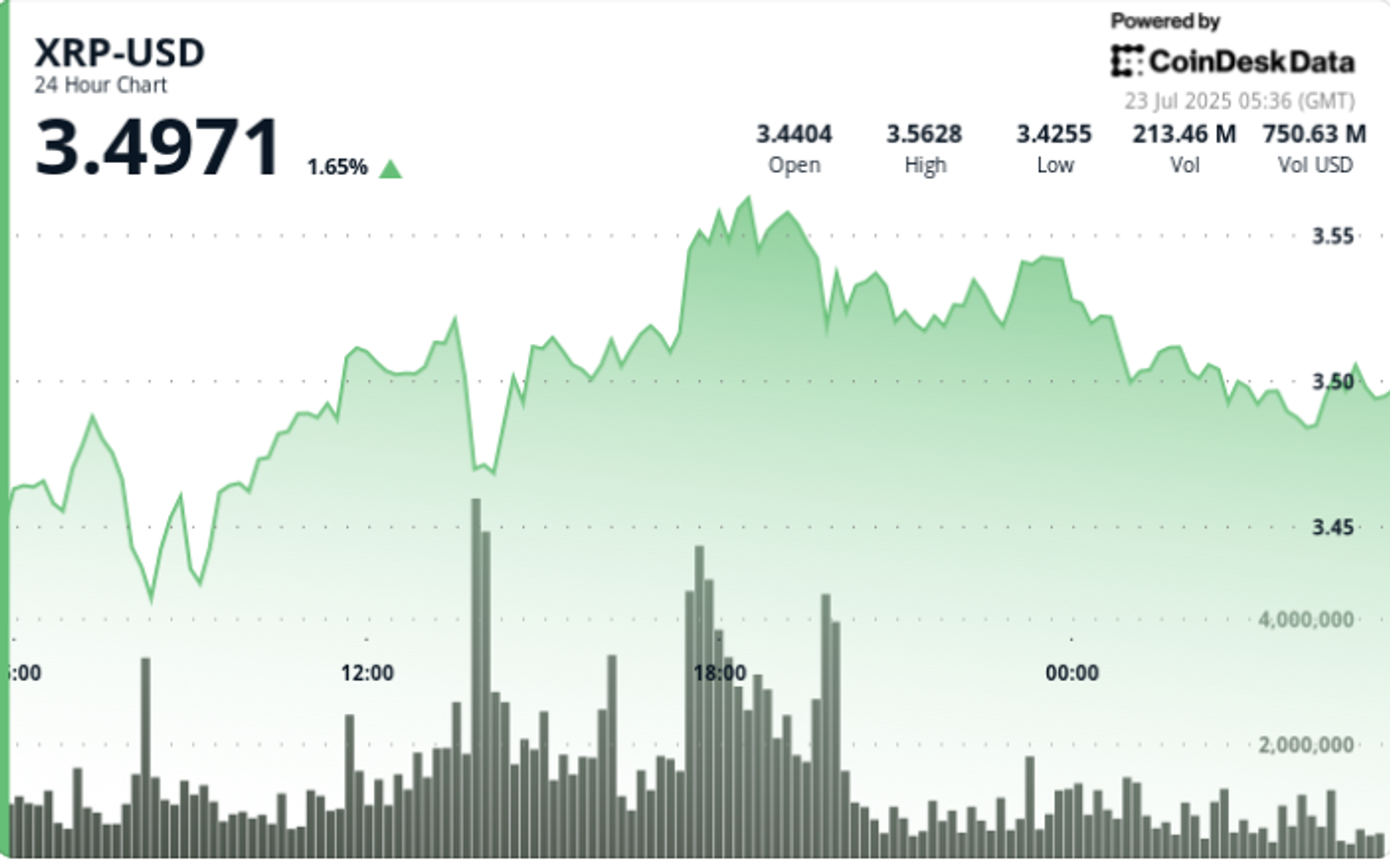

XRP posted a 4% achieve throughout the 24-hour buying and selling window from July 22 at 03:00 to July 23 at 02:00, with costs shifting between a low of $3.42 and a excessive of $3.57 earlier than closing close to $3.51.

The transfer follows a technical breakout from a six-year symmetrical triangle and coincides with key developments in U.S. crypto laws and the launch of institutional funding merchandise.

Regardless of bullish momentum all through the day, institutional promoting emerged within the last hour of buying and selling, paring good points and signaling doable near-term consolidation.

Information Background

- The U.S. Congress superior the GENIUS and CLARITY Acts, establishing a authorized framework for digital property and decreasing uncertainty round XRP’s safety classification.

- ProShares launched the primary XRP futures ETF, a milestone for institutional adoption.

- Wall Road analysts have issued $6.00 worth targets on XRP following affirmation of the triangle breakout, with longer-term projections reaching as excessive as $15.00.

Worth Motion Abstract

XRP broke above $3.52 resistance throughout the 17:00–18:00 window on quantity of 106.4 million—roughly 52% above the 24-hour common of 70.1 million. The breakout propelled costs towards the $3.57 session excessive earlier than promoting stress within the last hour dragged costs again to $3.51.

The ultimate 60-minute window from 01:09 to 02:08 GMT confirmed distribution conduct. Costs climbed from $3.50 to $3.52 by 01:46 earlier than reversing. A high-volume drop of two.25 million items between 02:02–02:03 marked the day’s most intense sell-off, pushing costs to $3.50 earlier than a marginal restoration.

Technical Evaluation

- Symmetrical triangle breakout confirmed above $3.00 with a excessive of $3.64 earlier within the week.

- Resistance: $3.57 (intraday), with sturdy overhead provide noticed within the last hour.

- Help: $3.42 retested efficiently a number of instances, confirming sturdy institutional bid zone.

- RSI and MACD stay impartial, suggesting restricted short-term momentum.

- Analysts keep $6.00 near-term goal; $15.00 flagged as long-term projection based mostly on breakout extension.

What Merchants Are Watching

- Whether or not $3.50 holds as a psychological and technical help stage within the subsequent 24 hours.

- Comply with-through shopping for curiosity from establishments post-ETF launch.

- Congressional momentum on additional digital asset regulation.

- Spot ETF developments and their affect on broader investor publicity.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.