Merchants brace for continued draw back as resistance caps at $3.04 and $2.93 flooring emerges following 169M quantity flush.

What to Know

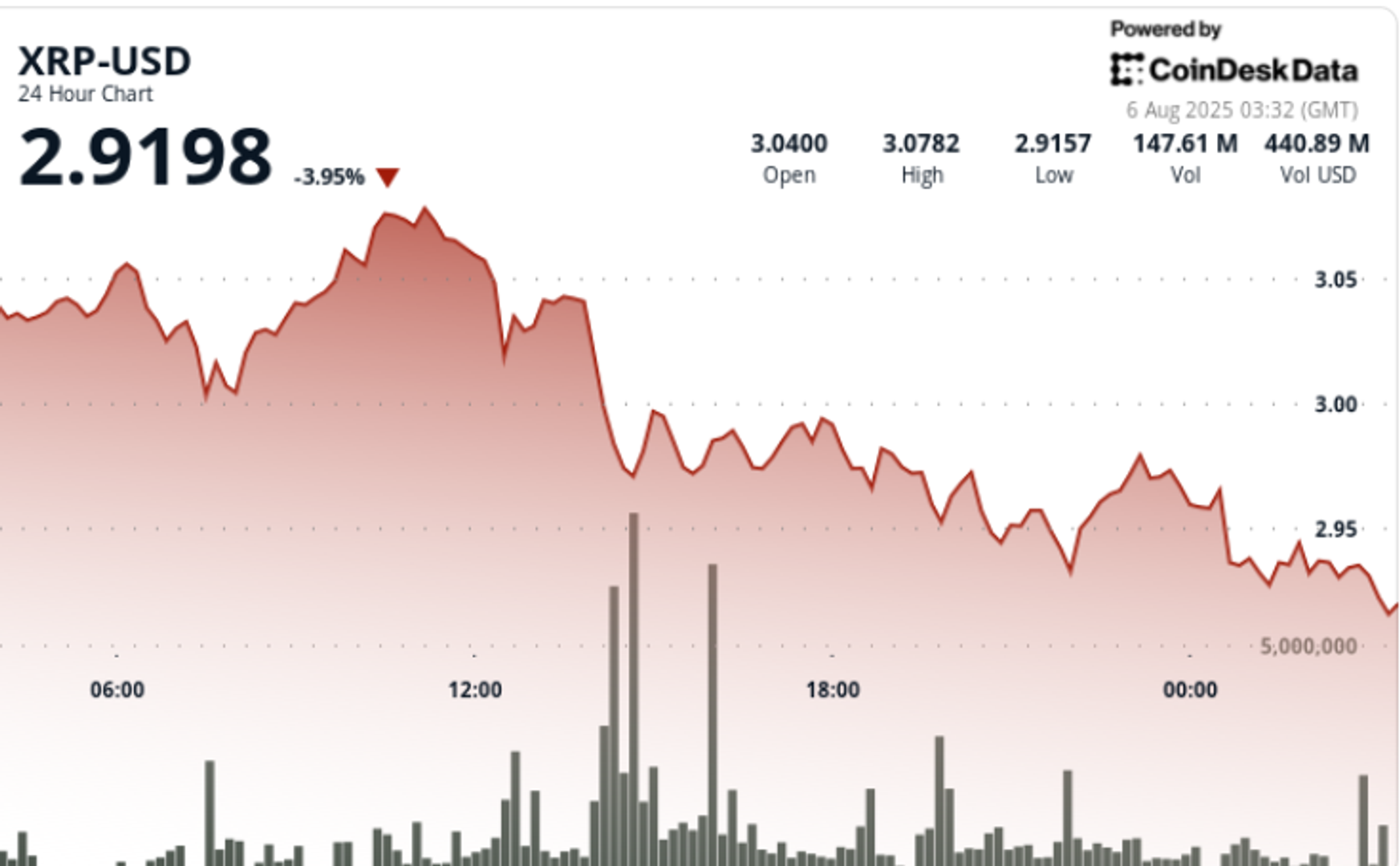

XRP fell 4.2% through the 24-hour session ending August 6 at 02:00, retreating from $3.06 to $2.93 in a volume-driven breakdown. The session’s excessive of $3.08 was hit at 10:00 earlier than a pointy reversal set in. Value motion accelerated at 14:00 when XRP fell from $3.04 to $2.97 on a 169.41 million quantity surge — over 3x its 24-hour common of 52.73 million — establishing $3.04 as interim resistance and validating $2.93 as an area help flooring.

Closing-hour value motion confirmed bearish management. XRP slid 1% from $2.94 to $2.92 between 01:15 and 02:14, finishing a high-volatility session that noticed a $0.13 swing, or 4.2% intraday vary. A late 02:11 quantity burst of 1.6 million sealed the decline because the token printed contemporary intraday lows.

Value Motion Abstract

- XRP traded inside a $0.13 vary between $3.08 and $2.93.

- Value collapsed 4.2% on 169.41 million whole quantity.

- Peak decline occurred between 14:00 and 15:00 with the very best hourly promote quantity.

- Closing hour noticed 1% extra draw back, led by a 1.6 million commerce at 02:11.

- Resistance caps at $3.04; help types at $2.93.

- Consolidation vary now sits between $2.96 and $2.97.

Technical Evaluation

Value construction confirms rejection at $3.04 with fast draw back to $2.93 on above-average quantity. The breach of short-term shifting averages and failure to maintain above $3.00 level to continuation threat. Quantity spikes throughout key selloff home windows help the bearish bias.

Volatility stays elevated with no clear reversal indicators printed. If $2.92 fails, subsequent help zones lie close to $2.87 and $2.80 primarily based on historic quantity nodes.

What Merchants Are Watching

- Reclaim of $3.00 psychological stage and protection of $2.93 zone.

- Whether or not bullish divergence emerges on intraday momentum indicators.

- Broader market influence from macro risk-off sentiment pushed by geopolitical tensions and renewed commerce instability.