping for stress relying on the facet of the commerce.

For merchants, liquidation information gives perception into market sentiment and threat of positioning. Excessive liquidation totals — notably concentrated in a single route (e.g., longs) — typically sign overextended positioning. This could point out potential inflection factors or impending reversals because the market resets.

Monitoring real-time liquidation heatmaps and funding charges may also help merchants establish areas of pressured promoting or shopping for, typically round key help/resistance ranges, time entries or exits throughout high-volatility zones and gauge market leverage and risk-on/off conduct

Speculative altcoins have been notably affected. Solana-ecosystem tokens similar to Fartcoin (FART), Pump.enjoyable (PUMP) and Jupiter (JUP) all confronted steep intraday corrections.

“We observe that tokens like Fartcoin and Pump.enjoyable are much less aligned with broader market beta and extra reflective of high-volatility, sentiment-driven microcycles,” stated Ryan Lee, Chief Analyst at Bitget, stated in a Telegram message.

“The latest corrections — FART dropping 14% to retest its 100-day EMA close to $1, JUP dropping help at its 200-day EMA, and PUMP persevering with its slide inside a descending channel — seem to stem from profit-taking and waning short-term momentum, not from a systemic market shift.”

Lee added that Bitcoin’s relative energy, supported by ETF inflows and macroeconomic stability, reinforces the view that the pullback is remoted, not broad-based.

Bitcoin holding above $115,000 stays the market’s anchor. Except that degree breaks, the broader construction stays intact.