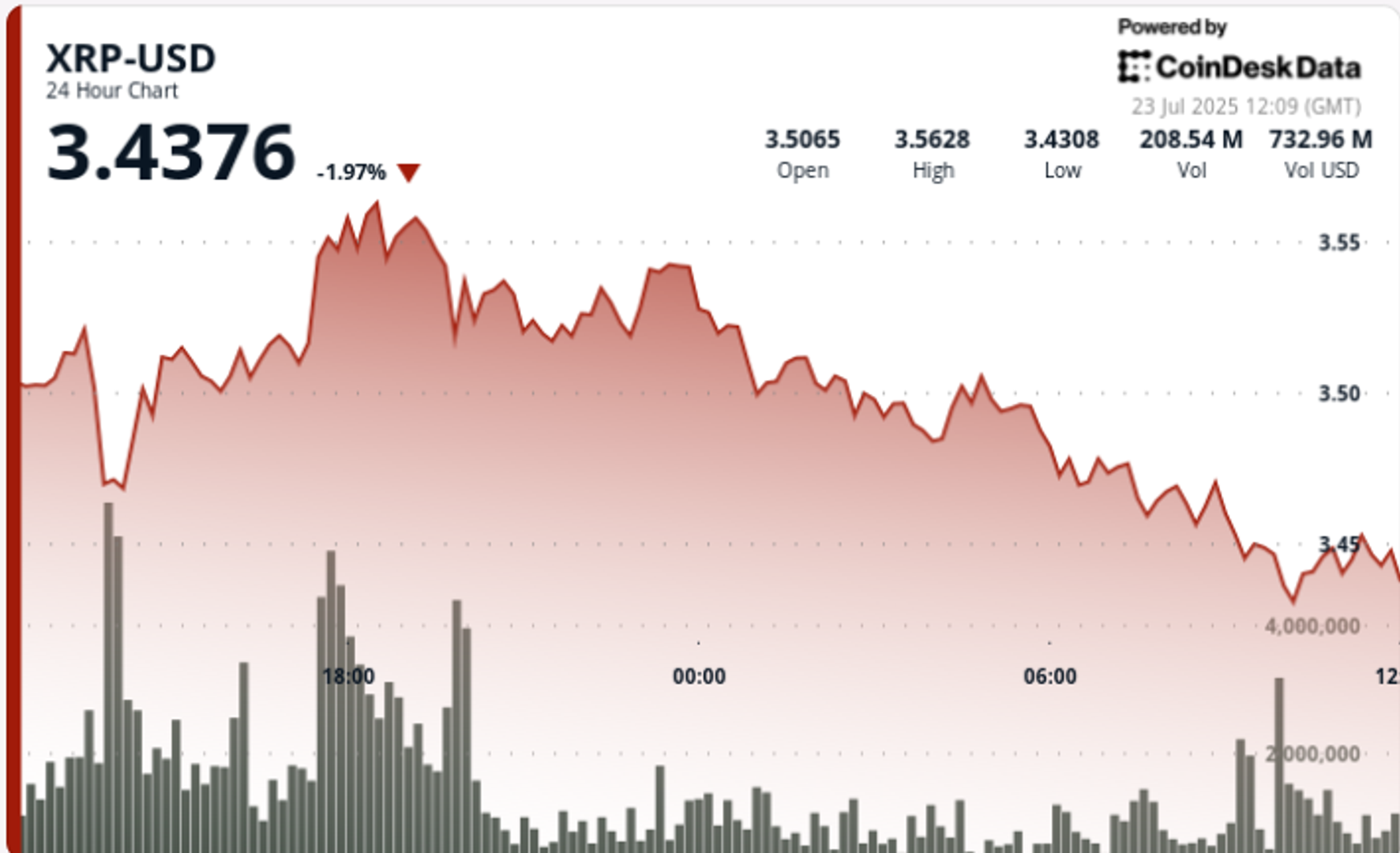

XRP traded in a large $0.11 vary between $3.46 and $3.57 throughout the 24-hour interval ending July 23 at 08:00 GMT. The asset posted a 3% swing as bulls drove value to a session excessive of $3.57 on 106.4 million quantity, earlier than profit-taking triggered a reversal again to $3.46.

The late decline broke key assist at $3.50, which had been retested a number of instances in a single day.

Quantity surged as institutional flows reacted to a confluence of catalysts: advancing U.S. crypto laws, recent ETF approvals, and long-awaited technical sample completion. Analysts nonetheless level to $6–$15 value targets long run, however warn of short-term consolidation threat.

Information Background

• XRP broke above $3.65 final week, finishing a six-year symmetrical triangle.

• ProShares launched the primary XRP futures ETF, marking a milestone in regulated institutional entry.

• U.S. Congress superior the GENIUS and CLARITY Acts, pushing ahead crypto regulation readability, fueling fund flows into large-cap digital belongings.

Worth Motion Abstract

Probably the most aggressive transfer got here at 17:00 GMT on July 22, when XRP jumped from $3.52 to $3.56 in underneath an hour on 106.4 million quantity—over 50% above the every day common of 70.1 million. Resistance shaped on the $3.56–$3.57 zone, capping upside and triggering a gentle retreat by means of the in a single day session.

The ultimate hour (07:10–08:09 GMT) noticed a breakdown from $3.47 to $3.46, as quantity spiked to 2.5 million between 07:37 and 07:49. That transfer cracked the beforehand agency $3.49–$3.51 assist band, confirming a short-term development shift as promoting overwhelmed consumers.

Technical Evaluation

• 24-hour buying and selling vary: $3.46–$3.57 (3.18%)

• Bullish breakout at 17:00 July 22: $3.52 → $3.56 on 106.4M quantity

• Help zone: $3.49–$3.51 examined a number of instances in a single day, failed by session shut

• Resistance zone: $3.56–$3.57 capped rally, now defining subsequent breakout level

• Breakdown affirmation: $3.47 → $3.46 on 2.5M quantity spike

• RSI impartial; MACD turning decrease — alerts probably consolidation earlier than subsequent directional transfer

What Merchants Are Watching

Institutional participation stays elevated amid ETF inflows and bettering regulatory optics. Regardless of the near-term rejection at $3.57, analysts proceed to flag bullish setups focusing on $6.00 and even $15.00 over multi-month timeframes. The $3.50 stage now acts as psychological pivot for bulls to defend in upcoming periods.