Bitcoin BTC is witnessing a notable resurgence in accumulation exercise throughout all investor cohorts, with whale wallets main the cost.

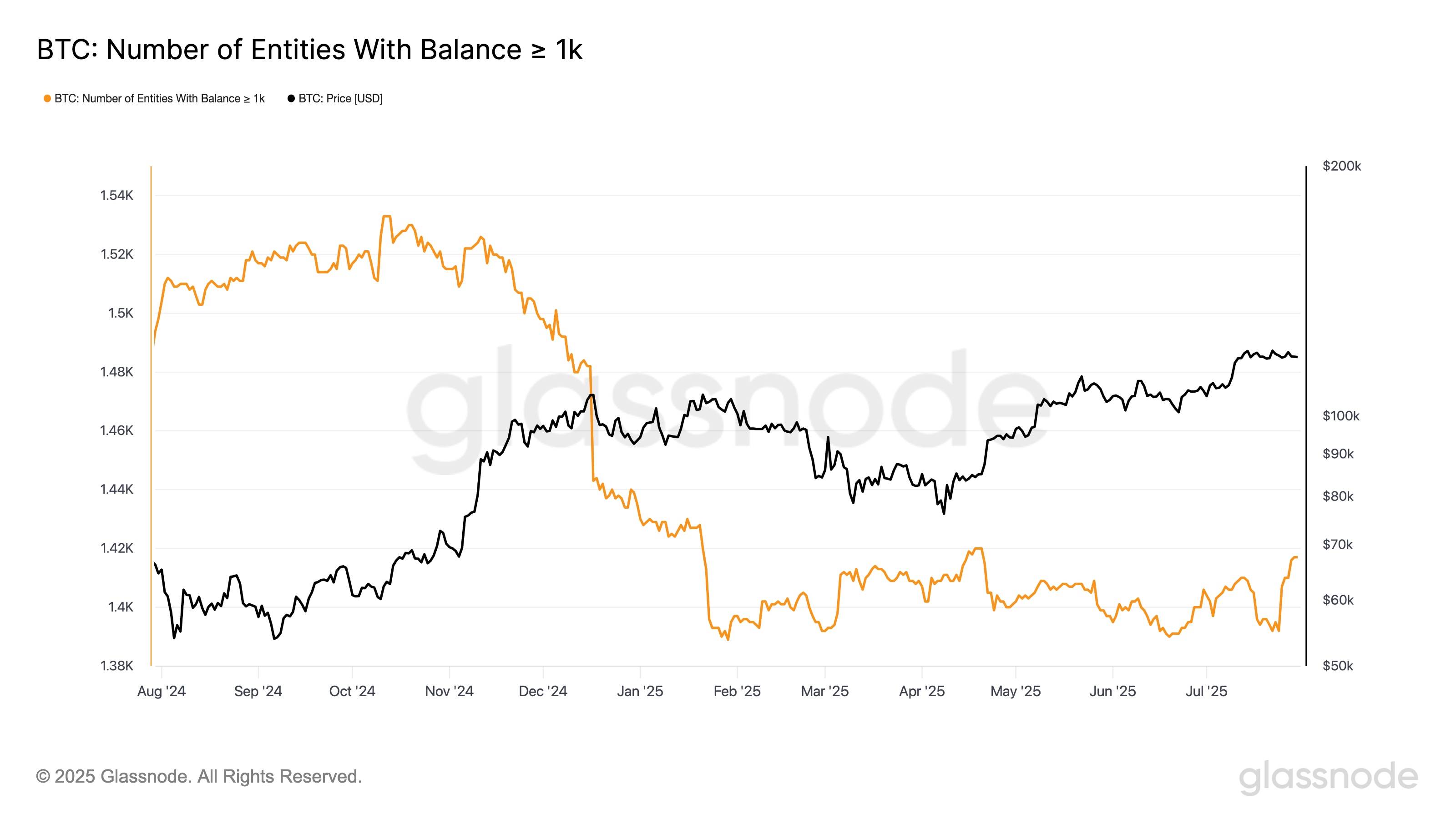

In accordance with current knowledge from Glassnode, the variety of distinctive whale entities, outlined as these holding a minimum of 1,000 BTC, has risen from 1,392 to 1,417 over the previous week. This marks one of many highest whale counts recorded in 2025, signaling a resurgence in institutional or large-scale investor confidence.

Glassnode identifies entities as clusters of addresses managed by the identical consumer or group.

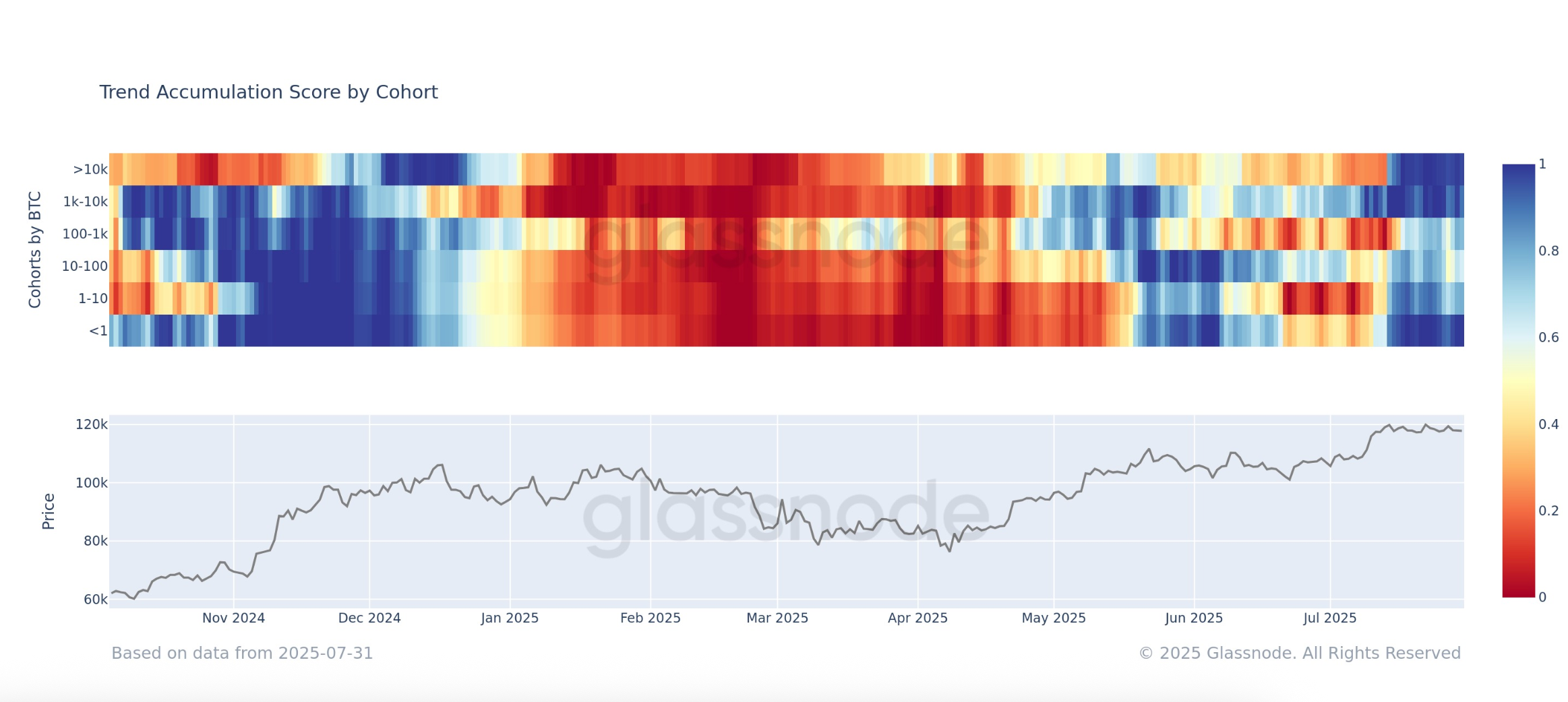

As well as, the Accumulation Pattern Rating, a key on-chain metric, reveals that not solely are whales accumulating aggressively, however so are the smallest holders, often known as shrimps, who personal lower than 1 BTC. This shopping for stress highlights a uncommon second of alignment between retail and institutional traders.

The metric breaks down accumulation power by pockets measurement and up to date acquisition conduct over a 15-day interval. A rating nearer to 1 suggests robust accumulation, whereas a price close to 0 signifies distribution. Entities reminiscent of exchanges and miners are excluded to concentrate on real investor sentiment.

Importantly, this stage of sustained accumulation throughout all cohorts has not been seen since November 2024, throughout President Trump’s re-election. That interval marked a pointy uptick in bullish sentiment and value momentum that noticed bitcoin declare $100,000.

Given the broad-based accumulation and the psychological enhance of renewed whale curiosity, market observers might be more and more assured that bitcoin is poised to problem and doubtlessly surpass its all-time excessive within the close to future.