Bitcoin {BTC} galloped to a brand new file excessive above $110,000 on Thursday, liquidating round $500 million price of derivatives positions in its wake, however some merchants aren’t shopping for into the bullish sentiment.

Buying and selling quantity jumped by 74% prior to now 24 hours as merchants tried to place themselves, nonetheless nearly all of these merchants are opting to go brief — or wager on bitcoin transferring downwards.

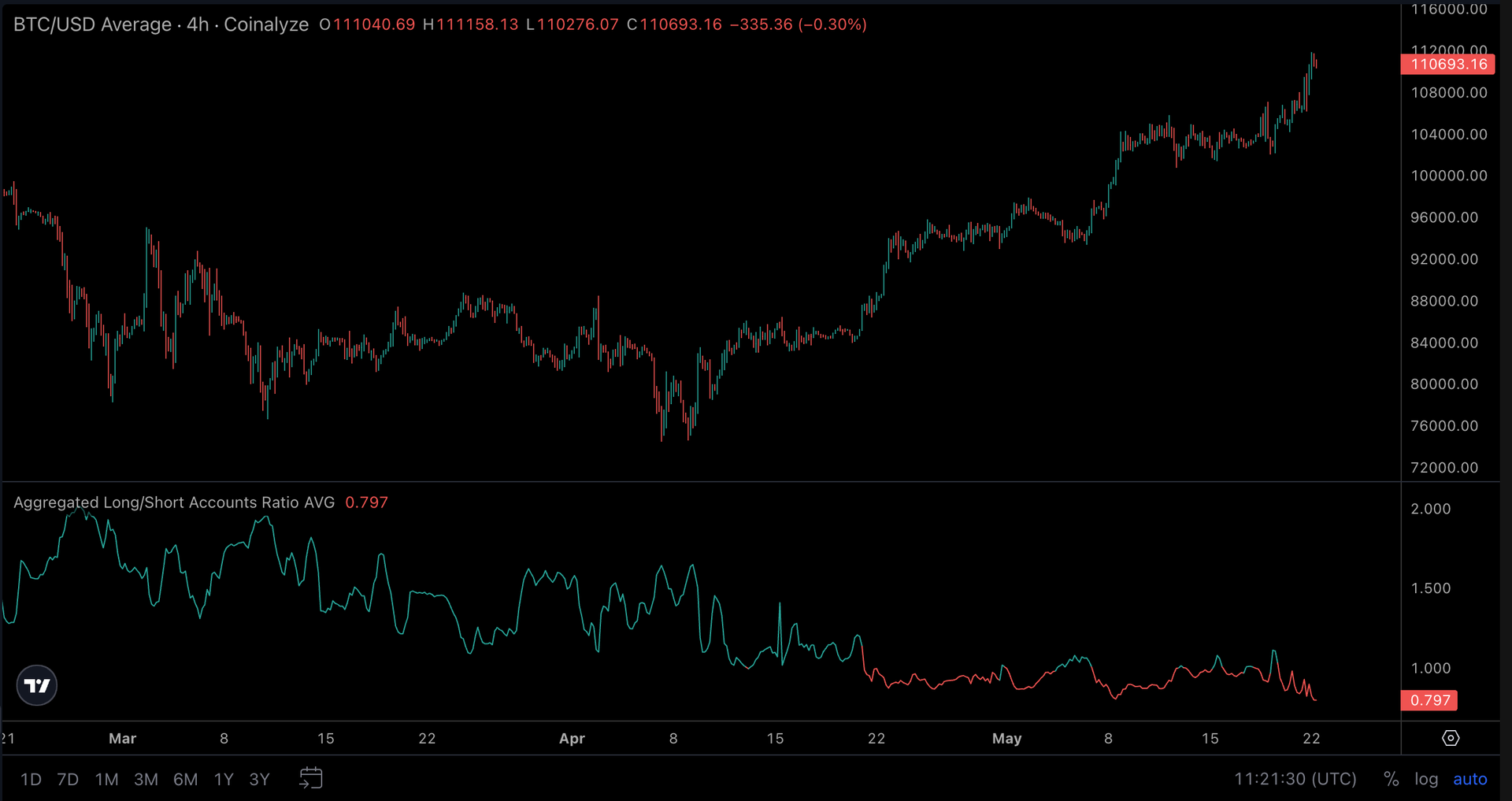

Coinalyze data reveals that the lengthy/brief ratio is at its lowest level since September 2022, which was the midst of crypto winter.

This development started on April 21 as merchants aggressively shorted the breakout above $85,000, seemingly beneath the impression that bitcoin had already shaped its cycle excessive and that any subsequent transfer would type a double high.

Nonetheless, regardless of a lack of retail participation, bitcoin continued to grind increased, taking out ranges of resistance at $97,000 and $105,000 on its path.

The transfer might be attributed to numerous components; a restoration in U.S. equities as tariff issues cooled, an increase in institutional exercise on exchanges, just like the CME, and crucially a wealth of brief positions to squeeze and power costs increased.

Whereas these brief positions could be thought-about bearish when it comes to market construction, they’re really fanning the flame to the upside because it provides bullish merchants areas to focus on and conduct stop-loss hunts like we saw earlier this week.

Shorting an asset’s file excessive will not be essentially a nasty technique; a dealer will usually decide to enter a brief place at a degree of resistance, whether or not that be technical or psychological, and layer cease losses above the place the thesis of a brief commerce can be invalidated.

On this case, if a dealer shorted $105,000 on every of BTCs three checks of that space, they might have closed their place in revenue on three events at $102,000, which means that even when they have been stopped out of the commerce at $109,000, it might be a worthwhile week.

Alongside the continued rise briefly positions we’ve seen open curiosity bounce disproportionately to BTC. Over the previous 24 hours BTC is up 4.8% whereas open curiosity is up by 17% regardless of a whole lot of million being liquidated.

This means that the file excessive break is pushed by leverage and could be much less sustainable that the preliminary drives above $100,000 in December and January.

It stays to be seen whether or not curiosity briefly positions continues to rise if BTC rolls on with its momentous transfer above $111,000, however there’s actually a minefield of brief positions to squeeze if it wants some ammunition.

Learn extra: Bitcoin’s Rally to Record Highs Puts Focus on $115K Where an ‘Invisible Hand’ May Slow Bull Run